A Wake-Up Call for Economic Revival

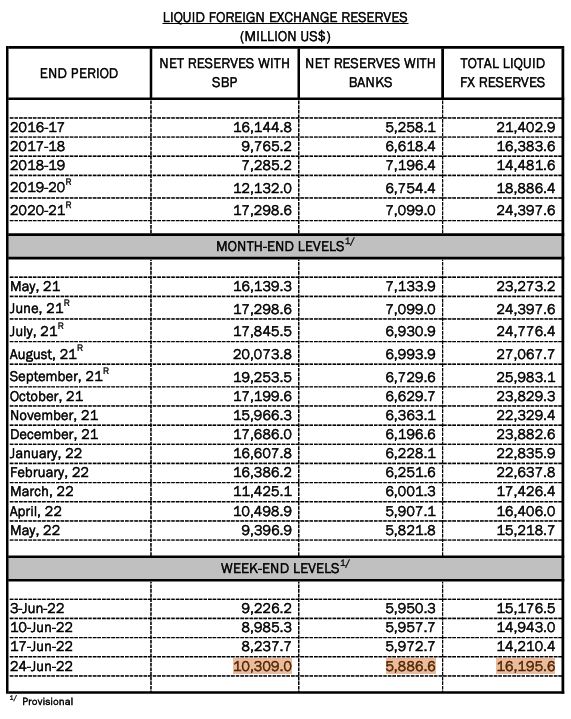

Pakistan’s foreign exchange reserves have witnessed a significant decline, plummeting to $17.5 billion as of June 19, 2023. This marks a sharp drop of over $1.2 billion in just two weeks and poses severe challenges for the nation’s economic stability.

Image: en.dailypakistan.com.pk

Navigating Economic Uncertainty

The dwindling forex reserves have set off alarm bells, prompting urgent measures to address the looming economic crisis. The country’s import coverage has shrunk to a mere six weeks, indicating a critical shortage of foreign currency to meet import obligations. This has raised concerns about a potential balance of payments crisis, which could lead to further economic deterioration.

Consequences and Solutions

The declining forex reserves have far-reaching consequences for Pakistan’s economy. It limits the country’s ability to pay for essential imports, including energy, raw materials, and food, leading to potential shortages, inflation, and economic slowdown. To address this challenge, Pakistan must implement drastic measures to bolster its forex reserves.

One crucial step is to curb unnecessary imports and promote exports through fiscal and monetary incentives. Pakistan can also seek international assistance from multilateral institutions, such as the International Monetary Fund (IMF), to stabilize its external position. Additionally, exploring non-traditional sources of foreign currency, such as remittances from overseas Pakistanis and foreign direct investment, can alleviate pressure on the country’s forex reserves.

Expert Insights and Actionable Tips

“Pakistan’s current forex crisis is a wake-up call for the government and policymakers,” says Dr. Ayesha Aisha, an economist at the Lahore University of Management Sciences. “Immediate and sustainable measures are essential to avert further economic deterioration and protect the country’s financial stability.” Dr. Aisha recommends implementing export-oriented policies, increasing remittances, and promoting tourism to generate foreign currency earnings.

Image: pakobserver.net

FAQs on Pakistan’s Forex Reserves

- Q: What is the current level of Pakistan’s forex reserves?

- A: As of June 19, 2023, Pakistan’s forex reserves stand at $17.5 billion.

- Q: What factors have contributed to the decline in forex reserves?

- A: A combination of rising imports, dwindling exports, and debt servicing obligations has led to the decline in forex reserves.

- Q: What are the consequences of low forex reserves?

- A: Low forex reserves can lead to a balance of payments crisis, currency devaluation, inflation, and economic slowdown.

- Q: What measures can Pakistan take to improve its forex reserves?

- A: Pakistan can curb imports, promote exports, seek international assistance, and explore non-traditional sources of foreign currency to improve its forex reserves.

Pakistan Forex Reserve June 19

Conclusion: A Call for Urgent Action

Pakistan’s dwindling forex reserves are a pressing concern that demands immediate attention. The government must implement comprehensive measures to address this challenge, including promoting exports, controlling imports, and seeking international support. Only through concerted efforts can Pakistan overcome this economic hurdle and ensure financial stability.

Are you interested in learning more about Pakistan’s forex reserves and its implications for the country’s economic future? Share your thoughts and questions in the comments section below.