Navigating the complexities of foreign exchange can be a daunting task, especially when dealing with the dynamic fluctuations of currency rates. In this comprehensive guide, we delve into the intricacies of SBI Forex Rates on 16 July 2019, providing a detailed analysis and practical insights to empower you with knowledge for informed financial decisions.

Image: nibexyxuro.web.fc2.com

SBI Forex: The Indian Currency Exchange Giant

State Bank of India (SBI) stands as India’s leading public sector bank, offering a comprehensive suite of foreign exchange services. SBI’s extensive global network, coupled with its competitive rates and reliable customer support, has established it as a trusted choice for individuals and businesses alike.

A Day in the Forex Market: 16 July 2019

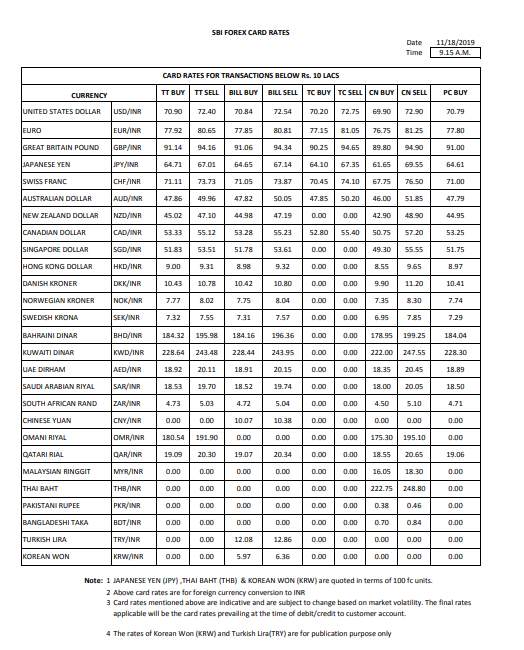

On 16 July 2019, the foreign exchange market witnessed a range of fluctuations, impacting the value of the Indian rupee against major global currencies. The following analysis provides a snapshot of SBI Forex rates on that day:

USD/INR: A Slight Dip

The Indian rupee opened at 69.10 against the US dollar on 16 July 2019. However, a slight dip was observed throughout the day, with the final closing rate settling at 69.15, indicating a depreciation of the rupee against the dollar by 0.05 paise.

EUR/INR: A Gradual Rise

In contrast to the USD/INR pair, the euro experienced a gradual rise against the rupee on 16 July 2019. The day commenced with an opening rate of 78.80 and steadily climbed to close at 79.10, marking an appreciation of 0.20 paise.

GBP/INR: A Minor Fluctuation

The Indian rupee maintained a relatively stable position against the British pound on 16 July 2019. The opening rate of 90.50 remained consistent throughout the day, closing marginally higher at 90.55.

Understanding Forex Rate Variations

Foreign exchange rates are highly dynamic and influenced by various macroeconomic factors, including economic growth, inflation rates, interest rate decisions, and political stability. Central banks play a crucial role in managing currency valuations through monetary policies and interventions.

External factors such as global trade, geopolitical events, and commodity prices can also significantly impact forex rates. Market sentiments, speculation, and news flow often drive short-term fluctuations, creating opportunities for traders to capitalize on market volatility.

Empowering You with Forex Knowledge

Navigating the forex market effectively requires a solid understanding of the underlying factors driving currency valuations. Stay updated with the latest economic news, central bank announcements, and geopolitical developments to make informed decisions.

Familiarize yourself with key forex trading terms, such as bid-ask spreads, leverage, and stop-loss orders, to optimize your trading strategies. Consider seeking guidance from experienced traders or financial advisors to gain insights and enhance your understanding.

Image: management.ind.in

Frequently Asked Questions (FAQs)

Q: What factors influence SBI Forex rates?

A: SBI Forex rates are influenced by domestic economic conditions, global economic factors, central bank policies, geopolitical events, and market sentiments.

Q: How often do SBI Forex rates change?

A: SBI Forex rates are updated in real-time throughout the trading day, reflecting the latest market conditions.

Q: Can I trade foreign exchange with SBI?

A: Yes, SBI offers foreign exchange trading services through its designated branches and online platforms.

Sbi Forex Rates 16 July 2019

Conclusion

Comprehending SBI Forex rates is paramount for making informed currency exchange decisions. The analysis presented in this article provides valuable insights into the fluctuations observed on 16 July 2019 and highlights the importance of staying abreast of market dynamics. Whether you’re a seasoned trader or an individual navigating foreign currency transactions, this article has equipped you with the knowledge and resources to navigate the forex market with confidence.

Are you ready to delve deeper into the fascinating world of foreign exchange rates? Explore our blog for the latest forex news, analysis, and expert advice to empower your financial acumen.