The foreign exchange (forex) market, where currencies across nations are exchanged, has witnessed a dramatic transformation in recent times. A complex interplay of economic, political, and global forces has sculpted the market landscape, creating new opportunities and challenges for traders.

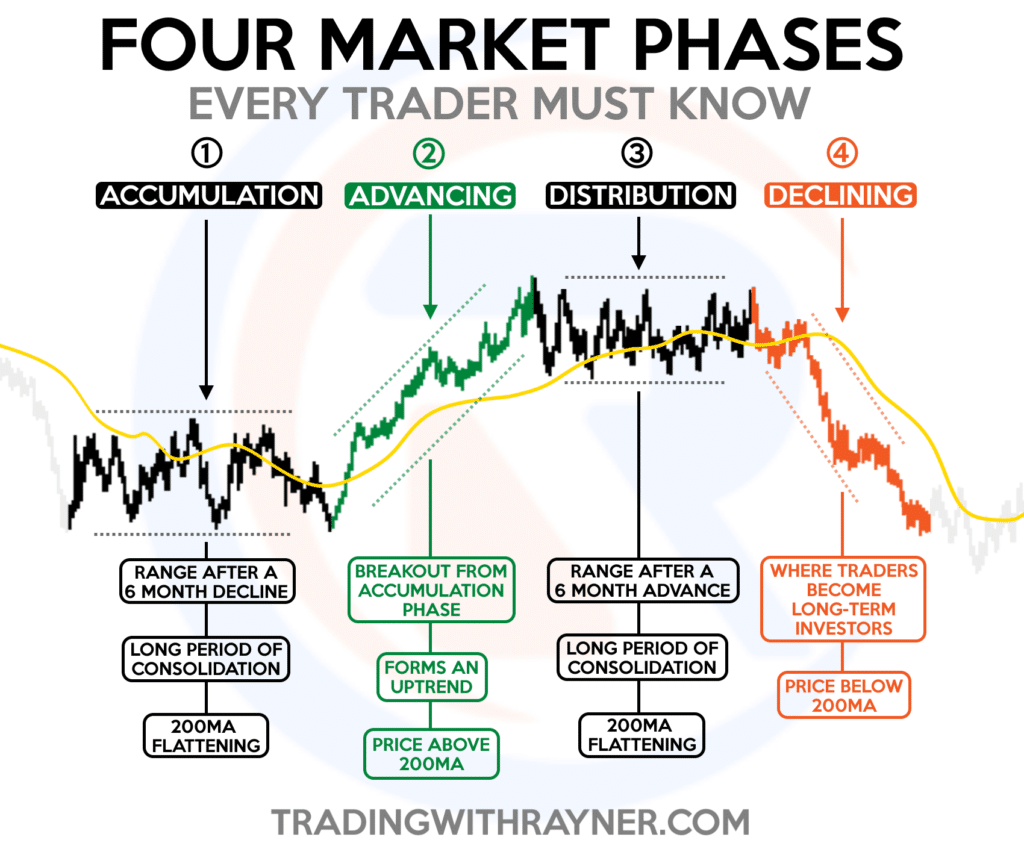

Image: www.tradingwithrayner.com

In this article, we embark on a comprehensive exploration of these recent trends, unraveling the factors that have catalyzed their emergence and examining their potential impact on the forex market. Join us as we delve into the dynamic world of forex, deciphering the intricacies that shape its ever-evolving nature.

The Rise of Artificial Intelligence and Algorithmic Trading

Artificial intelligence (AI) and algorithmic trading have taken the forex market by storm, revolutionizing the way traders approach the domain. With sophisticated algorithms executing trades at lightning speeds, human emotion and intuition are increasingly sidelined. This trend has intensified competition, demanded higher levels of technical proficiency, and accelerated market volatility.

The Global Impact of Cryptocurrencies

The burgeoning popularity of cryptocurrencies, such as Bitcoin and Ethereum, has created a ripple effect in the forex market. While not yet mainstream, cryptocurrencies have introduced novel concepts, such as decentralization and blockchain technology, which could challenge the dominance of traditional fiat currencies. Traders are closely monitoring the evolution of this sector, anticipating its potential to disrupt the status quo.

Central Bank Policies: Playing a Pivotal Role

Central bank policy decisions, particularly interest rate adjustments, exert a profound influence on currency valuations. The actions of the Federal Reserve in the United States and the European Central Bank heavily impact the value of the US dollar and the euro, respectively. Traders meticulously analyze central bank announcements to anticipate market shifts and formulate informed trading strategies.

Image: forextraininggroup.com

Political Unrest and Economic Volatility: Catalysts of Uncertainty

Political turmoil and economic instability can cause sharp fluctuations in currency values. Examples include Brexit negotiations, trade wars, and geopolitical crises, which introduce uncertainty into the market. Traders must monitor political and economic developments globally to gauge their potential impact on forex rates.

The Role of Emerging Markets

The rapid growth of emerging markets, such as China and India, has created fresh opportunities for forex traders. As these economies become more integrated into the global financial system, their currencies gain greater significance. Traders are exploring new avenues of currency trading, leveraging the potential for higher returns while navigating the increased risks associated with emerging market currencies.

Recent Trends In Forex Markets

Conclusion

The forex market, in its constant state of metamorphosis, presents an ever-shifting panorama of trends and developments. From the ascendancy of AI and algorithmic trading to the global implications of cryptocurrencies, the factors that mold the market landscape are multifarious and dynamic. Understanding these trends is imperative for traders seeking to navigate the complexities of this vibrant and demanding arena.

This article has shed light on the recent trends shaping the forex market, empowering you with the knowledge to make informed decisions and capitalize on emerging opportunities. The forex market remains an exciting and challenging domain, where traders must continuously adapt to the ebb and flow of market forces. We encourage you to delve deeper into this fascinating world, harnessing the power of knowledge and strategic thinking to unlock its boundless potential.