Navigating the Forex Market

Welcome fellow forex enthusiasts! Let me take you on a captivating journey into the vibrant realm of the foreign exchange market. In this comprehensive guide, we’ll delve into the intricacies of forex movements, decode market dynamics, and empower you with insights to enhance your trading strategies.

Image: www.ifcmarkets.com

Understanding Forex Market Drivers

The forex market is a vast and dynamic ecosystem influenced by a multitude of factors. Economic indicators, political events, and central bank decisions play pivotal roles in shaping price movements. By understanding these drivers, traders can gain a competitive edge and make informed decisions.

Key indicators include gross domestic product (GDP), inflation rates, interest rate decisions, and trade balances. These data provide valuable insights into a country’s economic health and influence the value of its currency. Additionally, unforeseen events such as natural disasters, political crises, and global pandemics can trigger significant market fluctuations.

Technical Analysis and Market Trends

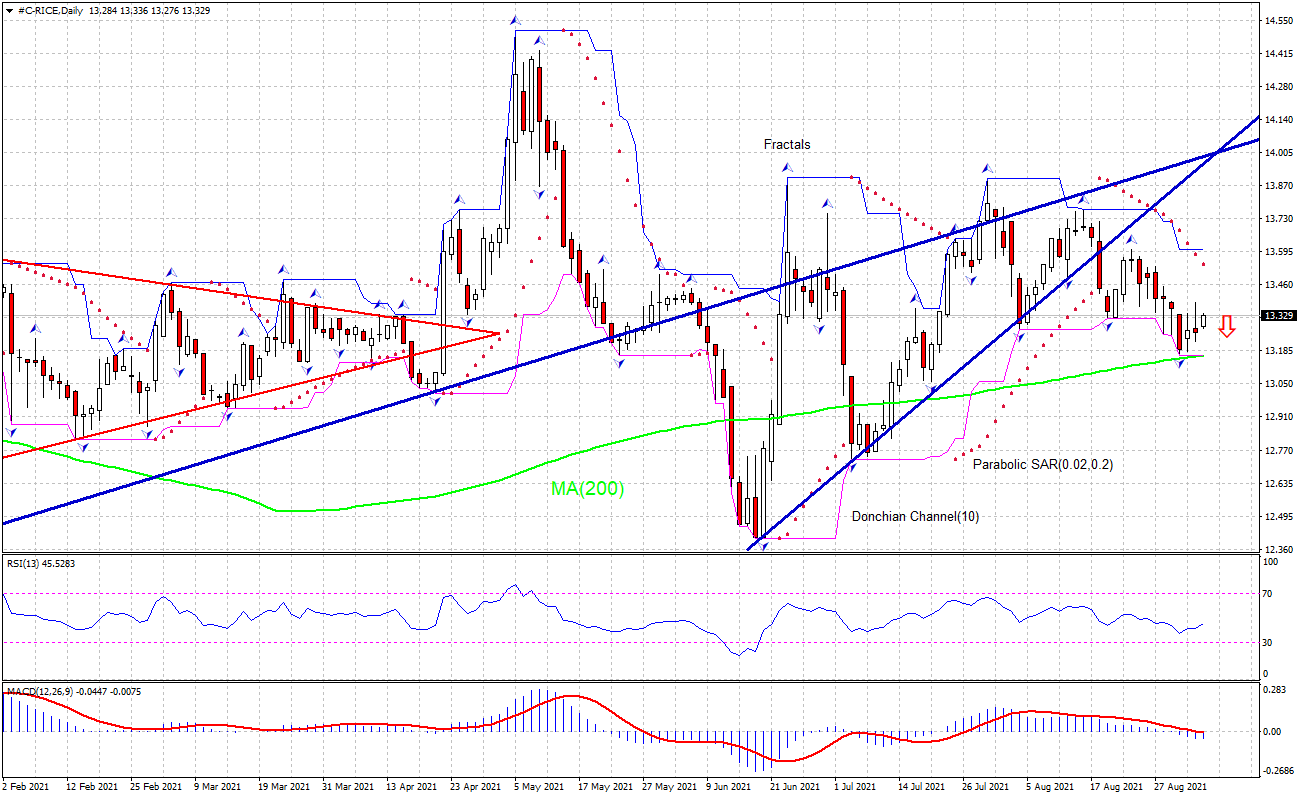

Technical analysis is an indispensable tool for traders seeking to decipher price movements and uncover trading opportunities. Technical indicators, such as moving averages, support and resistance levels, and chart patterns, offer valuable insights into market behavior. By studying price action and identifying key trends, traders can enhance their ability to forecast future price movements.

Price action is the bread and butter of technical analysis. It involves analyzing historical and current price movements to identify patterns, trends, and potential reversal points. Support and resistance levels are crucial concepts, representing areas where prices tend to find temporary barriers and resume previous trend directions. Chart patterns, such as double tops, head and shoulders, and pennants, provide traders with valuable clues regarding potential market reversals or continuations.

Tips for Success in Forex Trading

Now that we’ve explored the basics of forex market movements, let’s delve into some practical tips to enhance your trading performance:

- Set realistic expectations: Forex trading is inherently volatile, and it’s crucial to set realistic profit targets. Avoid getting caught in the trap of chasing quick gains that may ultimately lead to losses.

- Manage your risk: Risk management is paramount in forex trading. Use stop-loss orders to limit potential losses and position sizing appropriately based on your risk tolerance.

Image: ricenewstoday.com

FAQs on Forex Market Movements

To conclude our comprehensive guide, let’s address some frequently asked questions that may be lingering in your mind:

- Q: What are the most important economic indicators to watch when trading forex?

A: Key indicators include GDP, inflation rates, interest rate decisions, and trade balances. - Q: Is technical analysis effective in forex trading?

A: Technical analysis can provide valuable insights into market behavior and potential trading opportunities, but it’s important to note that it is not a foolproof method. - Q: What is the best way to learn about forex trading?

A: Educate yourself through books, online resources, courses, and webinars. Seek guidance from experienced traders and practice with a demo account before risking real capital.

Rice Action Guide To How The Forex Market Moves

Call to Action

As we reach the end of this journey, I hope you’ve gained a deeper understanding of forex market movements. Whether you’re a seasoned trader or just starting out, the insights presented here can help you navigate the complexities of the forex market with greater confidence. Continue your quest for knowledge, stay informed about market dynamics, and let your trading strategies evolve with the ever-changing landscape of the global currency market.

So, are you ready to dive headfirst into the world of forex trading? Embark on this rewarding adventure with a newfound understanding of market movements. If you have any further questions don’t hesitate to reach out. Happy trading, and may your trades bear fruitful profits!