In the realm of global finance, the foreign exchange market, or forex, stands as a leviathan of unparalleled magnitude. Its tentacles stretch across continents, unceasingly trading trillions of dollars each day. For the uninitiated, navigating this tempestuous ocean can seem an insurmountable task. But fear not, dear reader, for we present to you an illuminating questionnaire that will serve as your beacon of clarity in this enigmatic market.

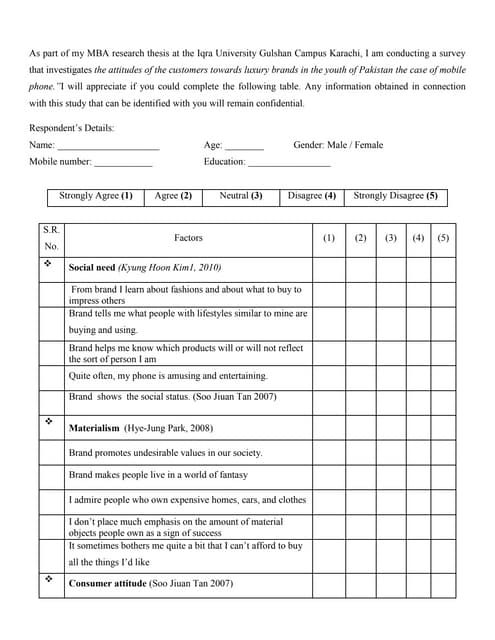

Image: www.slideshare.net

1. Decoding Forex Fundamentals

What exactly is forex, and why does it matter? To unravel this Gordian knot, we must first understand its essence. Forex is the marketplace where currencies are bought, sold, and exchanged. Its significance lies in its ability to facilitate global commerce and investment, enabling businesses and individuals to transact across borders. Without a well-functioning forex market, international trade would be crippled, and the global economy would grind to a halt.

2. Understanding Currency Pairs

In the forex market, currencies are always traded in pairs. Each currency exchange rate represents the value of one currency relative to another. For example, the EUR/USD exchange rate indicates how many U.S. dollars are needed to purchase one euro. The first currency in a pair is known as the base currency, while the second is the quote currency.

3. Forex Mechanics: How Does Trading Work?

Forex trading involves buying and selling currency pairs in anticipation of fluctuations in their exchange rates. Traders capitalize on the differences in value between currencies to generate profits. For instance, if a trader believes that the euro will strengthen against the U.S. dollar, they can buy the EUR/USD pair. If the euro indeed appreciates, the trader can sell their EUR/USD position at a higher price, pocketing the difference.

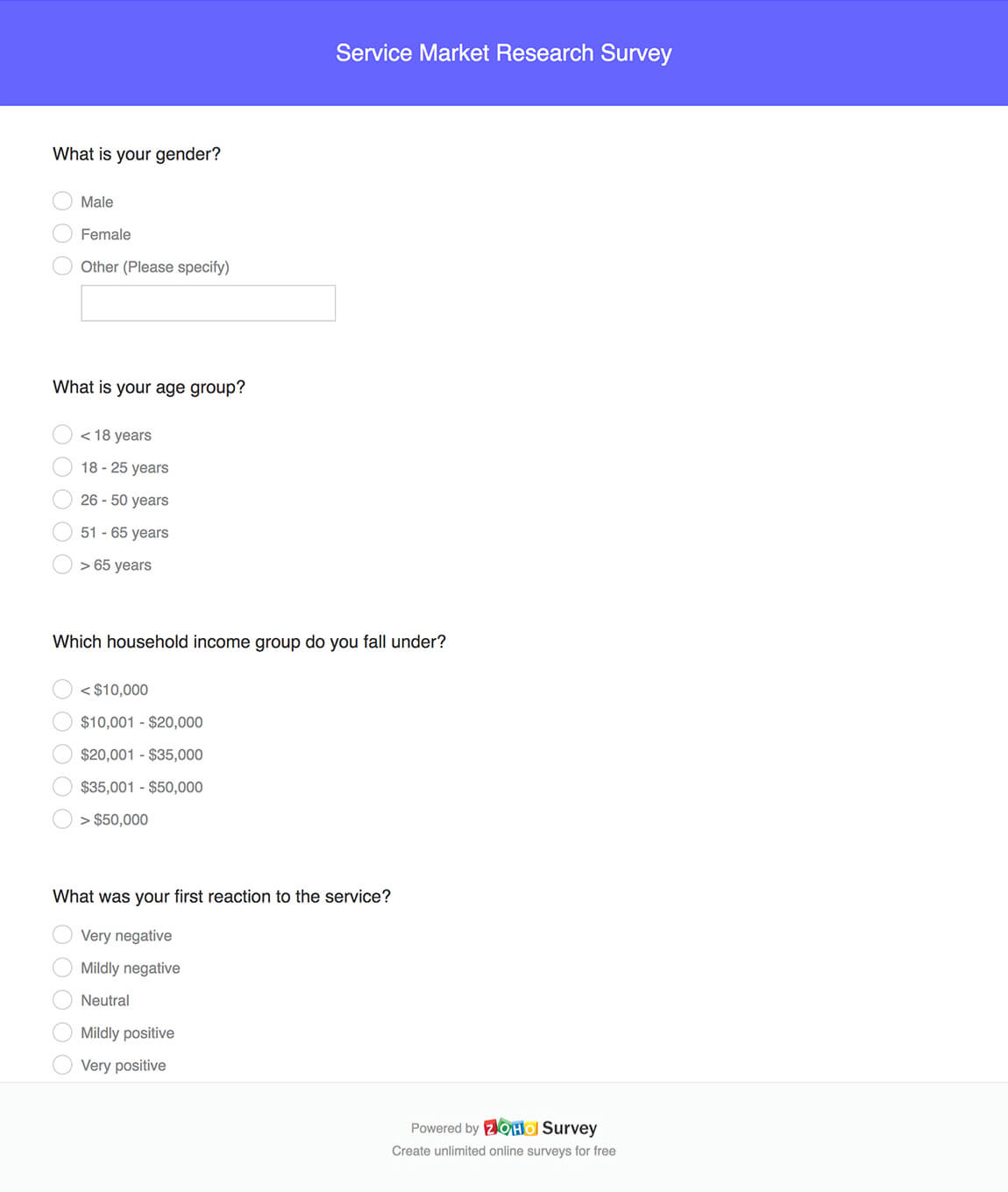

Image: www.zoho.com

4. Key Factors Driving Forex Market Movements

A myriad of factors can influence the forex market, including economic data, political events, interest rate changes, and natural disasters. Understanding these factors is crucial for successful trading. Economic data releases, such as GDP growth, employment figures, and inflation reports, can have a significant impact on currency values. Political events, such as elections or wars, can also roil the markets. Interest rate changes by central banks can alter the attractiveness of a currency for investors.

5. Types of Forex Market Participants

The forex market is home to a diverse cast of participants, each playing a vital role in the functioning of the market. Commercial banks facilitate currency exchange for businesses and individuals. Hedge funds and investment banks engage in speculative trading to generate profits. Central banks intervene in the market to stabilize currencies and manage monetary policy.

6. Common Forex Trading Strategies

Seasoned forex traders employ a diverse array of strategies to navigate the ever-changing market currents. Scalping involves making small, frequent profits by trading on very short timeframes. News trading involves capitalizing on the price movements caused by economic data releases or political events. Swing trading entails holding positions for a few days or weeks, targeting larger price swings. Trend trading involves riding longer-term trends in currency values.

7. Tools of the Trade: Forex Platforms and Technical Analysis

Forex traders rely on a range of tools to analyze the market and make informed decisions. Forex trading platforms provide real-time data, charting capabilities, and order execution tools. Technical analysis involves studying price charts and identifying patterns that may indicate future market movements. Indicators, such as moving averages and MACD, can assist traders in making trading decisions.

8. Demystifying Forex Trading Risks

While forex trading offers the allure of potential profits, it’s imperative to recognize the inherent risks involved. The forex market is highly volatile and can amplify losses as well as gains. Inadequately managing risk can quickly deplete a trader’s capital. It’s crucial to trade only with funds one can afford to lose and to implement prudent risk management strategies, such as stop-loss orders and position sizing.

9. The Psychology of Forex Trading

Fear and greed are the twin scourges of a forex trader’s psyche. Allow these emotions to cloud your judgment, and you will inevitably pay a steep price. Successful trading requires a disciplined mindset, unwavering emotional control, and the ability to learn from mistakes.

Sample Questionnaire On Forex Market

https://youtube.com/watch?v=GvhD_WwlMq0

Conclusion: Unveiling Forex’s Hidden Depths

The foreign exchange market is an immensely complex and dynamic arena that demands a combination of knowledge, skill, and emotional fortitude. By embarking on this journey of discovery, you have taken the first step towards mastery of this enigmatic realm. Embrace the challenges that lie ahead, and with unwavering determination, you will emerge as a formidable force in the forex market.