Unlocking the benefits of your HDFC Forex Card requires understanding the process of selling off any unutilized foreign currency. Whether you’re a seasoned globetrotter or an occasional traveler, this comprehensive guide will equip you with the knowledge and steps necessary to sell money from your HDFC Forex Card with ease. By providing practical insights and valuable information, we aim to empower you to maximize the value of your travel funds.

Image: howtotradeonforex.github.io

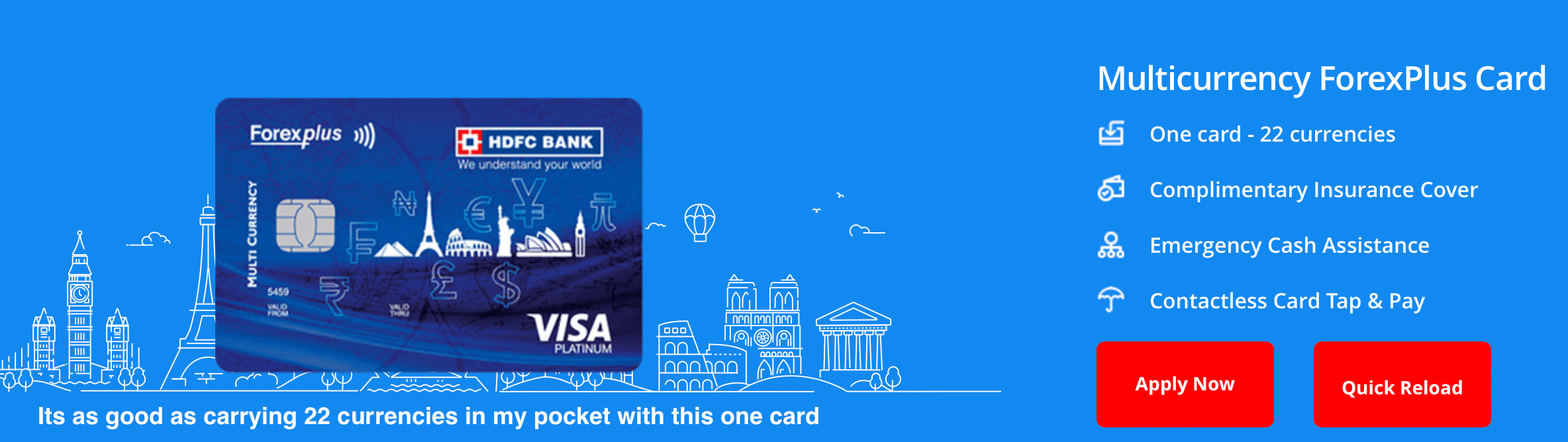

Introduction to HDFC Forex Card

HDFC Forex Card is a prepaid card designed to facilitate hassle-free currency exchange and global payments. It is linked to your Indian bank account and allows you to load multiple currencies onto the card. This eliminates the need for carrying large amounts of cash while traveling, reducing the risk of loss or theft. When making purchases or withdrawing cash abroad, the HDFC Forex Card automatically converts the transaction amount from the designated currency into Indian Rupees, offering competitive exchange rates and convenience.

However, after your travels, you might find yourself with unspent foreign currency on your HDFC Forex Card. The next step is to sell this currency back to get the equivalent value in Indian Rupees. This process is not only simple but also ensures that you recover the value of your remaining travel funds.

Understanding the Selling Process

Selling money from an HDFC Forex Card involves converting the unutilized foreign currency back into Indian Rupees. This can be done through various channels, each having its own set of requirements and procedures. To ensure a smooth experience, it’s crucial to choose the method that aligns with your preferences and situation.

Selling through HDFC Bank Branches

HDFC Bank branches provide a convenient option for selling foreign currency from your Forex Card. Here’s a step-by-step guide:

-

Visit an HDFC Bank Branch: Locate the nearest HDFC Bank branch that offers forex services.

-

Carry Necessary Documents: Bring your HDFC Forex Card, passport, and a valid ID proof (Aadhaar Card, PAN Card, or Voter ID).

-

Fill out the Form: Complete the prescribed form provided by the bank, indicating the details of the foreign currency you wish to sell and the equivalent Indian Rupee amount you expect to receive.

-

Submit the Card and Documents: Submit your HDFC Forex Card and the completed form along with the required documents for verification.

-

Verification and Transaction: The bank staff will verify your details and the currency notes. Once everything is in order, the transaction will be processed.

-

Receive Indian Rupees: The equivalent amount in Indian Rupees will be credited to your designated bank account linked to the HDFC Forex Card.

Image: windsorwhock2002.blogspot.com

Selling through Online Forex Platforms

Several online forex platforms allow you to sell foreign currency from your HDFC Forex Card. This method is typically more convenient and time-saving than visiting a bank branch. Here’s how it works:

-

Choose a Platform: Research and select a reputable online forex platform that offers competitive exchange rates and supports HDFC Forex Card transactions.

-

Create an Account: Register on the chosen platform and complete the KYC (Know Your Customer) process.

-

Add Your Forex Card: Link your HDFC Forex Card to your online forex account.

-

Initiate the Sale: Specify the amount and currency you wish to sell, and the platform will provide a live exchange rate.

-

Confirm the Transaction: Once you agree to the exchange rate, confirm the transaction and provide the necessary details.

-

Receive Indian Rupees: The equivalent amount in Indian Rupees will be credited to your bank account linked to the HDFC Forex Card.

Other Selling Channels

Apart from these two primary methods, you may also consider the following options to sell money from your HDFC Forex Card:

-

Authorized Currency Dealers: Approach authorized currency dealers who offer foreign exchange services. They may have different procedures and exchange rates, so compare their offerings before making a decision.

-

Local Money Changers: In certain locations, you can find local money changers who accept HDFC Forex Cards. However, it’s essential to check their credibility and exchange rates before proceeding.

Essential Tips for Selling Money

To make the most of your HDFC Forex Card sale, keep these tips in mind:

-

Compare Exchange Rates: Research and compare exchange rates offered by different channels to get the best value for your money. Online forex platforms often provide competitive rates compared to banks.

-

Check for Hidden Charges: Pay attention to any additional charges or fees associated with selling foreign currency. These might include transaction fees, processing fees, or service charges.

-

Keep Records: Maintain a record of your selling transactions, including the exchange rates, amounts, and dates. This can be helpful for future reference or if you need to dispute any discrepancies.

-

Sell Unused Currency Promptly: Avoid holding onto leftover foreign currency for extended periods. Exchange rates can fluctuate, and you might end up losing value if the currency depreciates.

Sell Money From Hdfc Forex Card

Conclusion

Selling money from an HDFC Forex Card is a straightforward process that allows you to recover the value of your unspent travel funds. By choosing the selling method that suits your needs, comparing exchange rates, and following the steps outlined above, you can ensure a smooth and beneficial transaction. So, whether you’re planning your next adventure or need to convert leftover currency, this comprehensive guide will empower you to make the most of your HDFC Forex Card and maximize your travel funds efficiently.