Introduction

In today’s globalized world, remittances have become an indispensable part of international financial transactions. Whether you’re sending money to support family overseas, making business payments, or investing in foreign markets, understanding remittance instructions is crucial for a smooth and secure transfer. This comprehensive guide will walk you through the intricacies of SBI Forex outward remittance instructions, providing you with a step-by-step understanding of the process and empowering you to navigate international money transfers with confidence.

Image: bank2home.com

Understanding Outward Remittances and SBI Forex

An outward remittance refers to the transfer of funds from one country to another. Starting from an account in India (remitter’s account), it travels through the banking network and ultimately lands in a beneficiary account abroad. SBI Forex, a specialized foreign exchange arm of the renowned State Bank of India, offers a range of outward remittance services to cater to the diverse needs of individuals and businesses.

Step-by-Step Remittance Instructions:

1. Open an SBI Forex Account

To initiate outward remittances through SBI Forex, you must first open an account with them. Visit their website or any of their branches to initiate the process. Submit the necessary documentation and follow the instructions provided by the bank representatives.

![[Resolved] State Bank Of India [SBI] — Telegraphic Transfer (TT) or ...](https://www.consumercomplaints.in/thumb.php?complaints=3019328&src=813703879.png&wmax=900&hmax=900&quality=85&nocrop=1)

Image: www.consumercomplaints.in

2. Gather Required Documents

Depending on the purpose of your remittance and the amount being transferred, you may need to provide additional documents such as:

• Proof of identity (e.g., passport or Aadhaar card)

• Proof of residence (e.g., utility bills or bank statement)

• Details of the beneficiary (name, address, bank account details)

• Purpose and source of funds

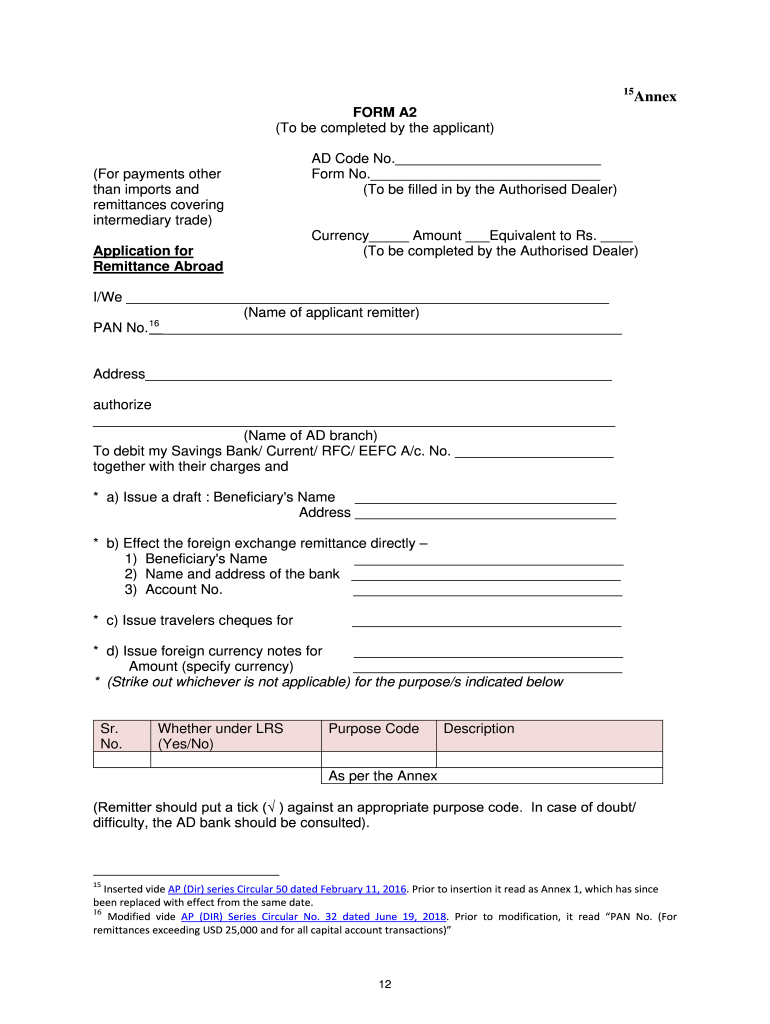

3. Complete the Remittance Form

The SBI Forex remittance form is designed to capture all essential details pertaining to your transfer. Ensure you fill out this form accurately and completely, specifying the following information:

• Remitter’s details (name, address, account number)

• Beneficiary’s details (name, address, account number)

• Amount and currency of the remittance

• Purpose of remittance (education, business, etc.)

• Payment mode (swift, wire transfer, demand draft)

4. Submit the Form and Documents

Once you have completed the remittance form and gathered all required documents, submit them to your SBI Forex branch. Double-check the documents to ensure they are all in order to avoid any delays in processing.

5. Payment and Transfer Initiation

Once your remittance request is reviewed and approved by SBI Forex, you can make the payment through various modes such as cash, cheque, or online transfer. Upon receiving the payment, SBI Forex will initiate the transfer through their banking network, ensuring the funds reach the beneficiary’s account as per your instructions.

Important Considerations:

• Exchange Rates:

SBI Forex offers competitive exchange rates for outward remittances. Keep track of currency fluctuations to optimize your transfers.

• Remittance Charges:

SBI Forex charges a nominal fee for outward remittances. These charges vary based on the amount, destination, and mode of transfer.

• Delivery Time:

The delivery time for outward remittances can vary depending on the destination and mode of transfer. SBI Forex provides estimated delivery timelines to keep you informed.

• Compliance and Regulations:

SBI Forex adheres to strict compliance and regulatory guidelines governing international money transfers. Ensure you provide accurate information and comply with all necessary documentation to ensure smooth processing of your remittances.

Remittance Instructions Sbi Forex Outward Remittance

Conclusion

Understanding remittance instructions is essential for seamless and secure international money transfers. By following the comprehensive guide outlined above, you can confidently navigate SBI Forex outward remittance services to fulfill your cross-border financial needs. Remember to research exchange rates, factor in remittance charges, and stay informed about delivery timelines. By adhering to compliance regulations and providing accurate information, you can ensure your remittances reach their intended destinations efficiently. SBI Forex offers reliable and tailored services, making it an ideal choice for individuals and businesses seeking a trusted partner for their outward remittance needs.