Navigating Currency Dynamics: A Comprehensive Guide

The global financial landscape is a sea of currencies, each with its own unique value and trajectory. Understanding the intricate dynamics of these currencies is crucial for businesses and individuals alike. Among the leading financial institutions shaping these dynamics is the State Bank of India (SBI), India’s largest commercial bank, playing a pivotal role in setting foreign exchange (forex) rates that influence global transactions. On November 27, 2018, SBI’s forex rates reflected a fluctuating market, offering valuable insights into the intricacies of currency exchange.

Image: myinvestmentideas.com

SBI Forex Rates: A Snapshot of Currency Movements

On November 27, 2018, the Indian rupee (INR) stood at 71.41 against the US dollar (USD), indicating a slight depreciation compared to the previous day’s rate of 71.35. This movement reflected a broader trend of INR depreciation that had been ongoing for several months.

However, the INR’s performance against other major currencies painted a more favorable picture. Against the British pound (GBP), the INR strengthened marginally, moving from 95.27 to 95.24. This strength was also evident against the euro (EUR), with the INR appreciating from 84.66 to 84.61. These fluctuations underscore the dynamic nature of currency markets, where geopolitical events, economic data, and investor sentiment can all drive rapid shifts in value.

Understanding Currency Exchange: A Balancing Act

Currency exchange rates are influenced by a complex interplay of factors that affect supply and demand. A country’s economic growth, interest rates, inflation, and trade balance are all key determinants of its currency’s value. For example, a country with strong economic growth and a stable political environment typically sees its currency appreciate against other currencies.

Central banks play a crucial role in managing currency exchange rates. They intervene in the market by buying or selling their domestic currency to maintain a desired exchange rate or curb volatility. This intervention can have a significant impact on currency movements, as seen in the case of the INR’s depreciation against the USD in the months leading up to November 27, 2018.

Leveraging Forex Rates for Business and Travel

Understanding forex rates is essential for businesses and individuals involved in international transactions. Businesses with foreign operations need to be aware of how currency fluctuations can impact their revenue and expenses. Travelers, too, should monitor currency rates to optimize their travel budget and make informed decisions about currency exchange.

Various tools and platforms are available to track forex rates in real-time and stay updated on market trends. These tools provide valuable information for making informed decisions and mitigating currency risk.

Image: management.ind.in

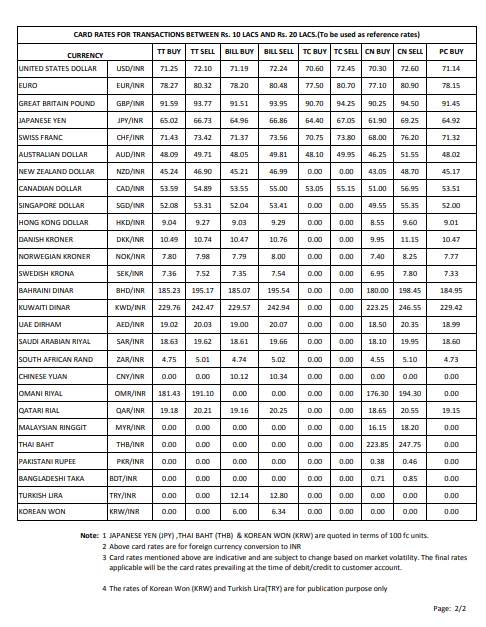

Sbi Forex Rates 27 November 2018

Conclusion: Unlocking the Potential of Currency Dynamics

SBI forex rates on November 27, 2018, offer a glimpse into the ever-evolving world of currency exchange. Understanding the factors that influence these rates and the role of central banks is crucial for navigating the complexities of global finance. By staying informed about currency dynamics, businesses and individuals can leverage forex rates to their advantage, mitigating risks and maximizing opportunities.