Introduction

Image: forex-pak.com

In the fast-paced world of forex trading, understanding the intricacies of the market is paramount. Among the fundamental pillars of this exciting realm lies a seemingly enigmatic term: pips. From novice traders to seasoned veterans, unraveling the true meaning and significance of pips unlocks a gateway to unlocking the potential of forex trading.

What Are Pips, Really?

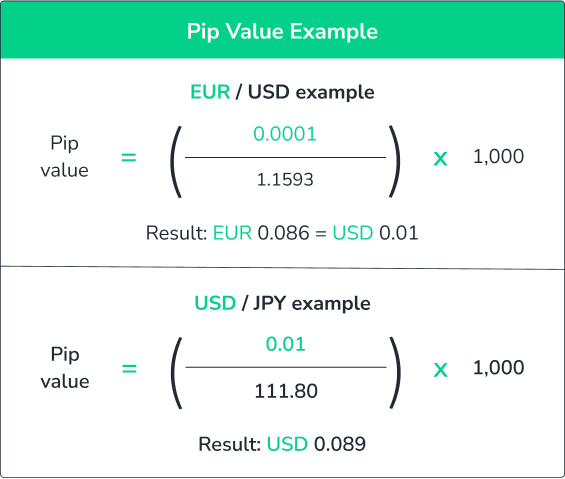

In essence, a pip, short for “point in percentage,” represents the smallest unit of price change for a given currency pair. This minuscule movement, often expressed in the fourth decimal place for major currency pairs, serves as the heartbeat of forex trading.

The value of a pip varies depending on the currency pair being traded. For example, a one-pip movement in the EUR/USD pair equates to a fluctuation of $0.0001, while a similar shift in the GBP/USD pair corresponds to £0.0001.

The Cornerstone of Trading

Pips form the very foundation of forex trading. They are the numerical shorthand for quantifying profits, losses, and the overall performance of a trade. Understanding the value of a pip empowers traders to precisely measure the potential returns (or risks associated with any given trade.

Beyond their role as accounting tools, pips also play a pivotal role in determining leverage. This financial tool allows traders to amplify their potential gains (or losses), but it’s crucial to remember that increased leverage comes with increased risk.

Pips, the Storytellers

The subtle dance of pips weaves a compelling narrative of market dynamics. A series of steady upward pips suggests a bullish trend, while a sustained downtrend is characterized by a string of consistent downward pips. Moreover, abrupt and substantial pip fluctuations often signal market instability or significant news events.

Interpreting Pip Movements

Deciphering pip movements is an art that requires patience and practice. By observing historical price charts, traders can discern patterns and trends that provide valuable insights into the market’s behavior. Technical analysis tools such as moving averages and support and resistance levels further enhance the ability to predict future price movements.

Pips in Action: A Real-World Example

Let’s consider a hypothetical scenario to illustrate the practical application of pips. Suppose you’ve entered a long (buy) position on the EUR/USD pair at 1.1250. Your target take-profit level is 1.1260.

If the EUR/USD pair rises to 1.1260, you would have realized a gain of 10 pips. Converting this into a monetary value, you would have earned $10 per standard lot (100,000 units) traded.

Conclusion

Embracing the intricacies of pips is essential for navigating the complex landscape of forex trading. Pips are not mere digits; they are the language of the market, revealing the ebb and flow of currency valuation. By mastering the art of deciphering pip movements and leveraging technical analysis tools, you can empower yourself to make informed decisions and unlock the potential of this dynamic financial realm.

Image: reportspdf549.web.fc2.com

Pips Full Form In Forex