Forex trading is a high-stakes game where precision is paramount. One crucial aspect of successful trading is determining the optimal position size. Understanding how to calculate position size empowers traders to minimize risk and maximize returns. This article delves into the world of position size calculations in forex, addressing everything from foundational concepts to advanced strategies and expert advice.

Image: mavink.com

The Basics of Position Size

What is Position Size?

Position size refers to the amount of currency units a trader buys or sells in a forex transaction. It directly affects the potential profit or loss, making it a critical decision.

Factors Affecting Position Size

Determining position size requires consideration of several factors:

Image: tradingforexguide.com

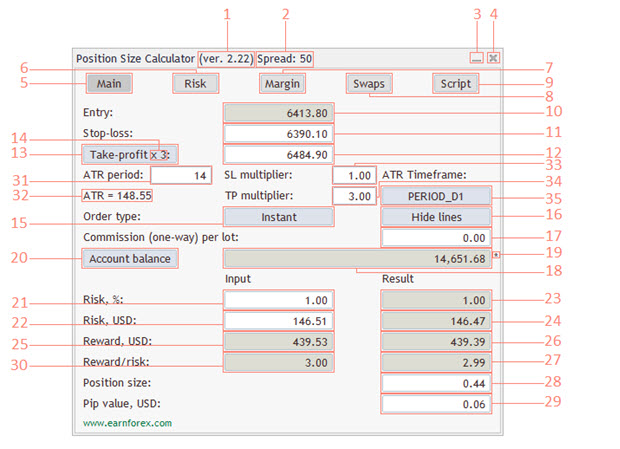

Calculating Position Size

There are several methods for calculating position size, each with its advantages and disadvantages:

Fixed Percentage Method

This method involves risking a fixed percentage of your account balance on each trade. While simple, it can lead to overleveraging during volatile market conditions.

Fixed Dollar Amount Method

With this method, you risk a fixed dollar amount on each trade. It provides consistency but can limit profit potential in favorable market conditions.

Kelly Criterion

The Kelly Criterion is a mathematical formula that optimizes position size based on historical data. It’s complex but offers potential advantages for experienced traders.

Advanced Strategies for Position Sizing

As traders progress, they may explore advanced position sizing strategies:

Dynamic Position Sizing

This approach adjusts position size based on changing market conditions. Traders increase position size when volatility is low and decrease it when volatility rises, adapting to market fluctuations.

Correlation Analysis

Traders can use correlation analysis to determine the relationship between different currency pairs. This helps mitigate risk by diversifying positions and avoiding overexposure to correlated pairs.

Tips and Expert Advice from the Pros

Experienced forex traders offer invaluable advice:

Start Small

Begin with small position sizes until you gain confidence and experience. Gradually increase positions as you develop a successful trading system.

Use Stop-Loss Orders

Protect your account by using stop-loss orders to limit potential losses. Position size calculations should consider the impact of stop-loss placement.

Backtest Your Strategies

Test your position sizing strategies using historical data. This allows you to refine your calculations and identify optimal risk-reward ratios.

FAQ

Q: What is the preferred position size calculation method?

A: The optimal method depends on individual trader risk tolerance and trading style.

Q: Can I adjust position size during a trade?

A: Yes, you can employ dynamic position sizing to adjust position size based on market conditions.

Q: How often should I reassess my position size?

A: Regularly review your risk tolerance, capital balance, and market conditions to optimize your position size calculations.

Position Size Calculator In Forex

Conclusion

Mastering position size calculation in forex trading is crucial for success. By understanding the basics, exploring advanced strategies, and considering expert advice, traders can determine the optimal position size for each trade. Remember, the path to profitable trading lies in precise position sizing, risk management, and a disciplined approach.

Are you interested in learning more about position size calculation in forex? Leave a comment below or join our online community for expert insights and support.