Introduction

Embarking on international adventures or conducting global business transactions seamlessly requires a reliable financial instrument. The SBI Forex Card presents an unparalleled solution, offering a secure and convenient gateway to manage your foreign exchange needs. In this comprehensive guide, we will delve into the intricacies of the SBI Forex Card application process, providing you with the knowledge and confidence to navigate it effortlessly.

Image: www.youtube.com

Unlocking the Advantages of SBI Forex Card

The SBI Forex Card is a prepaid travel card specifically designed for foreign currency transactions. It empowers you with a myriad of advantages:

-

Convenience: Say goodbye to the hassle of carrying cash or exchanging currency at unfavorable rates. With the SBI Forex Card, you can make purchases, withdraw cash, and pay for services in over 150 countries worldwide.

-

Security: Rest assured, your funds are safeguarded with advanced chip-and-PIN technology and a zero-liability guarantee. In case of card loss or theft, you can instantly block it, preventing unauthorized access.

-

Competitive Exchange Rates: SBI offers highly competitive exchange rates, ensuring you get the most value for your money.

-

Transaction Transparency: Track your expenses effortlessly through real-time SMS alerts and online statements, providing complete visibility into your transactions.

Navigating the SBI Forex Card Application Process

Applying for an SBI Forex Card is a straightforward process that requires meticulous adherence to the following steps:

1. Eligibility Criteria

To qualify for an SBI Forex Card, you must:

- Be an Indian resident.

- Hold an active SBI Savings or Current Account.

- Provide valid photo identification documents (Aadhaar Card, Passport, or Voter ID).

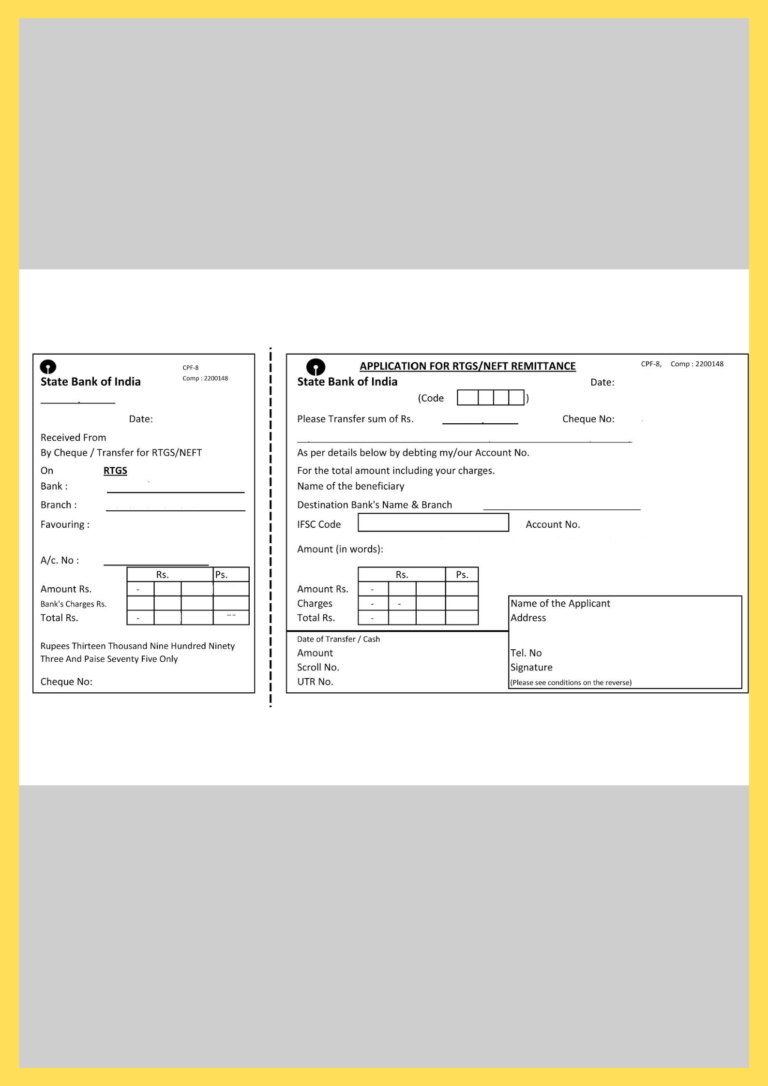

Image: www.getpdfform.com

2. Online Application

Visit the official SBI website and navigate to the ‘Forex Card’ section. Select ‘Apply Now’ and follow the online application prompts carefully.

3. Mandatory Documents

Attach scanned copies of the following documents:

- Photo identification proof.

- Address proof (Aadhaar Card, Utility Bill, etc.).

- Proof of Income (Salary Slip, Income Tax Return, etc.).

- Copy of SBI Savings or Current Account statement.

4. Submit and Track Application

After completing the online application, submit it and note the reference number provided. You can track the status of your application online using the reference number.

Essential Tips for a Smooth Application

- Ensure the accuracy of all the information provided.

- Submit clear and legible copies of all supporting documents.

- Be mindful of the income criteria and provide supporting documents accordingly.

- Allow ample time for application processing, typically 5-7 business days.

Sbi Forex Card Form Apply

Conclusion

Empowering yourself with an SBI Forex Card provides unparalleled convenience, security, and value for your international financial transactions. By following the detailed steps outlined in this comprehensive guide, you can confidently navigate the application process and unlock the potential of this indispensable tool. Remember, the SBI Forex Card is your passport to a world of seamless financial management, enabling you to embrace global adventures or business endeavors with peace of mind.