Are you ready to step into the world of trading and leverage the power of price action trends? In this comprehensive guide, we’ll delve into the realm of price action trading, arming you with essential knowledge to navigate the financial markets effectively.

Image: forexswingprofit.com

Price action trading is an art form, a skill that empowers traders to identify and capitalize on market trends by observing price movements rather than relying solely on technical indicators. It’s a potent technique, offering valuable insights into market behavior and sentiment.

Understanding Price Action Trends

Price action refers to the historical and real-time movements of a financial instrument’s price, which can include stocks, currencies, commodities, or indices. By studying price action, traders aim to discern the underlying forces driving market sentiment and predict future price movements.

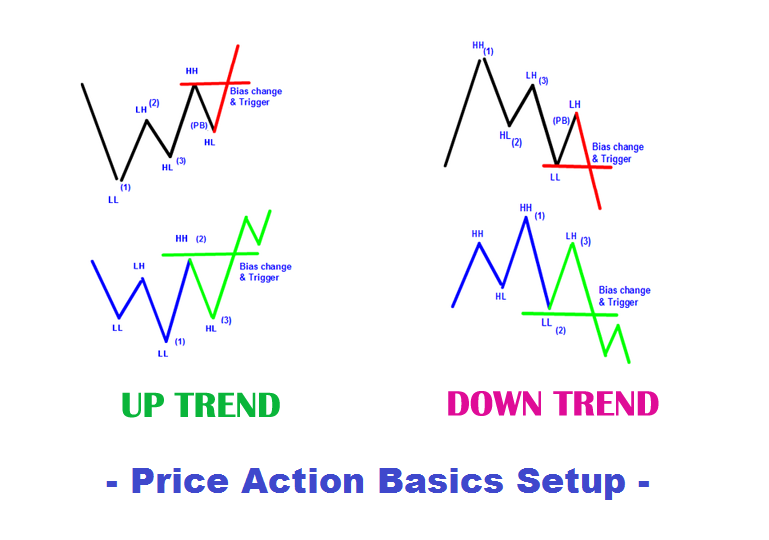

Price trends emerge when a security’s price consistently moves in a particular direction, either bullish (upward) or bearish (downward). Identifying these trends is crucial for successful trading, as they provide valuable clues about potential market opportunities.

How to Identify Price Action Trends

Recognizing price action trends requires careful observation and practice. Here are several key indicators to consider:

- Trendlines: Draw lines connecting price highs or lows to visually identify potential trends.

- Support and Resistance Levels: These are price levels that have repeatedly hindered price movement in one direction or the other.

- Moving Averages: By calculating the average price over a specific period, moving averages help smooth out price fluctuations and reveal underlying trends.

Latest Trends and Developments

Staying abreast of the latest trends and developments in price action trading is essential for adapting to evolving market conditions. Market news, research, and insights from forums and social media platforms provide valuable information about market sentiment and potential trading opportunities.

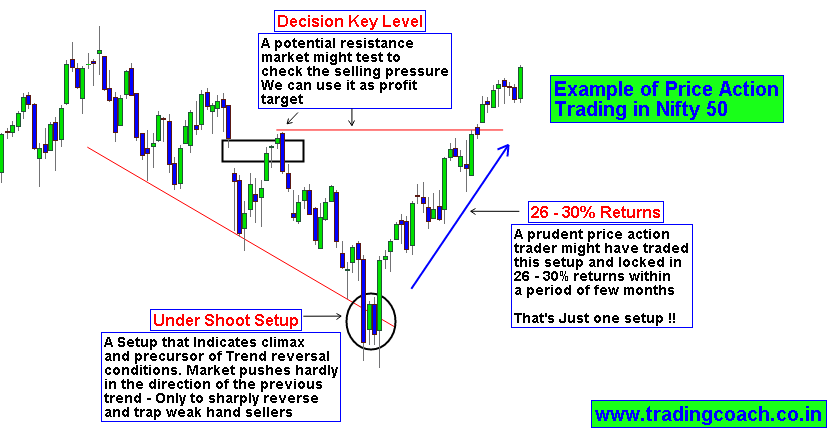

For instance, recent advancements in artificial intelligence and machine learning have opened up new avenues for analyzing price action patterns, aiding traders in identifying high-probability trade setups.

Image: original-herbs.com

Tips and Expert Advice

To enhance your price action trading skills, consider incorporating these expert tips into your approach:

- Market Analysis: Thoroughly analyze market conditions, including factors that could influence price movements, such as macroeconomic events or industry news.

- Risk Management: Implement a robust risk management strategy to minimize losses and protect your capital.

- Chart Patterns: Familiarize yourself with different chart patterns, such as double tops, triangles, and head and shoulders, to identify potential trading opportunities.

Frequently Asked Questions

To address common inquiries regarding price action trading, we’ve compiled a concise FAQ section:

- Q: What is the difference between price action and technical analysis?

A: While price action solely focuses on price movements, technical analysis incorporates additional data and indicators. - Q: Is price action trading suitable for beginners?

A: With proper education and practice, beginners can leverage price action trading. - Q: What is the best time frame for price action trading?

A: The optimal time frame depends on the individual trader and strategy.

Trading Price Action Trends Pdf

Conclusive Remarks

Understanding and trading price action trends is a formidable skill that can empower you to make informed trading decisions and potentially enhance your financial success. By embracing the insights and advice provided in this comprehensive guide, you can gain a competitive edge in the ever-evolving world of financial markets.

Embark on your price action trading journey today! Are you eager to master this compelling technique and unlock the boundless opportunities it offers?