Introduction: The Enigma of Forex Valuation

In the dynamic realm of international finance, the conversion of currencies presents an ever-present challenge. The intricate interplay between multiple factors, including economic conditions, political stability, and market sentiment, constantly shapes the value of different currencies. Embracing this complexity, Rule 32 emerged as a groundbreaking framework for valuing forex converters, meticulously detailing the parameters that influence their worth. This comprehensive guide delves into the intricacies of Rule 32, equipping you with the knowledge to navigate the complexities of forex valuation and harness its transformative power.

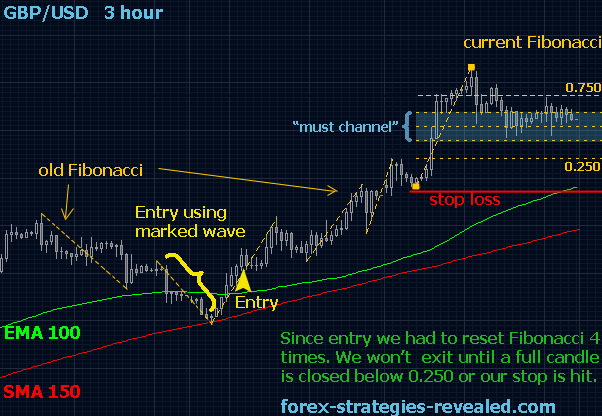

Image: www.forexfactory.com

Decoding Rule 32: Unveiling the Valuation Framework

Rule 32 lays down a comprehensive framework for evaluating forex converters based on four critical determinants:

- Net Asset Value (NAV): The intrinsic value of the converter’s underlying assets, comprising foreign currencies and other financial instruments.

- Earning Power: The ability of the converter to generate revenue and profitability through conversion fees and other operations.

- Market Value: The price at which the converter can be bought or sold in the market.

- Investment Value: The present value of future cashflows generated by the converter, considering its business plan and growth prospects.

These multifaceted factors work in concert to determine the overall valuation of a forex converter, providing a holistic assessment of its financial position and market potential.

Navigating the Nuances of Currency Conversion

Understanding the complexities of currency conversion is paramount for successful forex valuation. Each currency’s fluctuations are influenced by a myriad of factors, including:

- Economic Indicators: Gross domestic product (GDP), inflation, and unemployment rates provide insights into a country’s economic health.

- Political Stability: Political stability fosters economic growth, enhancing currency value. Conversely, political instability can erode confidence, leading to currency depreciation.

- Interest Rates: Central bank interest rates influence currency demand, affecting international capital flows and exchange rates.

- Market Psychology: Market sentiment can drive currency fluctuations, sometimes divorced from economic fundamentals.

Comprehending these dynamics is crucial for precise forex converter valuation, ensuring that market forces are suitably accounted for.

Real-World Applications: Unlocking Value in Forex Conversion

Rule 32 finds practical application in a variety of settings, enabling investors and businesses to make informed decisions regarding forex converters:

- Merger and Acquisition Transactions: Rule 32 provides a comprehensive framework for valuing forex converters during mergers and acquisitions, ensuring fair and transparent transactions.

- Capital Raising: Rule 32 assists forex converters in determining their market value, enabling them to effectively raise capital for growth and expansion.

- Investment Analysis: Investors rely on Rule 32 to evaluate the potential returns and risks associated with forex converters, informing investment decisions.

- Risk Management: Rule 32 facilitates the identification and mitigation of potential risks associated with forex converters, safeguarding financial stability and resilience.

By leveraging Rule 32, market participants can harness the multifaceted aspects of forex valuation, unlocking the full potential of this dynamic asset class.

Image: ykumixyqatala.web.fc2.com

Rule 32 For Valuation Of Forex Converter

https://youtube.com/watch?v=JnxM32DOODc

Conclusion: Empowering Informed Decisions in Forex Valuation

Rule 32 empowers investors, businesses, and policymakers with a robust framework for evaluating forex converters. Understanding the interconnected factors that influence valuation, from NAV to market value, equips individuals with the knowledge to make sound decisions in a complex and ever-evolving financial landscape. Embracing the principles of Rule 32 ensures informed investments, strategic mergers and acquisitions, and efficient risk management. Ultimately, it empowers individuals to harness the transformative power of forex conversion, fostering global trade, facilitating cross-border transactions, and promoting economic growth.