In the tumultuous realm of forex trading, scalping stands as a lucrative technique that harnesses fleeting market movements to generate profits. By employing Bollinger Bands, traders can amplify their scalping prowess and elevate their profits to new heights.

Image: www.forexcracked.com

Bollinger Bands: A Compass for Market Volatility

Bollinger Bands are an indispensable technical analysis tool that embodies the meticulous symphony of financial markets. In essence, they encase price action within a set of three lines: the middle line, the upper band, and the lower band. These lines fluctuate seamlessly, harmonizing with the market’s volatility and reflecting its ever-shifting temperament.

Navigating Market Movements

Traders leverage Bollinger Bands as a guiding star, illuminating the ebb and flow of market volatility. When the upper and lower bands draw closer, it suggests a contraction in volatility, signaling a lull in market activity. Conversely, when these bands expand, volatility surges, paving the way for scalping opportunities.

Scalping Forex with Bollinger Bands

Scalping with Bollinger Bands in the forex market is akin to pirouette on a razors edge, demanding razor-sharp accuracy and lightning-fast execution. Traders scour for ideal entry and exit points, aiming to extract profits from even the minutest market fluctuations.

Image: www.pinterest.com

Trading the Squeezes

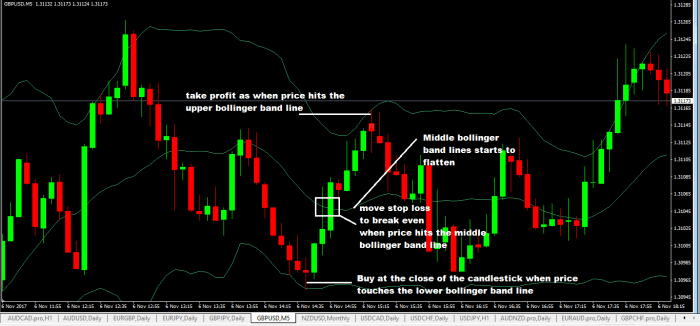

The essence of this technique lies in identifying Bollinger Band squeezes, periods of heightened volatility followed by a lull. Scalpers patiently await these fleeting opportunities, anticipating an imminent breakout as the bands expand once more. Acting swiftly, they initiate a trade, riding the wave of increased volatility until the bands contract again.

Trading the Breakouts

Another scalping strategy harnesses Bollinger Band breakouts. When price candles decisively pierce through the upper or lower band, it signifies a potential reversal or breakout trade. Scalpers seize these moments, capitalizing on the momentum surge that typically accompanies such breakouts.

Maximizing Profits with Bollinger Bands

To amplify profits while scalping with Bollinger Bands, traders employ a multitude of tactics.

Expert Tips for Enhanced Profits

- Trade with the Trend: Align your trading strategy with the prevailing trend for increased probability of success.

- Use Multiple Time Frames: Analyze Bollinger Bands on multiple time frames to gain a comprehensive perspective on market sentiment.

- Manage Risk: Implement robust risk management strategies to safeguard your profits and mitigate potential losses.

FAQ on Forex Scalping with Bollinger Bands

- Q: What time frames are best suited for Bollinger Band scalping?

A: Traders typically focus on short-term time frames, such as the 1-minute, 5-minute, or 15-minute charts, to capture rapid market fluctuations. - Q: Is Bollinger Band scalping suitable for all market conditions?

A: Bollinger Band scalping is particularly effective during periods of elevated volatility. In sideways markets, scalpers may encounter challenges.

Scalping Forex With Bollinger Bands And Maximizing Profits

Conclusion

Mastering the art of forex scalping with Bollinger Bands unlocks a boundless realm of profit-making opportunities. By leveraging this powerful technical analysis tool, traders can navigate the turbulent seas of the forex market with increased precision, reaping the rewards of fleeting market movements. Embark on this exhilarating journey into scalping, harnessing Bollinger Bands as your guiding star, and elevate your trading prowess to unprecedented heights.

Are you ready to unravel the secrets of forex scalping with Bollinger Bands and unlock the hidden profits that await you in the financial markets?