For centuries, money has played a pivotal role in shaping economies and facilitating commerce. Today, the global financial landscape is a complex and interconnected web, with three key components holding significant sway: money markets, debt markets, and the foreign exchange (forex) market. In this article, we will delve into the intricacies of these markets, exploring their functions, interdependencies, and profound impact on our financial system.

Image: fabalabse.com

Unlocking the Basics: Defining Money Markets, Debt Markets, and the Forex Market

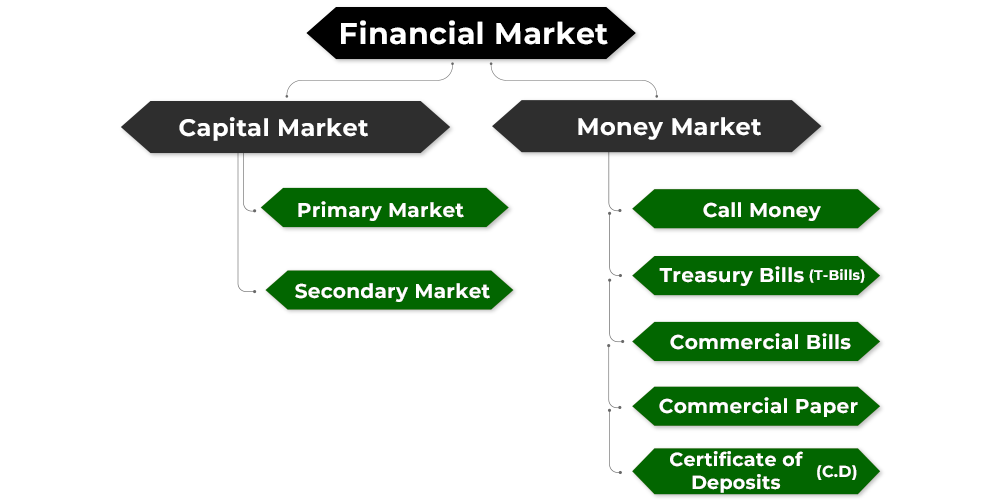

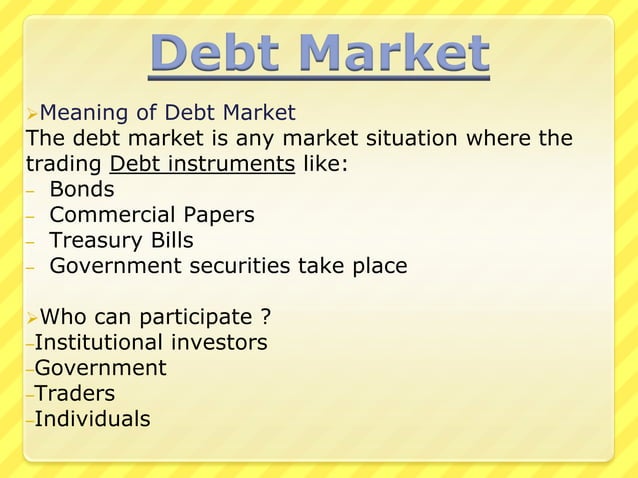

Money markets are short-term financial markets where participants can borrow and lend money at prevailing interest rates. These markets facilitate the flow of liquidity within the financial system and provide a platform for banks and other institutions to manage their daily cash needs. Debt markets, on the other hand, involve the trading of debt instruments with longer maturities, such as bonds and debentures. These markets play a crucial role in capital formation and provide governments and corporations with a means to raise funds for their projects and operations.

Completing the triad is the forex market, the world’s largest financial market, where currencies of different countries are traded. This global marketplace facilitates international trade and investment and plays a critical role in determining the relative value of currencies around the world. Its impact extends beyond currency exchange, influencing interest rates and shaping economic policies.

Money Markets: The Heartbeat of Liquidity

Money markets serve as the lifeblood of the financial system, providing liquidity and maintaining interest rate stability. Banks, investment firms, and other institutions rely on money markets to deposit excess funds or borrow funds to meet their daily operational needs. The transactions in these markets are typically short-term, usually for less than a year.

Examples of money market instruments include treasury bills, commercial paper, and money market mutual funds. Treasury bills, issued by governments, are considered low-risk and highly liquid, while commercial paper is short-term debt securities issued by large corporations. Money market mutual funds provide investors with a convenient and low-risk way to earn interest on their short-term cash holdings.

Debt Markets: Fueling Growth and Innovation

Debt markets are essential for economic growth and the financing of major infrastructure projects and business ventures. By issuing bonds and other debt instruments, governments and corporations can raise capital from a wide range of investors, including institutional investors, pension funds, and retail investors. Bonds, typically with maturities ranging from one to several decades, represent a contractual obligation by the issuer to pay interest payments at regular intervals and repay the principal amount at maturity.

The bond market is vast and diverse, with government bonds, corporate bonds, and municipal bonds being some of the most prominent. Government bonds, issued by governments to finance their operations, are considered low-risk investments and serve as benchmarks for other fixed-income securities. Corporate bonds, issued by companies to raise capital, have a wider range of risk profiles depending on the issuer’s financial health and creditworthiness.

Image: www.slideshare.net

The Forex Market: A Global Currency Exchange

The foreign exchange market, also known as the forex market, is the largest and most liquid financial market globally. It operates 24 hours a day, 5 days a week, with transactions involving the simultaneous buying and selling of currencies. The forex market facilitates international trade and investment, allowing businesses and individuals to exchange currencies at prevailing exchange rates.

The forex market is decentralized, with no central exchange. Instead, trading is conducted electronically through a network of banks and other financial institutions. Participants in the forex market include global banks, central banks, hedge funds, and individual traders seeking to profit from fluctuations in currency prices. The forex market influences exchange rates, which impact the prices of goods and services internationally. Understanding the dynamics of this market is crucial for businesses conducting international operations and investors seeking to diversify their portfolios.

Interdependencies and Symbiotic Relationships

Together, money markets, debt markets, and the forex market form a symbiotic and interconnected ecosystem. Money market interest rates directly impact debt market yields, as investors consider short-term rates when making decisions about longer-term bond investments.

Forex market fluctuations, in turn, can affect interest rates in different countries. For instance, a strengthening US dollar may lead to lower interest rates in the United States, as the demand for dollars increases, making it cheaper for businesses and individuals to borrow.

Role Of Money Markets Debt Markets & Forex Market

Conclusion: The Pillars of Global Finance

Money markets, debt markets, and the forex market are the pillars upon which the global financial system stands. Their harmonious interaction ensures a continuous flow of liquidity, facilitates the allocation of capital, and enables international trade and investment. Understanding the workings of these markets is paramount for investors, businesses, and individuals alike. Whether you are seeking to grow your wealth, finance your next business venture, or navigate the complexities of international trade, a deeper understanding of these financial markets empowers you to make informed decisions and reap the benefits of a globalized economy.