Introduction: Navigating the Currency Landscape

In the realm of international trade and finance, foreign exchange rates play a pivotal role in facilitating the exchange of currencies. The Reserve Bank of India (RBI), India’s central bank, is entrusted with managing the nation’s exchange rate policy, ensuring the smooth flow of funds and promoting economic stability. One of the key aspects of this policy is determining the foreign exchange rate between the Indian rupee (INR) and other major currencies, such as the United States dollar (USD). Understanding the dynamics of the RBI forex rate for USD in INR is crucial for businesses, investors, and individuals engaging in cross-border transactions.

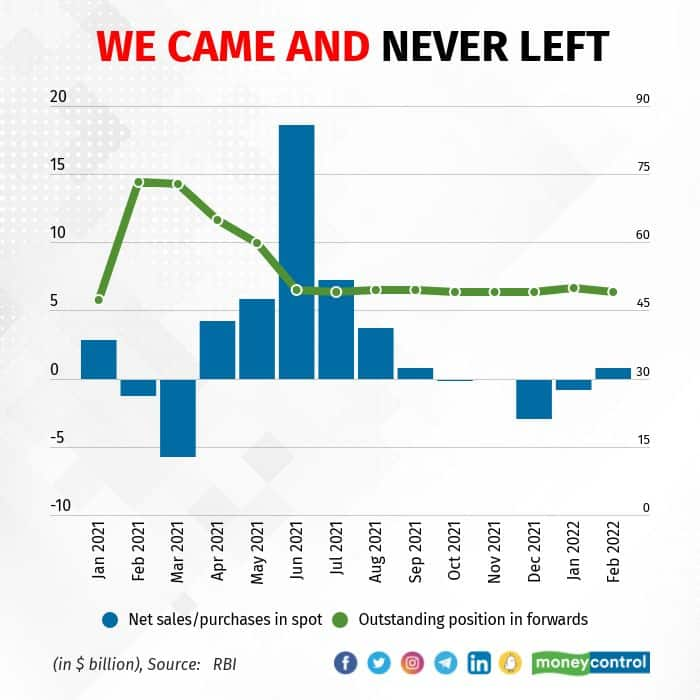

Image: www.moneycontrol.com

Exchange Rate Mechanism: A Balancing Act

The RBI employs a market-determined exchange rate system, allowing the value of the rupee to fluctuate based on supply and demand in the foreign exchange market. This approach provides flexibility to respond to global economic conditions and market forces, facilitating the smooth functioning of international trade and investment. The central bank intervenes in the market when necessary to prevent excessive volatility or maintain orderly conditions.

Factors Influencing Exchange Rates: A Multifaceted Web

A myriad of factors influence the exchange rate between the INR and USD. These include:

- Economic growth and inflation: Strong economic performance, characterized by GDP growth and low inflation, tends to strengthen the rupee against the dollar. Conversely, a weaker economy can lead to a depreciation of the rupee.

- Interest rates: The RBI’s monetary policy and interest rate decisions affect returns on investments in India. Higher interest rates attract foreign capital inflows, strengthening the rupee.

- Foreign exchange reserves: India’s foreign exchange reserves, held by the RBI, provide a buffer against exchange rate fluctuations. Ample reserves allow the central bank to intervene and support the rupee if needed.

- Global economic conditions: External factors, such as global economic growth, geopolitical events, and currency market volatility, also impact the exchange rate.

- Trade balance: The balance of payments, reflecting the value of goods and services exported and imported, affects the supply and demand for the rupee in the foreign exchange market.

Implications for Businesses and Investors: Strategic Considerations

Fluctuations in the RBI forex rate have significant implications for businesses and investors:

- International trade: Exporters benefit from a stronger rupee, which makes their goods and services more competitive in global markets. Importers, on the other hand, may face higher costs when the rupee weakens.

- Foreign investment: A favorable exchange rate attracts foreign investors seeking higher returns in India. A weaker rupee, however, can make it more expensive for foreign investors to repatriate their profits.

- Investments abroad: Indian individuals and companies investing overseas may experience varying returns based on the exchange rate when converting their investments back to rupees.

Image: www.pinterest.com

Forecasting Exchange Rates: An Art and a Science

Predicting the direction of the RBI forex rate is a challenging but crucial task for market participants. Analysts employ various techniques, including:

- Historical data analysis: Identifying trends and patterns in past exchange rate movements.

- Economic modeling: Using econometric models to assess the impact of economic factors on the exchange rate.

- Market sentiment: Gauging the prevailing sentiment among market participants through surveys and indicators.

- Central bank communication: Monitoring statements and actions from the RBI for clues on future exchange rate policy.

Despite these efforts, predicting exchange rates with certainty remains elusive due to the inherent complexity and unpredictability of financial markets.

Rbi Forex Rate Us In Indian Rupees Today

Conclusion: A Dynamic Landscape

The RBI forex rate between the USD and INR is a dynamic and multifaceted aspect of India’s economic landscape. Understanding the factors influencing exchange rates and the implications for businesses and investors is essential for effective decision-making in the global marketplace. As the global economy continues to evolve, the RBI will continue to monitor and manage the forex rate, ensuring the stability of the rupee and fostering India’s economic growth