Are you planning to establish a forex company in the esteemed financial hub of Cyprus? Understanding the registration charges involved is crucial for making informed decisions. In this comprehensive guide, we delve into the intricacies of forex company registration in Cyprus, outlining the various fees and associated costs. Gain invaluable insights into the regulatory framework and optimize your business strategy.

Image: www.tetraconsultants.com

Navigating the Cyprus Forex Regulatory Landscape

Cyprus has emerged as a prime destination for forex companies seeking a reputable and well-regulated jurisdiction. The Cyprus Securities and Exchange Commission (CySEC) acts as the foremost regulatory body, ensuring adherence to strict compliance guidelines. Companies operating within Cyprus benefit from a transparent and robust regulatory framework, fostering investor confidence.

Unveiling the Registration Charge Structure

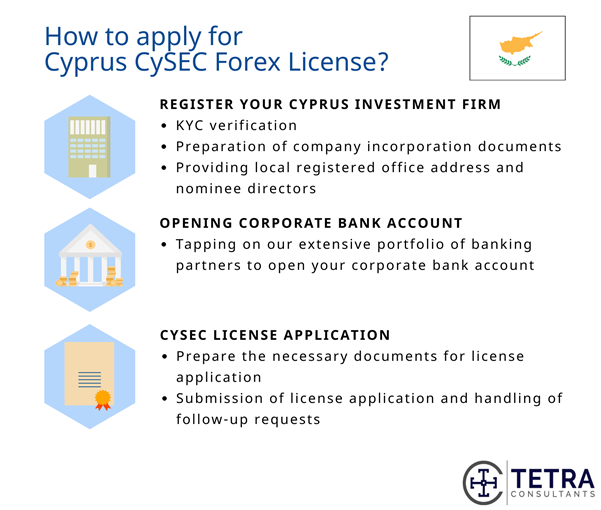

To establish a forex company in Cyprus, entities must navigate a series of registration charges and fees. These costs cover the fundamental processes involved in setting up and maintaining a compliant operation within the CySEC framework. The primary charges include:

- Registration Fee: This initial payment serves as the entry point for registering a forex company in Cyprus. It entails submitting a comprehensive application along with supporting documentation.

- Capital Requirements: Forex companies operating in Cyprus must maintain a minimum capital requirement as a testament to their financial stability. This capital must be deposited in a segregated account, ensuring the protection of client funds.

- Annual Levy: An annual levy, payable to CySEC, constitutes a recurring fee to sustain regulatory oversight and supervision. The levy amount varies depending on the size and activities of the forex company.

- Auditing and Compliance Costs: External audits and compliance reviews are mandatory for forex companies in Cyprus. These costs cover the services of qualified professionals to assess the company’s financial statements and adherence to regulations.

Additional Fees and Considerations

Beyond the core registration charges, forex companies may incur additional fees depending on their specific circumstances and business operations. These may include:

- Third-party Service Fees: Entities may utilize external service providers, such as legal counsel or accounting firms, for assistance with registration and ongoing compliance. Associated fees should be factored into the overall budget.

- Technology and Infrastructure Costs: Establishing a robust trading platform, acquiring necessary software, and maintaining IT infrastructure incur ongoing expenses that must be accounted for.

- Market Data and Analysis Costs: Access to real-time market data and analytical tools is essential for forex trading operations. Subscription fees for these services contribute to the overall operational expenses.

Image: cyprus-mail.com

Registration Charges In Cyprus For Forex Company

Conclusion: Empowering Forex Companies with Registration Knowledge

Understanding the registration charges for forex companies in Cyprus is critical for strategic decision-making. By familiarizing yourself with the fees and associated costs, you can allocate resources effectively and plan for a compliant and successful operation within the CySEC’s regulatory framework. Leverage this knowledge to navigate the registration process confidently and establish a thriving forex company in Cyprus.