Prologue: A Cautionary Tale of Trading Triumphs and Perils

In the exhilarating realm of forex trading, where currencies dance in a mesmerizing symphony, fortunes can be made and lost in the blink of an eye. Like a seasoned traveler navigating uncharted waters, every trader embarks on a quest for financial freedom, armed with dreams and ambitions. However, beneath the surface of this alluring financial arena lurks the ever-present specter of risk.

Image: www.youtube.com

The story of Amelia, a young and ambitious forex trader, serves as a poignant reminder of the delicate balance between triumph and peril in this high-stakes world. With each trade, Amelia meticulously analyzed market trends, her instincts guiding her towards potentially lucrative opportunities. Success smiled upon her endeavors, swelling her account with enviable profits. Yet, as fate would have it, a sudden shift in market sentiment sent her carefully constructed trades toppling like dominoes. Losses mounted relentlessly, threatening to engulf her hard-earned gains.

Amelia’s experience encapsulates the inherent risk associated with forex trading. While tantalizing rewards await those who navigate the markets with precision, it is imperative to acknowledge the potential consequences of adverse events. A restatement of liability serves as a crucial safeguard in this volatile landscape, providing traders with a clear understanding of their obligations and the limits of their exposure.

Defining Restatement of Liability in Forex

At its core, a restatement of liability is a formal agreement that defines the terms and conditions under which a trader is responsible for any losses or damages incurred during forex transactions. It outlines the extent to which the broker, acting as the intermediary between the trader and the wider market, can be held accountable.

The restatement of liability typically covers various aspects, including:

-

The trader’s maximum potential loss, often expressed as a percentage of their account balance or a specific monetary amount. This limit helps protect traders from catastrophic losses that could exceed their financial means.

-

The circumstances under which the trader is responsible for losses, such as negligence, fraud, or unauthorized trading.

-

The broker’s obligations, including providing accurate information, executing trades promptly, and maintaining the security of the trader’s funds.

Understanding the restatement of liability is paramount for traders to make informed decisions and manage their risks effectively. It serves as a constant reminder of the inherent risks involved and the importance of trading within one’s financial capabilities.

Navigating the Forex Landscape: Key Considerations

As traders venture into the dynamic realm of forex, several key considerations must be taken into account to navigate the complexities of this financial arena:

-

Broker Selection: Choosing a reputable and reliable broker is of utmost importance. Traders should thoroughly research and compare brokers, paying attention to their regulatory compliance, financial stability, trading platform, and customer service.

-

Understanding Market Risks: Forex trading involves inherent risks, including currency fluctuations, leverage, and liquidity issues. Traders must have a thorough understanding of these risks and their potential impact before entering the market.

-

Risk Management Strategies: Implementing sound risk management strategies is crucial for mitigating potential losses. This includes setting clear trading limits, using stop-loss orders, and managing leverage prudently.

-

Trading Education: Continuous education is essential for successful forex trading. Traders should dedicate time to learning and honing their skills, staying abreast of market trends, and expanding their knowledge base.

Empowering Traders: Experts’ Insights and Actionable Tips

Seasoned forex traders have traversed the market’s treacherous waters, amassing a wealth of knowledge and experience. Their insights can provide invaluable guidance for aspiring traders:

-

“Risk management is the cornerstone of successful trading. Discipline and adherence to predefined trading rules are paramount,” advises veteran trader John Carter.

-

“Embrace the learning process and seek continuous improvement. The forex market is constantly evolving, and traders must adapt to stay ahead,” emphasizes currency analyst Anna Coulling.

Actionable tips for minimizing risks and maximizing trading success:

-

Start with a demo account to practice trading strategies without incurring real losses.

-

Trade only with capital you can afford to lose, and never risk more than you can withstand.

-

Use a trading journal to track your trades, analyze performance, and identify areas for improvement.

-

Seek guidance from experienced traders or mentors who can provide valuable insights and support.

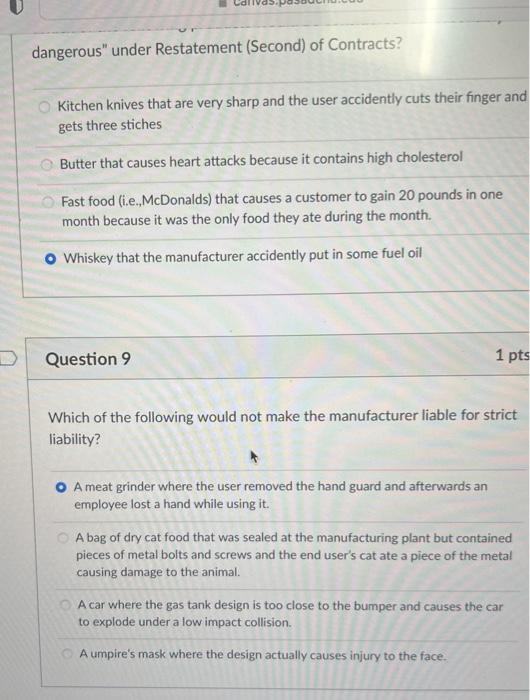

Image: www.chegg.com

Restatement Of Liability On Forex

Conclusion: Embracing Risk and Responsibility

In the intricate world of forex trading, where opportunities and risks intertwine, understanding your restatement of liability is a fundamental step towards responsible and successful trading. It provides a clear framework for both traders and brokers, defining their obligations and mitigating potential losses.

By embracing a proactive approach to risk management, traders can minimize their exposure and increase their chances of long-term profitability. Continuous education, judicious trading strategies, and the unwavering support of reputable brokers can empower traders to navigate the forex markets with confidence and conquer the challenges that lie ahead.

Remember, the path to financial success in forex trading is not without its hazards. Yet, by accepting the inherent risks and embracing the principles of responsible trading, you can embark on this exciting financial journey with a clear understanding of your obligations, empowering you to seize opportunities while safeguarding your dreams of financial freedom.