Embarking on Your Forex Journey: Understanding SBI’s Essentials

The foreign exchange market, commonly known as forex, beckons global participants to navigate the dynamic interplay of currencies. SBI e-Forex, a reliable gateway for Indian residents, enables seamless forex transactions. To embark on your forex endeavor, it’s crucial to grasp the minimum transaction size stipulated by SBI. This article delves into the intricacies of SBI e-Forex’s minimum transaction size, guiding you towards making informed decisions.

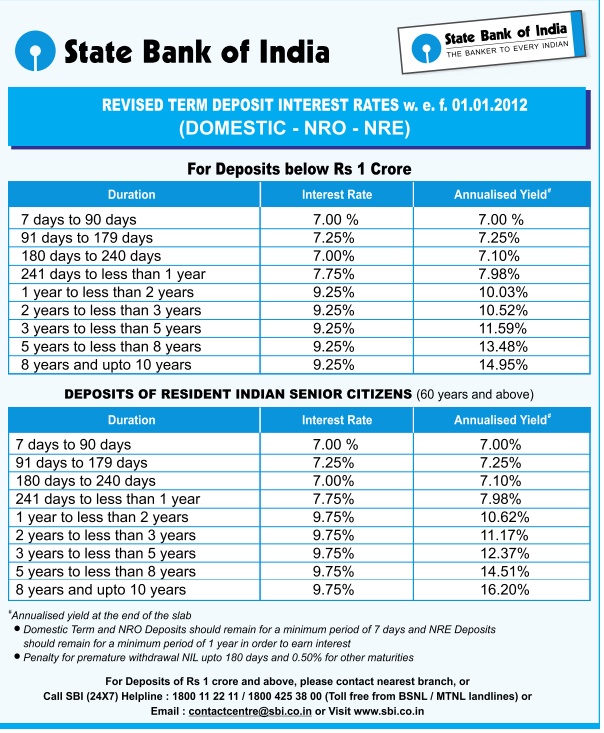

Image: teresaayden.blogspot.com

SBI e-Forex: Unraveling the Minimum Transaction Size

The minimum transaction size for SBI e-Forex stands at USD 1000, applicable to all forex transactions executed through the platform. This threshold ensures that traders maintain a disciplined approach, minimizing the risks associated with market fluctuations. For instance, imagine a trader with a modest capital of USD 500 attempting to trade a currency pair priced at USD 1.1234. A trade involving the entire capital would result in a position size of approximately 445 units (500/1.1234). However, with the minimum transaction size set at USD 1000, the trader is compelled to scale down their position to 890 units (1000/1.1234), effectively mitigating potential losses.

Strategic Considerations: Adhering to the Minimum Transaction Size

Comprehending the rationale behind SBI e-Forex’s minimum transaction size is essential for prudent trading. Firstly, it fosters responsible risk management by preventing traders from risking an excessive portion of their capital on a single trade. Secondly, it aligns with the regulatory framework governing forex trading in India, ensuring compliance with established standards. Moreover, adhering to the minimum transaction size allows traders to accumulate valuable experience without incurring substantial financial risks. By adhering to this threshold, traders can hone their trading strategies and refine their market insights before venturing into larger positions.

Navigating the Forex Market with SBI e-Forex: Key Features

SBI e-Forex empowers traders with a suite of features designed to simplify and enhance their forex trading journey. These include:

-

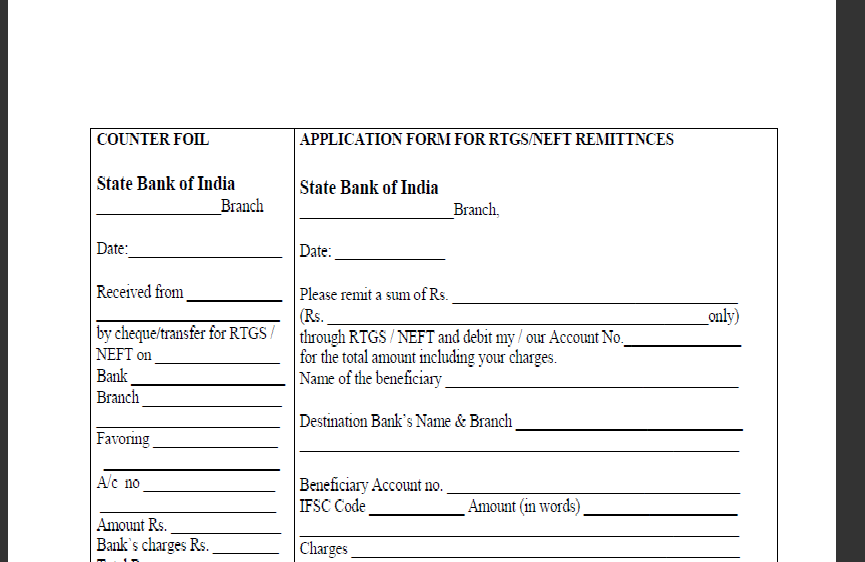

Image: payehuvyva.web.fc2.comUser-Friendly Platform

: SBI e-Forex boasts an intuitive interface, making it accessible even for novice traders. The platform’s user-friendly design ensures seamless navigation and efficient order execution.

-

Competitive Spreads

: Traders benefit from competitive spreads offered by SBI e-Forex, enabling them to minimize transaction costs and maximize their trading profits.

-

Extensive Market Coverage

: SBI e-Forex grants traders access to a wide array of currency pairs, catering to the diverse trading needs of its clientele.

-

Dedicated Support

: SBI e-Forex provides round-the-clock customer support, offering traders timely assistance and resolving their queries promptly.

Expert Tips for Enhanced Trading: Unlocking Success with SBI e-Forex

Seasoned traders advocate the following tips for maximizing success with SBI e-Forex:

-

Thorough Market Analysis

: Conduct meticulous market analysis before executing trades. Stay abreast of economic news, market trends, and geopolitical developments that may influence currency movements.

-

Risk Management

: Implement robust risk management strategies to safeguard your capital. Determine appropriate stop-loss levels and adhere to the minimum transaction size to mitigate potential losses.

-

Disciplined Trading

: Maintain discipline and avoid impulsive trading decisions. Stick to your trading plan and refrain from chasing losses or overtrading.

FAQs: Frequently Asked Questions about SBI e-Forex Minimum Transaction Size

-

Q: What is the minimum transaction size for SBI e-Forex?

-

A: USD 1000.

-

Q: Why is there a minimum transaction size?

-

A: To promote responsible risk management and align with regulatory guidelines.

-

Q: Can I trade with less than the minimum transaction size?

-

A: No, all trades executed through SBI e-Forex must meet or exceed the minimum transaction size.

Sbi E Forex Minimum Transaction Size

Conclusion: Empowering Traders of All Levels

SBI e-Forex’s minimum transaction size serves as a guiding principle for forex traders, fostering responsible trading practices and enhancing overall trading experiences. By adhering to this threshold, traders can navigate the forex market strategically, managing their risks effectively and maximizing their chances of success. As you delve deeper into the exciting world of forex trading, remember that knowledge and discipline are your most valuable allies. Are you ready to embark on this journey with SBI e-Forex as your trusted companion?