Begin your journey into the captivating realm of Forex, where fortunes rise and fall with the unpredictable ebb and flow of currency values. Scalping, a lightning-fast trading strategy, empowers traders to seize minuscule profit margins in the blink of an eye, emerging victorious from the market’s volatile currents. However, conquering this lucrative arena demands a strategic alliance with technology—enter the power of programming. Harnessing the computational prowess of algorithms, traders gain an unparalleled edge, executing trades with precision and lightning speed, maximizing their profit potential.

Image: howtotradeonforex.github.io

Embarking on the Scalping Crusade: A History of Algorithmic Dominance

The origins of scalping can be traced back to the bustling trading floors of the early 20th century. Back then, human traders relied on their keen instincts and manual dexterity to capture fleeting profit opportunities. But as the financial landscape evolved, so did the tools of the trade. Algorithmic trading emerged, introducing automation into the once purely manual realm of scalping, making it possible to execute trades at speeds that humans simply cannot match.

Today, scalping algorithms reign supreme, navigating the labyrinthine complexities of the Forex market, analyzing vast amounts of data in real-time. They monitor price movements, identify trading opportunities, and execute trades autonomously, empowering traders to capitalize on market fluctuations with unmatched precision and efficiency.

Demystifying Scalping Strategies: A Blueprint for Algorithmic Triumph

The art of algorithmic scalping lies in crafting strategies that capitalize on short-term price movements, aiming to squeeze out small but consistent profits from each trade. One popular technique involves identifying support and resistance levels, acting as price boundaries within which currencies tend to oscillate. When prices approach these levels, the algorithm triggers buy or sell orders, anticipating a reversal in the trend.

Another effective strategy centers around trend following. The algorithm identifies the prevailing market trend and executes trades in alignment with it. For instance, if the algorithm detects an upward trend, it will initiate buy positions, seeking to ride the positive momentum. Conversely, if a downtrend is detected, the algorithm switches to sell positions, capitalizing on the market’s decline.

Harnessing the Power of Indicators: Guiding Your Algorithmic Decisions

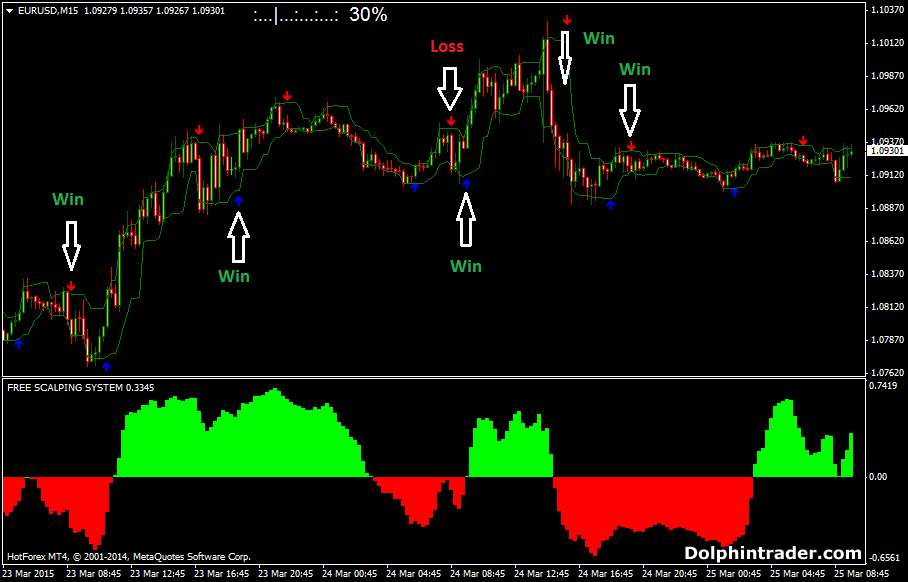

Technical indicators serve as valuable allies in the scalper’s arsenal, offering insights into market behavior and aiding in the identification of trading opportunities. These algorithmic tools analyze price movements, volume, and other data points, generating signals that guide the algorithm’s decision-making process.

One commonly employed indicator is the moving average, which smooths out price fluctuations to identify the underlying trend. Traders can set different time frames for the moving average, allowing them to adapt to varying market conditions. Another popular indicator, the Relative Strength Index (RSI), measures the strength and momentum of a trend, helping traders gauge whether the market is overbought or oversold.

Image: tradingforexguide.com

Risk Management: The Bedrock of Algorithmic Scalping

While algorithms bring unparalleled precision and speed to scalping, risk management remains paramount. Market volatility can be unforgiving, and it’s crucial to implement safeguards against potential losses. One key risk management technique involves setting well-defined stop-loss orders. These orders automatically exit trades when a certain loss threshold is reached, preventing catastrophic drawdowns.

Position sizing is another essential aspect of risk management. Traders must carefully calculate the appropriate trade size based on their risk tolerance and account balance. Leveraging algorithms to automate this process ensures consistent and disciplined position management, mitigating the risks associated with excessive trading.

The Future of Algorithmic Scalping: Charting the Course of Innovation

As technology continues to advance, so do the possibilities for algorithmic scalping. Artificial intelligence (AI) and machine learning (ML) are rapidly gaining traction, introducing new levels of sophistication to scalping strategies. AI algorithms can analyze vast datasets, identify complex patterns, and make predictive decisions that outperform traditional algorithmic models.

ML algorithms, on the other hand, have the ability to adapt and learn from historical data, continuously refining their decision-making process. By leveraging these cutting-edge technologies, traders can unlock unprecedented opportunities in the Forex market, maximizing their profit potential while minimizing their risks.

Scalping In Forex Market Using Programming

Conclusion: Unveiling the Lucrative Secrets of Algorithmic Scalping

The fusion of scalping and algorithmic trading empowers traders to navigate the turbulent waters of the Forex market with confidence and precision. By harnessing the power of programming, traders gain a competitive edge, executing trades at superhuman speeds and exploiting even the slightest market fluctuations. However, it’s important to remember that the path to profitability lies not only in the adoption of advanced algorithms but also in a deep understanding of risk management principles. By mastering this delicate balance, traders can unlock the full potential of scalping, transforming the chaos of financial markets into a symphony of profit.