In the turbulent waters of the foreign exchange market, the art of forex management navigates a course to financial success. Delving into this captivating realm, I’m reminded of a seasoned trader I encountered, his eyes gleaming with the wisdom of a seasoned captain weathering the storms of the market. His profound advice, etched indelibly in my mind, set me on a quest to unlock the secrets of forex management.

Image: ebook4trader.com

The Anatomy of Forex Management

Forex management, like a symphony, harmonizes a multitude of essential elements. It encompasses risk management, capital allocation, position sizing, trade execution, and performance monitoring. Like a skilled surgeon, the forex manager operates with precision and dexterity, balancing these factors to maximize returns while minimizing exposure.

Unveiling the Science of Risk Management

In the forex arena, risk management reigns supreme. It’s the prudent art of minimizing potential losses while maximizing potential gains. Like a tightrope walker, the forex manager balances calculated risks, employing stop-loss orders and appropriate leverage to tame the market’s volatility.

Conquering Capital Allocation

Capital allocation, akin to resource management in warfare, determines how a trader deploys their financial resources. Balancing investments across multiple currency pairs and diversifying portfolios, the forex manager seeks to mitigate risk and enhance profitability. Allocation strategies vary, from conservative to aggressive, tailored to each trader’s risk appetite.

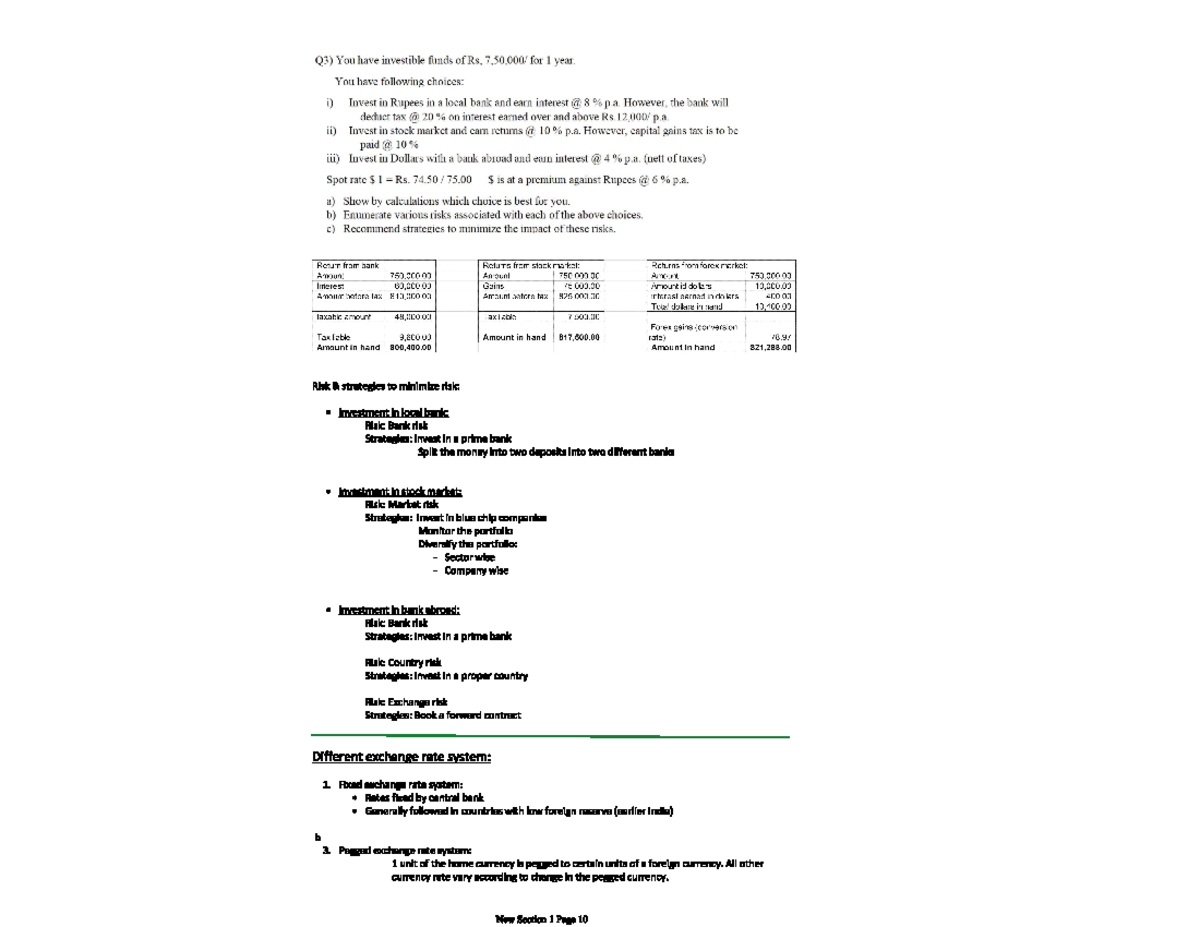

Image: www.studocu.com

Mastering Position Sizing

Position sizing, the cornerstone of prudent trading, dictates the amount of currency to buy or sell. This decision hinges upon the trader’s risk tolerance and capital base. Like a master chess player, the forex manager carefully calculates position size, balancing potential profits with the potential risk of each trade.

Trading Beyond Execution

Trade execution marks the culmination of meticulous planning. Forex managers employ various order types to capitalize on market movements. Whether executing at market price or setting limit orders, the choice of order type influences the timing and price at which trades are executed.

The Art of Performance Analysis

Like a sculptor refining their masterpiece, forex managers continuously monitor their trades, evaluating performance, and identifying areas for improvement. Performance analysis, like a surgeon’s scalpel, dissects trades, identifying patterns and isolating strengths and weaknesses. Through this rigorous process, traders refine their strategies, seeking to achieve optimal results.

Navigating the Evolving Forex Landscape

Forex management is a dynamic field, constantly evolving in response to market trends and advancements. Staying abreast of the latest news, updates, and innovations is essential for traders to stay ahead of the curve. Engaging in forums, social media, and educational resources provides invaluable insights into the ever-changing landscape of the forex market.

Expert Advice for Navigating Forex

From my years of experience as a forex trader, I’ve compiled invaluable tips and expert advice to guide your journey:

- Embrace Discipline: Forex management is not a get-rich-quick scheme. Discipline in risk management, trading strategies, and emotional control is paramount.

- Seek Knowledge: Education empowers traders. Dive into books, articles, and online courses to continuously expand your knowledge of forex fundamentals and strategies.

- Practice with Demo Accounts: Before venturing into live trading, hone your skills on demo accounts. This risk-free environment allows you to experiment with strategies and gain invaluable experience.

- Manage Emotions: Control over emotions is crucial in forex management. Avoid impulsive decisions, and instead, base trades on rational analysis.

- Follow Market Trends: Staying informed about market conditions and economic events enables traders to anticipate price movements and make informed decisions.

Frequently Asked Questions

What is the most crucial aspect of forex management?

Risk management, the ability to minimize potential losses while maximizing potential gains.

How do I determine the right position size?

Position sizing should align with the trader’s risk tolerance and capital base. Careful calculation is essential to balance potential profits and risks.

What is the most effective trading strategy?

The best strategy depends on the trader’s risk tolerance, time horizon, and market conditions. There is no one-size-fits-all solution.

Research Papers On Forex Management

Embracing the Forex Adventure

Forex management, like any endeavor worth pursuing, requires dedication, perseverance, and a thirst for knowledge. For those who dare to venture into this realm, the rewards can be substantial. But be warned: the market is a formidable adversary that demands respect and a healthy dose of caution. Are you ready to navigate the turbulent waters of the forex market and master the art of currency management?