In the ever-evolving world of currency trading, understanding Regalia Forex cross currency rates is paramount for seasoned traders and novice investors alike. Cross currency rates, devoid of the influence of the US dollar, offer unique opportunities and challenges in the foreign exchange market.

Image: cardinfo.in

This comprehensive guide will delve into the intricacies of Regalia Forex cross currency rates, providing invaluable insights into their characteristics, advantages, and trading strategies. By mastering this essential aspect of forex trading, you can unlock a gateway to enhanced profitability and informed decision-making.

Navigating the Complexities of Cross Currency Rates

Definition and Significance

Cross currency rates measure the exchange rate between two currencies directly, bypassing the US dollar as an intermediary. Unlike major currency pairs, cross currency rates fluctuate based solely on the supply and demand dynamics of the two currencies involved.

This distinction opens up a wider range of trading opportunities, allowing traders to capitalize on specific market conditions and diversify their portfolios.

Leveraging Cross Currency Rates for Profit

Cross currency rates present distinct advantages for traders:

- Reduced Volatility: Cross currency rates often exhibit lower volatility compared to major currency pairs, offering opportunities for more stable and calculated trading.

- Diversification: Expanding your trading repertoire with cross currency rates enhances portfolio diversification, reducing overall risk exposure.

li>Specific Market Insights: By analyzing cross currency rates, traders can gain deeper insights into the economic relationships between specific countries and their respective currencies.

Image: www.forexfactory.com

Expert Tips for Successful Cross Currency Trading

Embarking on cross currency trading requires a strategic approach:

- Identify Trends: Thoroughly analyze historical data and market trends to identify profitable cross currency trading opportunities.

- Manage Risk: Employ risk management strategies such as stop-loss orders and position sizing to mitigate potential losses.

- Stay Informed: Continuously monitor economic news and events to stay abreast of factors influencing cross currency rates.

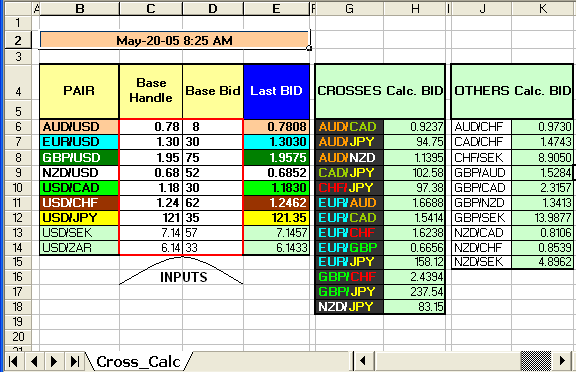

Commonly Traded Cross Currency Pairs

Among the myriad of cross currency rates available, certain currency pairs stand out for their liquidity and popularity:

- EUR/GBP (Euro to British Pound)

- EUR/JPY (Euro to Japanese Yen)

- GBP/JPY (British Pound to Japanese Yen)

Understanding the dynamics of these highly traded cross currency pairs can greatly enhance your opportunities for success in the forex market.

Regalia Forex Cross Currency Rates

Conclusion

By unlocking the complexities of Regalia Forex cross currency rates, traders can access a wealth of profitable opportunities and mitigate risks. Whether you are a seasoned trader or just starting out, embracing these principles will empower you to navigate the forex market with confidence.

So, are you ready to embark on the exciting journey of mastering cross currency rates? Let the journey begin today!