Forex trading, the dynamic world of currency exchange, has its own set of jargon and terminologies.

One such term that every trader encounters is “pip,” which is often used to assess profit or loss in a trade.

Understanding the value of a pip is instrumental in making well-informed trading decisions, especially for novice traders.

Image: en.fxbangladesh.com

Unveiling the Pip: A Unit of Measurement

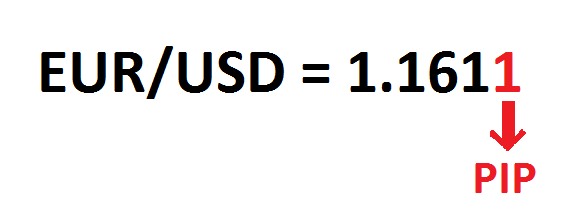

In the foreign exchange market, a pip (point in percentage) represents the smallest unit of change in the exchange rate

between a currency pair. It is usually the fourth decimal place for most currency pairs, except for the Japanese yen,

where it refers to the second decimal place. By understanding the value of a pip, traders can accurately measure

the potential profit or loss in a given trade.

Calculating Pip Value: The Formula

To calculate the pip value of a currency pair, we use the following formula:

Pip Value = (1 / Exchange Rate) * Contract Size

For example, let’s determine the pip value for the EUR/USD currency pair with an exchange rate of 1.1234 and a

contract size of 100,000 euros.

Pip Value = (1 / 1.1234) * 100,000 = 89.02 euros

This means that every one-pip movement in the EUR/USD exchange rate is equivalent to a gain or loss of 89.02 euros

per contract.

Current Trends and Developments in Forex

The forex market is constantly evolving, driven by political, economic, and social factors. Staying abreast of the latest

trends and developments is crucial for successful trading. Some notable trends include:

- Rise of algorithmic trading using artificial intelligence (AI) and machine learning (ML)

- Increasing popularity of decentralized finance (DeFi) and blockchain technology in forex

- Growing adoption of retail forex trading platforms with advanced features and educational resources

Image: www.youtube.com

Expert Advice for Maximizing Pip Profits

Based on my experience as a blogger, here are some valuable tips for maximizing pip profits:

1. Choose the Right Currency Pairs:

Some currency pairs offer more favorable pip values than others. Consider pairs with higher volatility or lower spreads.

2. Determine the Market Direction:

Analyze technical and fundamental factors to identify the trend of the currency pair you’re trading. Trade in the

direction of the trend to increase your chances of success.

Frequently Asked Questions (FAQs)

Q: What is another term for a pip?

A: One pip can also be referred to as a “point.”

Q: Can pips be different for different currency pairs?

A: Pip values vary depending on the exchange rate and contract size of the currency pair being traded.

Q: How do I use pip values in my trades?

A: Pip values help calculate the potential profit or loss in a trade by multiplying the pip value by the number of pips

moved.

Q: Can I trade pips without knowing their value?

A: It’s not advisable to trade pips without understanding their value, as it can lead to inaccurate profit calculations

and potential losses.

1 Pip Is Equal To How Many Dollars

Conclusion

Understanding the value of a pip is essential in forex trading, as it enables traders to assess the potential risk and

reward of their trades. By employing the formula provided and staying updated with the trends and developments in

the forex market, traders can make informed decisions to maximize their profits and navigate the ever-changing

trading landscape.

Are you ready to delve deeper into the world of forex and unlock the secrets of pip trading? Follow our tips, consult

with experts, and continually expand your knowledge to become a successful trader in this dynamic market.