In the tumultuous world of finance, central banks play a pivotal role in stabilizing economies and managing currency fluctuations. One crucial tool in their arsenal is the foreign exchange (forex) swap. In this article, we delve into the fascinating realm of RBI forex swaps and their profound impact on the value of the Indian rupee against the US dollar.

Image: www.dailyfx.com

Forex swaps are short-term agreements between central banks to exchange currencies at a predetermined rate. These agreements enable central banks to manage short-term liquidity, stabilize exchange rates, and influence monetary policy.

RBI Forex Swap and USD INR

The Reserve Bank of India (RBI) routinely engages in forex swaps to manage the value of the Indian rupee against the US dollar (USD INR). By entering into forex swaps, the RBI can inject or withdraw liquidity from the currency market, thereby influencing the demand and supply of rupees.

When the RBI purchases US dollars from banks and sells rupees in exchange, it is known as a ‘sell/buy’ swap. This action increases the supply of rupees in the market, leading to a depreciation of the rupee against the dollar. Conversely, a ‘buy/sell’ swap involves the RBI buying rupees and selling US dollars, which reduces the supply of rupees and causes it to appreciate against the dollar.

Significance of RBI Forex Swaps

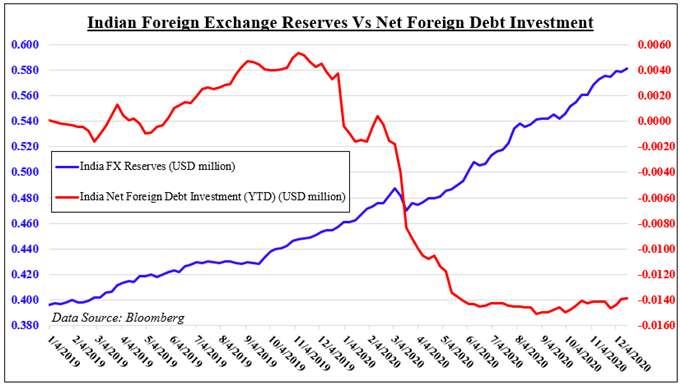

RBI forex swaps are crucial for managing exchange rate volatility and maintaining price stability. By intervening in the currency market, the RBI can prevent sharp fluctuations in the value of the rupee, which could harm the economy. Forex swaps also help neutralize the impact of global economic events and protect India’s foreign exchange reserves.

However, excessive intervention through forex swaps can have potential implications. If the RBI sustains its selling of one currency while buying another, it may lead to the accumulation of large amounts of foreign exchange reserves. This can create imbalances in India’s asset portfolio and expose the country to currency risks.

Latest Trends and Developments

The RBI’s forex swap operations have been closely monitored amid recent market turmoil. In 2020, the RBI announced a series of forex swaps worth $6 billion to address liquidity concerns caused by the COVID-19 pandemic. These swaps helped stabilize the rupee and prevent excessive depreciation.

In 2023, the RBI continued its swap operations, conducting multiple ‘sell/buy’ and ‘buy/sell’ swaps to manage exchange rate volatility. These swaps have been instrumental in moderating the rupee’s fluctuations against the US dollar, mitigating the impact of global events and supporting economic recovery.

Image: forextraders.guide

Tips and Expert Advice

Understanding RBI forex swaps is essential for investors, traders, and individuals interested in the currency market. Here are some tips and expert advice to consider:

- Monitor RBI announcements and news on forex swaps to stay informed about the latest developments.

- Consider the impact of forex swaps on your investments or trading strategies.

- Consult with a financial advisor to better understand the complexities of forex swaps and their potential implications.

By following these tips, you can gain a deeper understanding of RBI forex swaps and make more informed decisions in the currency market.

FAQ on RBI Forex Swaps

Q: What is the purpose of an RBI forex swap?

A: RBI forex swaps are used to manage exchange rate volatility, influence monetary policy, and maintain the stability of the Indian rupee against the US dollar.

Q: How do forex swaps affect the value of the rupee?

A: When the RBI sells rupees and buys US dollars (a ‘sell/buy’ swap), the rupee depreciates. Conversely, a ‘buy/sell’ swap leads to the appreciation of the rupee.

Q: What are the risks associated with RBI forex swaps?

A: Excessive intervention through forex swaps may lead to imbalances in India’s asset portfolio and expose the country to currency risks.

Rbi Forex Swap And Usd Inr

Conclusion

RBI forex swaps are an integral part of the central bank’s toolkit for managing the currency market. By understanding the mechanics, significance, and latest trends of RBI forex swaps, individuals can make informed decisions about their investments and trading strategies.

Are you intrigued by the fascinating world of RBI forex swaps and USD INR? Delve deeper into the complexities of this topic by exploring reliable sources, engaging in discussions, and seeking expert guidance. Your quest for knowledge will unravel a rich tapestry of insights and empower you with a stronger understanding of how central banks shape the global financial landscape.