Introduction

In the multifaceted world of finance, where every decision carries intricate implications, mastering practical sums plays a pivotal role in ensuring the success of financial treasury and forex management operations. From calculating cash flows to determining currency exchange rates, these sums equip professionals with the analytical prowess to make informed decisions that drive profitability and mitigate risks.

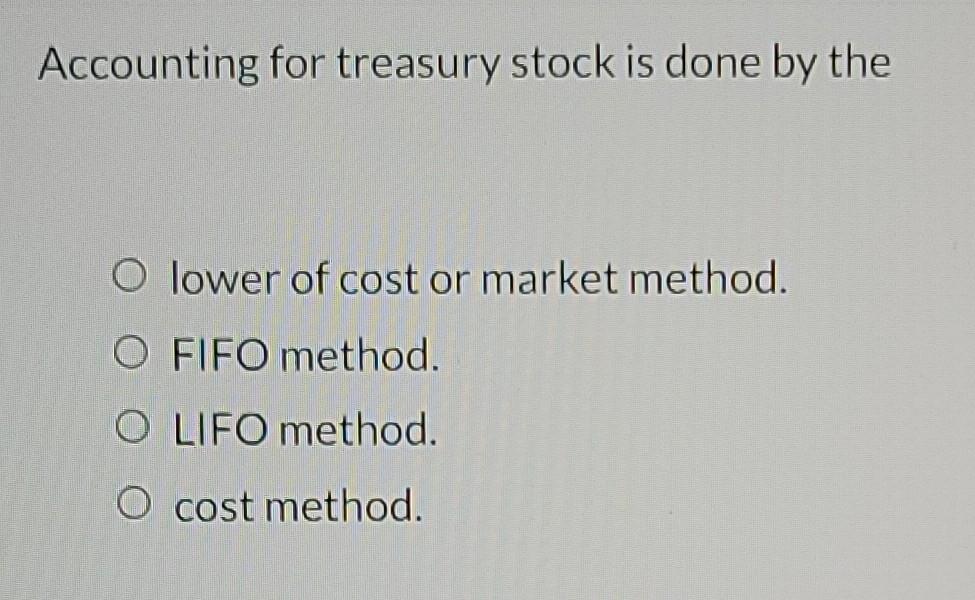

Image: www.chegg.com

Understanding their fundamental concepts and skillful application in real-world scenarios empowers treasury and forex managers to navigate the dynamic financial landscape with greater confidence and efficiency. This comprehensive guide delves into the essential calculations crucial for these professionals, providing in-depth explanations and hands-on examples to enhance their decision-making abilities.

Types of Practical Sums

The spectrum of practical sums encompasses a wide range of calculations, each tailored to a specific aspect of financial treasury and forex management:

- Cash Flow Calculations: Forecasting and managing cash flows to ensure adequate liquidity for day-to-day operations and investment opportunities.

- Interest Rate Calculations: Determining the interest earned or charged on loans, bonds, and other financial instruments.

- Currency Exchange Calculations: Converting currencies for international transactions and hedging against exchange rate risks.

- Risk Management Calculations: Measuring and mitigating financial risks through calculations such as Value at Risk (VaR) and stress testing.

- Investment Calculations: Evaluating potential returns on investments and making sound investment decisions based on calculations like Internal Rate of Return (IRR) and Net Present Value (NPV).

Importance of Practical Sums

Practical sums serve as indispensable tools for financial treasury and forex managers due to their direct impact on crucial aspects of these functions:

- Decision-Making: Precise calculations provide the basis for rational decision-making, enabling professionals to assess the financial implications of different scenarios.

- Scenario Planning: Quantifying potential financial outcomes allows for proactive scenario planning and risk mitigation.

- Compliance: Adhering to regulatory requirements and industry best practices requires accurate calculations to ensure transparency and accountability.

- Performance Measurement: Quantitative measures facilitate performance evaluation and the identification of areas for improvement.

- Communication: Financial professionals can effectively communicate their findings and recommendations to stakeholders through clear and objective calculations.

Example 1: Cash Flow Forecasting

A financial treasury manager responsible for a global business needs to forecast cash flows for the upcoming quarter. The manager gathers historical data on revenue, expenses, and cash balances, along with estimates of future cash inflows and outflows. Using a cash flow projection template, the manager plugs in the numbers and calculates the expected net cash flow for each month. This forecast helps the manager anticipate potential cash shortfalls and make arrangements for additional financing if needed.

Image: www.scribd.com

Example 2: Currency Exchange Calculation

A forex manager is tasked with executing a foreign currency transaction involving the exchange of Euros into U.S. Dollars. The manager calculates the exchange rate using the prevailing market rates. The transaction is completed using the calculated rate, ensuring the accurate conversion of funds and the avoidance of potential losses due to unfavorable exchange rate fluctuations.

Practical Sums For Financial Treasury And Forex Management

Conclusion

Practical sums are the lifeblood of financial treasury and forex management. Equipping oneself with a thorough understanding of these calculations empowers professionals to optimize their decision-making, manage risks effectively, and ultimately achieve the desired financial outcomes. By continually honing their skills and staying abreast of industry advancements, treasury and forex managers can rise to the challenges of the ever-evolving financial landscape, ensuring the success and profitability of their operations.