As a seasoned forex trader, I’ve witnessed firsthand the transformative power and perils of leverage. It’s a double-edged sword that can amplify both gains and losses. Understanding how to wield leverage safely is crucial for long-term success.

Image: icamaveyi.web.fc2.com

In the realm of forex, leverage enables traders to multiply their trading positions beyond the limits of their capital. This can lead to substantial profits or significant losses. The key is to strike a delicate balance between risk and reward.

Leverage: A Double-Edged Sword

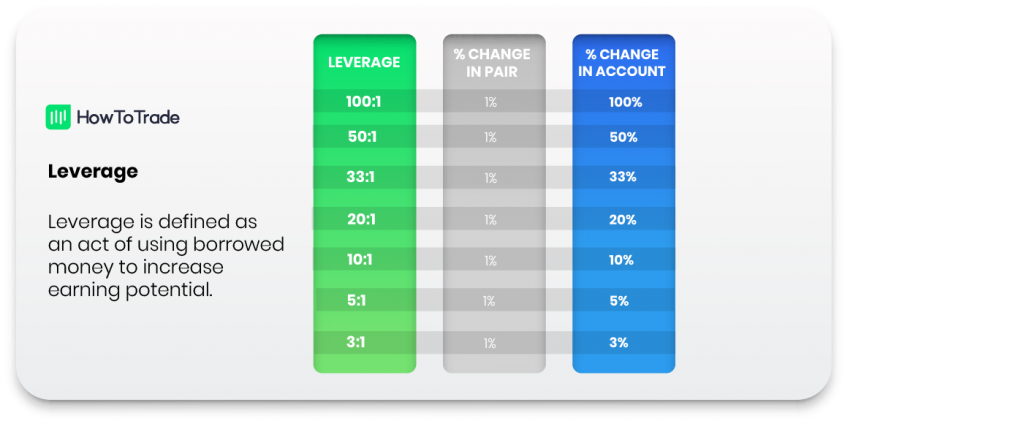

Leverage is essentially a loan from your broker, allowing you to magnify your trading volume. For instance, with a 100:1 leverage ratio, you can control $100,000 worth of currency pairs with a mere $1,000 deposit.

Leverage can dramatically increase your profit potential. However, it also magnifies your losses. A minor price movement in the unfavorable direction could result in substantial financial setbacks. Therefore, it’s essential to understand your risk tolerance and exercise caution.

Determining Safe Leverage

The ideal leverage ratio depends on several factors:

- Risk tolerance: How much risk are you comfortable taking?

- Trading style: Scalpers and day traders may require higher leverage, while long-term investors prefer lower leverage.

- Account balance: Leverage should be proportionate to your trading capital.

- Market conditions: Leverage should be adjusted based on market volatility.

As a general rule, beginner traders should start with low leverage (e.g., 10:1 to 50:1) and gradually increase it as they gain experience. It’s crucial to remember that leverage is a tool, not a guarantee of profit. Use it wisely to minimize risk.

Tips for Safe Leverage

-

Use Stop-Loss Orders: Set pre-defined stop-loss levels to mitigate losses if the market moves against you.

-

Manage Risk per Trade: Limit your risk on each trade to no more than 1-2% of your account balance.

-

Don’t Trade with Borrowed Money: Use only funds you can afford to lose.

-

Trade Only What You Understand: Focus on currency pairs and markets you have knowledge and experience in.

-

Practice on a Demo Account: Before trading with real money, test your leverage strategies in a risk-free environment.

Image: howtotrade.com

FAQ on Safe Leverage

Q: Is leverage always necessary?

A: No, leverage is not a requirement for forex trading. It amplifies potential gains and losses, so it should be used cautiously.

Q: Can I lose more than my initial deposit?

A: Yes, with leverage, you can lose more than your initial deposit. Therefore, it’s essential to manage risk effectively.

Q: How does leverage affect profitability?

A: Leverage can increase both profits and losses. Higher leverage can lead to larger profits, but it also exposes you to greater risk.

Safe Leverage In Forex Trading

https://youtube.com/watch?v=zA4YA2gx3Uo

Conclusion

Leverage is a powerful tool in forex trading, but it must be handled with caution. By following the principles of safe leverage and implementing the expert advice provided, you can harness its potential to enhance your trading performance.

Are you interested in learning more about safe leverage in forex trading? Leave a comment below or contact our expert team for personalized guidance.