Introduction:

Image: www.cmcmarkets.com

In the dynamic world of forex trading, where financial horizons expand across borders, a concealed fee lurks beneath the surface of every transaction known as the spread. This seemingly innocuous concept holds significant implications for traders, as it directly impacts their profitability and can either amplify gains or deepen losses. Understanding the forex spread is not merely an academic exercise but a vital key to navigating the complexities of currency markets.

Decoding the Forex Spread:

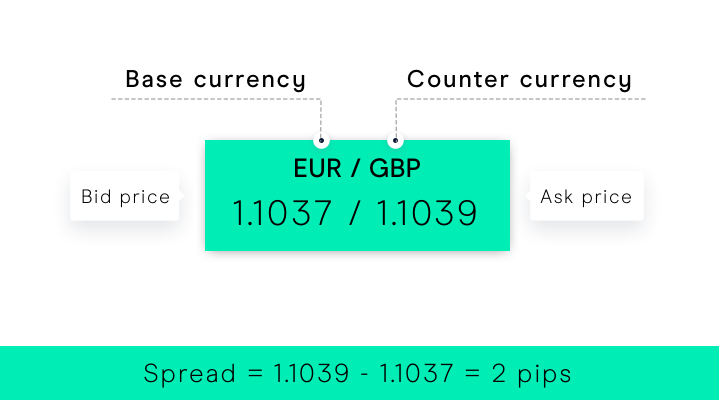

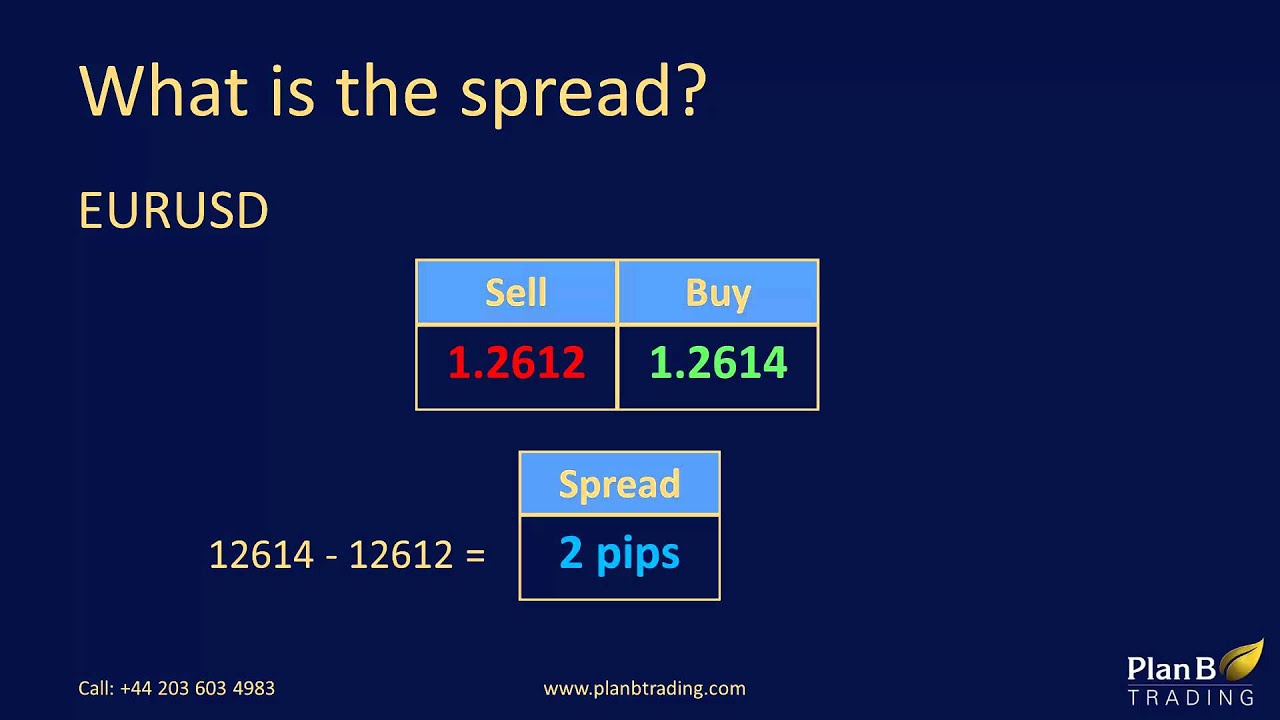

Simply put, the forex spread is the difference between the bid price (the price at which you can sell a currency) and the ask price (the price at which you can buy a currency). This disparity represents the profit margin earned by the forex broker for facilitating the currency exchange.

The Anatomy of a Forex Spread:

Forex spreads are typically quoted in pips (the smallest unit of change in currency value), which vary depending on the currency pair traded and the broker offering the service. For instance, in the EUR/USD currency pair, a spread of 1 pip would translate to a difference of $0.0001 per euro traded.

The Bigger Picture: Impact on Profitability:

The forex spread has a direct impact on your trading profitability. When you buy a currency, you pay the ask price, which is always higher than the bid price. Conversely, when you sell a currency, you receive the bid price, which is lower than the ask price. This spread effectively reduces your profit or increases your loss on each trade.

Spreads and Trading Strategies:

The size of the spread can influence your trading strategies. Scalpers, who make numerous small trades over a short period, are particularly sensitive to spreads, as even a small spread can eat into their profits. Conversely, long-term traders may find spreads less significant, as the impact is spread over a longer time frame.

Choosing Your Broker Wisely:

When selecting a forex broker, it is essential to consider the spreads they offer. Brokers with lower spreads enable you to retain more of your profits, while those with wider spreads can significantly impact your profitability in the long run.

The Importance of Account Type:

The type of account you open with your broker can also affect the spread you pay. ECN (Electronic Communication Network) accounts typically offer lower spreads but charge a commission per trade. Standard accounts, on the other hand, often have wider spreads but waive commissions. Weigh the pros and cons carefully to determine the account type that best aligns with your trading style.

Trading Hours and Spread Fluctuations:

Spreads can also vary depending on the time of day. During off-hours, or when liquidity is low, spreads tend to widen. Traders should be aware of these fluctuations and adjust their trading strategies accordingly.

Expert Insights and Actionable Tips:

- To minimize the impact of spreads on your profitability, trade currency pairs with tight spreads.

- Consider using ECN accounts if you are a high-frequency trader.

- Avoid trading during off-hours to avoid paying wider spreads.

- Monitor the spread for specific currency pairs before placing a trade to ensure it aligns with your profit expectations.

Conclusion:

Understanding the forex spread is not just an academic pursuit but an essential skill for currency enthusiasts. By embracing this knowledge, you can optimize your trading strategies, choose the right broker, and ultimately increase your chances of financial success in the ever-evolving world of forex trading.

Image: binaraoptionerhandelsverige.logdown.com

Forex What Is A Spread