Introduction

Image: www.youtube.com

In the labyrinthine world of finance, forex adjustments are essential for reconciling foreign exchange fluctuations. SAP, a renowned enterprise resource planning software, excels in automating financial processes. Within this robust ecosystem, the B/S Forex Adjustment Account plays a critical role in managing forex discrepancies, ensuring accurate financial reporting, and safeguarding your organization’s bottom line.

Understanding the SAP B/S Forex Adjustment Account

The SAP B/S Forex Adjustment Account, aptly named, accounts for differences arising from foreign exchange rate fluctuations between the balance sheet and profit and loss statements. These adjustments ensure that both statements reconcile despite the volatility of exchange rates. By leveraging the account, you empower your organization with precise and reliable financial data, fostering informed decision-making.

Best Practices for Account Management

Managing the SAP B/S Forex Adjustment Account requires diligence and precision. The following best practices serve as invaluable guidance:

-

Accurate Source Data: Meticulous record-keeping is paramount. Maintain accurate exchange rates and transaction values to minimize data integrity issues.

-

Regular Reconciliation: Regularly reconcile your forex transactions meticulously, ensuring that the account balance aligns with both the balance sheet and profit and loss statements.

-

Automated Processes: Leverage the automation capabilities of SAP to streamline reconciliation processes, reducing manual effort and enhancing efficiency.

-

Expert Consultation: If you encounter complexities, don’t hesitate to seek guidance from SAP experts or qualified accountants specialized in forex accounting.

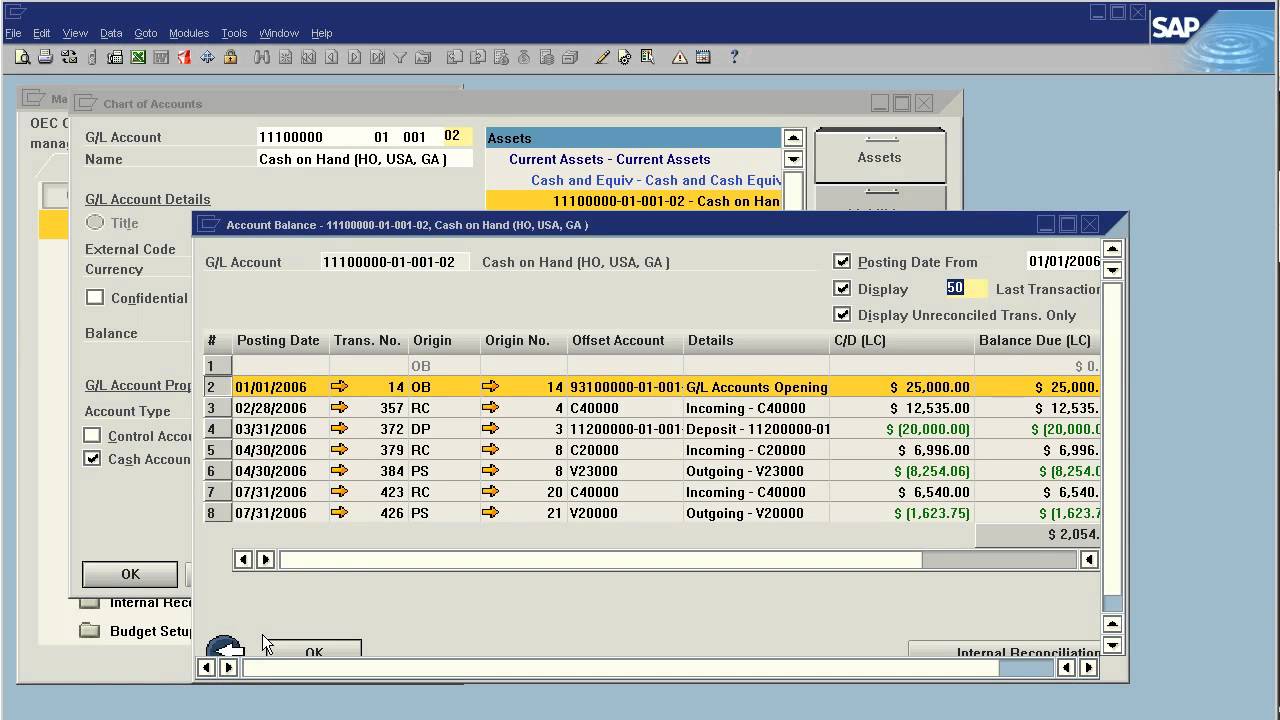

Executing Forex Adjustments

When forex adjustments are necessary, the SAP B/S Forex Adjustment Account facilitates seamless execution. The process involves the following steps:

-

Determine the Exchange Rate: Ascertain the relevant exchange rate applicable to the specific transaction.

-

Calculate the Adjustment Amount: Calculate the adjustment amount based on the exchange rate difference between the initial recording and the current reporting date.

-

Post the Adjustment: Utilize the B/S Forex Adjustment Account to post the calculated adjustment. This step reconciles the balance sheet and profit and loss statements, reflecting the impact of forex fluctuations.

Real-World Example

Consider a company conducting business in both the United States and Europe. If the euro strengthens against the U.S. dollar, the company’s European assets recorded in U.S. dollars will increase in value. This increase must be reflected in the balance sheet, while the corresponding adjustment is recorded in the B/S Forex Adjustment Account, ensuring the alignment of both financial statements.

Conclusion

The SAP B/S Forex Adjustment Account is an indispensable tool for organizations operating in a globalized economy. By employing best practices and adopting a meticulous approach, you can effectively manage forex adjustments, ensuring accurate financial reporting, informed decision-making, and ultimately, the success of your organization. Remember to prioritize accuracy, leverage technology, and seek expert advice when needed to optimize your forex accounting processes.

Image: www.youtube.com

Sap B S Forex Adjestment Account