When navigating the realm of foreign exchange, understanding the intricacies of currency exchange rates is paramount. SBI, the State Bank of India, is a prominent player in the Indian forex market, and its buy and sell rates significantly influence currency exchange transactions. In this comprehensive guide, we will delve into the intricacies of SBI Forex buy and sell rates, unravel their impact on currency exchange, and equip you with expert insights to optimize your currency conversions.

Image: depositselling.mystrikingly.com

Navigating the intricacies of currency exchange rates can be akin to navigating a labyrinth, but with the right guidance, you can emerge with a firm grasp of the fundamentals. Let’s embark on a journey to decipher the SBI Forex buy and sell rates, their implications, and strategies for making informed currency conversion decisions.

SBI Forex Buy Rate

The SBI Forex buy rate represents the amount of Indian Rupee (INR) that you will receive when you sell a foreign currency to SBI. When you exchange a foreign currency to INR, you are essentially selling that currency and purchasing INR. Therefore, a higher buy rate translates to a more favorable exchange rate for you as you will receive more INR for your foreign currency.

Factors influencing the buy rate include the global demand and supply for both currencies, economic conditions, interest rate differentials, and political stability. A strong demand for INR relative to the foreign currency will lead to a higher buy rate, while factors that weaken INR, such as economic instability or political turmoil, will result in a lower buy rate.

SBI Forex Sell Rate

Conversely, the SBI Forex sell rate represents the amount of foreign currency that you will receive when you purchase a foreign currency using INR. When you buy a foreign currency, you are essentially selling INR and purchasing the foreign currency. Thus, a lower sell rate indicates a more favorable exchange rate for you as you will receive more foreign currency for your INR.

Similar to the buy rate, the sell rate is influenced by a multitude of factors, including economic conditions, interest rates, and global currency demand and supply. A strong demand for foreign currency relative to INR will result in a lower sell rate, while factors that strengthen INR will lead to a higher sell rate.

Understanding the Spread

The spread refers to the difference between the buy and sell rates offered by foreign exchange providers like SBI. The spread represents the profit margin for the provider and varies depending on the currency pair, market conditions, and the provider’s policies. A wider spread indicates a higher profit margin for the provider and less favorable exchange rates for you.

To minimize the impact of the spread on your currency conversions, it is advisable to compare rates offered by different providers and choose the one with the narrowest spread. Additionally, it is worth noting that the spread is typically higher for less frequently traded currency pairs.

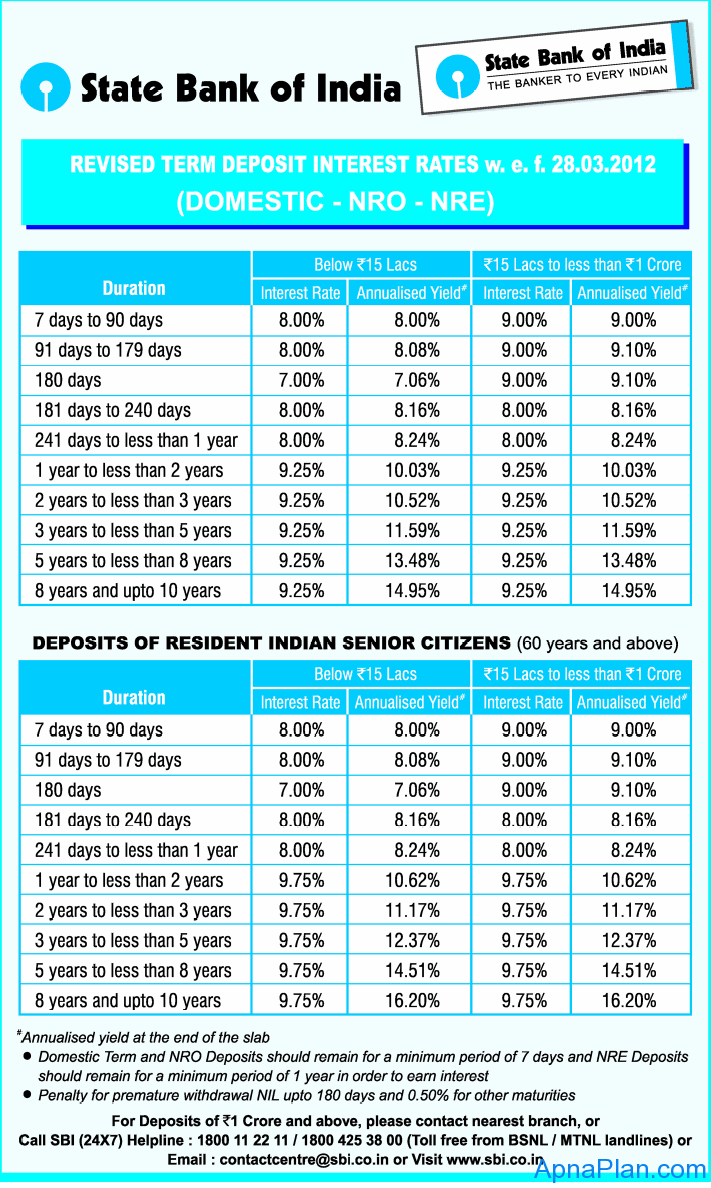

Image: www.apnaplan.com

Tips for Optimizing Currency Conversions

To master the art of currency conversions and maximize your returns, follow these expert tips:

- Monitor currency trends: Keep an eye on currency exchange rate fluctuations and market news to identify favorable exchange rate windows for your transactions.

- Compare rates from multiple providers: Don’t settle for the first rate you come across. Take the time to compare rates from different banks, currency exchange providers, and online platforms to find the best deal.

- Negotiate when possible: If you are exchanging large sums of currency, you may be able to negotiate a more favorable rate with your provider.

- Use a currency converter: Utilize currency converters to quickly calculate exchange rates and compare different providers’ offerings.

By adhering to these expert recommendations, you can optimize your currency conversions and make informed decisions that maximize your returns.

Frequently Asked Questions (FAQs)

To further clarify the intricacies of SBI Forex buy and sell rates, let’s address some frequently asked questions:

- Q: What is the difference between a buy rate and a sell rate?

- A: The buy rate is the rate at which you sell a foreign currency and receive INR, while the sell rate is the rate at which you buy a foreign currency using INR.

- Q: What factors influence the buy and sell rates?

- A: The rates are influenced by global currency demand and supply, economic conditions, interest rate differentials, and political stability.

- Q: How can I minimize the impact of the spread?

- A: Compare rates from multiple providers and choose the one with the narrowest spread.

- Q: Can I negotiate a more favorable rate?

- A: Yes, if you are exchanging large sums of currency, you may be able to negotiate a better rate with your provider.

Sbi Forex Buy Sell Rate Meaning

Conclusion

Navigating the world of foreign exchange rates can be daunting, but with a firm grasp of the intricacies of SBI Forex buy and sell rates, you can confidently make informed currency conversion decisions. Utilize the tips and insights outlined herein to optimize your currency conversions and maximize your returns.

If you found this article informative and would like to delve deeper into the topic, we invite you to explore our extensive blog on currency exchange and foreign exchange markets. By staying abreast of the latest trends and developments in the forex industry, you can empower yourself to make astute currency conversion decisions.