In the ever-fluctuating world of forex trading, understanding the pip movement of currency pairs is paramount for successful trading decisions. A pip, or point in percentage, represents the smallest increment of change in the exchange rate between two currencies.

Image: www.slicktrade.net

The daily pip movement of forex pairs significantly impacts traders’ strategies and profit potential. By analyzing historical data and market sentiment, traders can estimate the average pip movement for a given currency pair on any trading day.

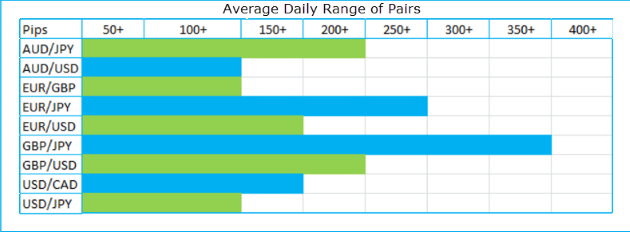

Average Pip Movement of Major Forex Pairs

The following table provides an overview of the average daily pip movement for major forex pairs:

| Forex Pair | Average Daily Pip Movement |

|---|---|

| EUR/USD | 70-100 |

| USD/JPY | 50-80 |

| GBP/USD | 60-90 |

| USD/CHF | 40-60 |

| AUD/USD | 50-70 |

Factors Affecting Pip Movement

Several factors influence the daily pip movement of forex pairs, including:

Economic Data Releases: Major economic indicators, such as gross domestic product (GDP), inflation data, and employment figures, can significantly impact currency values and pip movements.

Political Events: Geopolitical uncertainties, elections, and policy changes can trigger market volatility and impact forex rates.

Central Bank Decisions: Interest rate changes and monetary policy announcements by central banks can drive pip movement in currencies.

Market Sentiment: Risk appetite and trader sentiment can influence the pip movement of forex pairs, leading to sharp fluctuations.

Tips and Expert Advice for Trading PIP Movement

To effectively trade pip movement, consider the following tips and expert advice:

Identify High Volatility Pairs: Focus on currency pairs with higher average daily pip movement for increased profit potential.

Monitor News and Events: Stay informed about upcoming economic data releases and political events that could impact currency pairs.

Use Trading Software: Leverage trading platforms that provide real-time pip movement tracking and analysis tools.

Trade with a Strategy: Plan your trades based on pip movement analysis and consider using technical indicators, such as moving averages and Bollinger bands, to identify trading opportunities.

Image: alpari.com

FAQs on PIP Movement in Forex

Q: What is the average pip movement for the EUR/USD pair?

A: The average daily pip movement for EUR/USD is around 70-100 pips.

Q: How can I calculate pip value for a specific currency pair?

A: Pip value is typically calculated as 0.0001 of the quote currency.

Q: What is the impact of news on pip movement?

A: News and events can trigger significant pip movement by influencing market sentiment and risk appetite.

Q: How can I track pip movement in real-time?

A: Most forex trading platforms provide real-time pip movement tracking on charts and price quotes.

Pip Movement Of Forex Pairs Per Day

Conclusion

Understanding the pip movement of forex pairs is essential for successful currency trading. By analyzing daily pip movement and considering the various factors that influence it, traders can make informed decisions and optimize their profit potential. Whether you’re a seasoned trader or just starting, staying informed about pip movement is crucial for navigating the volatile forex market.

Are you ready to enhance your forex trading strategy with a deeper understanding of pip movement? Share your thoughts and questions in the comments below.