Introduction

In the labyrinth of global trade, seamless currency exchange plays a pivotal role. For Indian exporters striving to navigate the international marketplace, understanding and utilizing SBI forex rates for the A2 form is paramount. The A2 form, prescribed by the Reserve Bank of India (RBI), is an integral document that facilitates export transactions and ensures compliance with the Foreign Exchange Management Act (FEMA). In this comprehensive guide, we will delve into the intricacies of SBI forex rates for the A2 form, empowering you with the knowledge and strategies to maximize your export potential.

Understanding SBI Forex Rates for the A2 Form

SBI (State Bank of India) offers competitive forex rates for exporters, enabling them to exchange Indian rupees into foreign currencies seamlessly. The A2 form, also known as the “Exporter’s Declaration Form,” is a vital document required for all export transactions exceeding USD 5,000. It declares the value of exported goods, the currency of transaction, and the beneficiary’s details. The SBI forex rates for the A2 form are determined by various factors, including the prevailing market rates, the demand for foreign exchange, and the RBI’s guidelines.

Accessing the Most Favorable Rates

As an exporter, securing the most favorable SBI forex rates for the A2 form is crucial to maximizing profitability. To achieve this, it is recommended to:

- Monitor Currency Markets: Stay abreast of global currency fluctuations and identify periods when the Indian rupee is stronger against major foreign currencies.

- Negotiate with SBI: Engage in discussions with SBI to negotiate favorable rates, especially for large transactions or long-term contracts.

- Explore Online Platforms: Utilize online platforms that provide real-time forex rate comparisons, allowing you to compare rates from various banks and choose the most competitive option.

Documenting the Transaction

Once you have obtained the most favorable SBI forex rate for the A2 form, it is essential to document the transaction meticulously. This involves:

- Accurate Information: Ensure that all details in the A2 form, including the invoice value, currency, and beneficiary information, are accurate and match other supporting documents.

- Documentation Retention: Maintain a complete set of supporting documents, such as the purchase order, invoice, bill of lading, and shipping documents, to provide proof of the export transaction.

- Adherence to Timeframes: Submit the completed A2 form to SBI within the stipulated timeframe, as prescribed by FEMA regulations.

Expert Insights and Actionable Tips

Harnessing the experience of industry experts can further enhance your understanding and application of SBI forex rates for the A2 form. Here are a few valuable insights:

- Stay Informed About FEMA Regulations: Maintain up-to-date knowledge of FEMA guidelines and RBI circulars to ensure compliance and avoid potential penalties.

- Seek Professional Assistance When Needed: If you encounter complexities or uncertainties, consider consulting with a chartered accountant or an export documentation specialist for guidance.

- Optimize Transaction Timing: Time your export transactions strategically to capitalize on favorable currency exchange rates and minimize losses due to market fluctuations.

Conclusion

Mastering SBI forex rates for the A2 form is an indispensable skill for Indian exporters. By embracing the strategies and leveraging the insights outlined in this guide, you can navigate the complexities of global currency exchange confidently, secure favorable rates, and maximize your export potential. Remember, accurate documentation and adherence to FEMA regulations are essential to ensure seamless transactions and avoid unintended consequences. As you embark on your export journey, remain informed, negotiate effectively, and empower yourself with the knowledge and tools necessary to achieve success in the international marketplace.

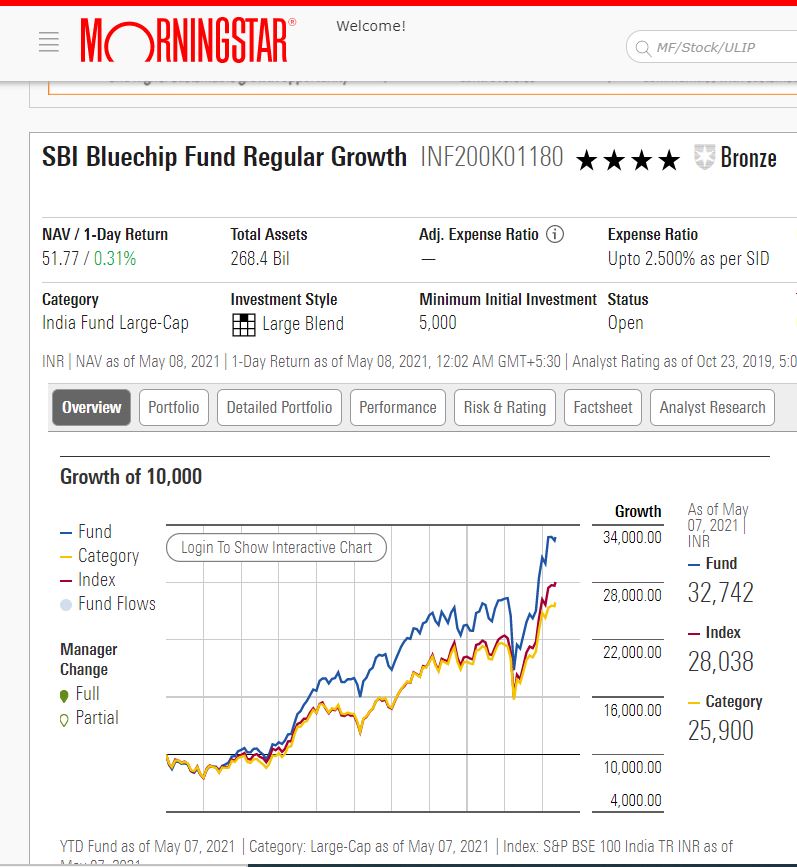

Image: www.morningstar.in

Image: www.forex.academy

Sbi Forex Rates A2 Form