Single Euro Payments Area: A Gateway to Efficient Forex Trading

Unregulated foreign exchange (forex) markets offer traders the opportunity to access global financial markets, leverage unique trading strategies, and potentially generate significant returns. However, these markets often pose challenges in terms of secure and efficient payment processing. SEPA (Single Euro Payments Area) solutions provide seamless and cost-effective payment channels for unregulated forex transactions, paving the way for enhanced liquidity and risk management.

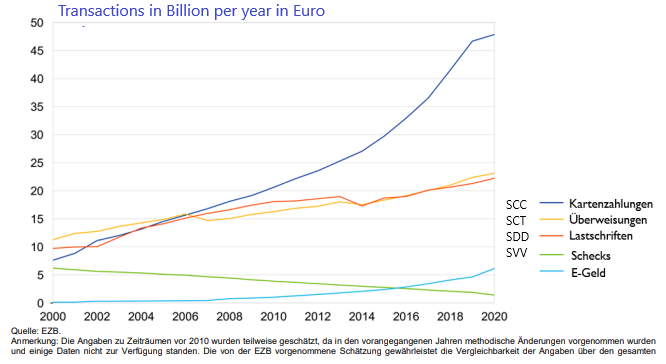

Image: www.cpg.de

SEPA: A Wealth of Benefits for Forex Traders

SEPA solutions offer a myriad of benefits for unregulated forex traders:

- Simplified Payment Processing: SEPA eliminates the complexities associated with cross-border payments, providing a standardized and streamlined process for transferring funds between different countries within the European Union.

- Reduced Transaction Costs: SEPA facilitates transactions at reduced fees, ensuring traders can minimize their overall operational costs and maximize their potential profits.

- Faster Payment Settlement: SEPA transactions are processed swiftly and efficiently, allowing traders to access their funds promptly for trading purposes or withdrawal.

- Enhanced Security: SEPA payments adhere to rigorous security protocols, reducing the risk of fraud and unauthorized transactions.

- Wide Market Reach: With SEPA, traders can connect with a vast network of financial institutions and brokers across the European Union.

The Evolution of SEPA in Unregulated Forex

SEPA’s integration into unregulated forex markets has been a progressive journey. Initially, traders primarily relied on traditional banking channels for funding their trading accounts. However, the emergence of SEPA-compliant payment processors revolutionized the payment landscape, enabling traders to access more efficient and cost-effective payment options.

As SEPA gained traction, it became the preferred payment solution for many unregulated forex brokers. Brokers recognized the advantages of offering SEPA integration, which not only streamlined payment processes but also enhanced their credibility and trustworthiness.

Tips for Leveraging SEPA Solutions in Unregulated Forex

Seasoned forex traders share the following tips for effectively utilizing SEPA solutions:

- Identify Reputable Payment Providers: Choose payment processors that have a strong track record of reliability, security, and compliance with SEPA regulations.

- Explore Multiple Payment Options: Leverage different SEPA payment methods such as instant transfers, credit transfers, and direct debit to optimize payment speed and convenience.

- Prioritize Quick Payment Processing: Select payment providers that offer swift transaction processing to minimize delays in funding trading accounts and withdrawing profits.

- Maximize Cost Efficiency: Compare transaction fees and other charges between different payment providers to identify the most cost-effective solutions.

- Ensure Compliance: Adhere to SEPA regulations and your payment provider’s terms of service to avoid potential disruptions or penalties.

Image: www.scribd.com

Frequently Asked Questions

-

Q: Are SEPA payments secure?

A: Yes, SEPA payments are highly secure, employing advanced encryption technologies and adhering to strict security protocols. -

Q: Does SEPA support all currencies?

A: SEPA primarily supports payments in euros, enabling streamlined transactions within the European Union. -

Q: Is SEPA available outside the European Union?

A: While SEPA is primarily designed for payments within the European Union, some payment providers offer extended services to non-EU countries.

Sepa Solitions For Unregulated Forex

Conclusion

SEPA solutions have transformed payment processing in unregulated forex, providing traders with secure, efficient, and cost-effective channels for funding their accounts and withdrawing profits. By embracing SEPA and following the tips outlined in this article, traders can enhance their liquidity, reduce transaction costs, and ultimately optimize their trading performance.

Are you ready to leverage SEPA solutions and unlock the full potential of unregulated forex trading?