Step into the thrilling world of forex trading, where order flow analysis unlocks a profound understanding of market behavior. Forex order flow, a revolutionary technique, empowers traders with the ability to read the intentions of large market participants, allowing them to make informed trading decisions with unmatched precision.

Image: support.motivewave.com

Forex order flow analysis involves meticulously studying the flow of buy and sell orders, enabling traders to decipher the underlying sentiment and anticipate price movements with remarkable accuracy. Like a master detective unraveling a complex mystery, order flow analysts track the footprints left by institutional traders, discerning their strategies and exploiting their presence in the market.

Deciphering the Forex Order Flow Landscape

Market giants, such as investment banks, hedge funds, and central banks, possess immense financial resources and wield significant influence over currency markets. By analyzing their order flow, retail traders can gain valuable insights into the direction of the market’s momentum and make calculated trading decisions.

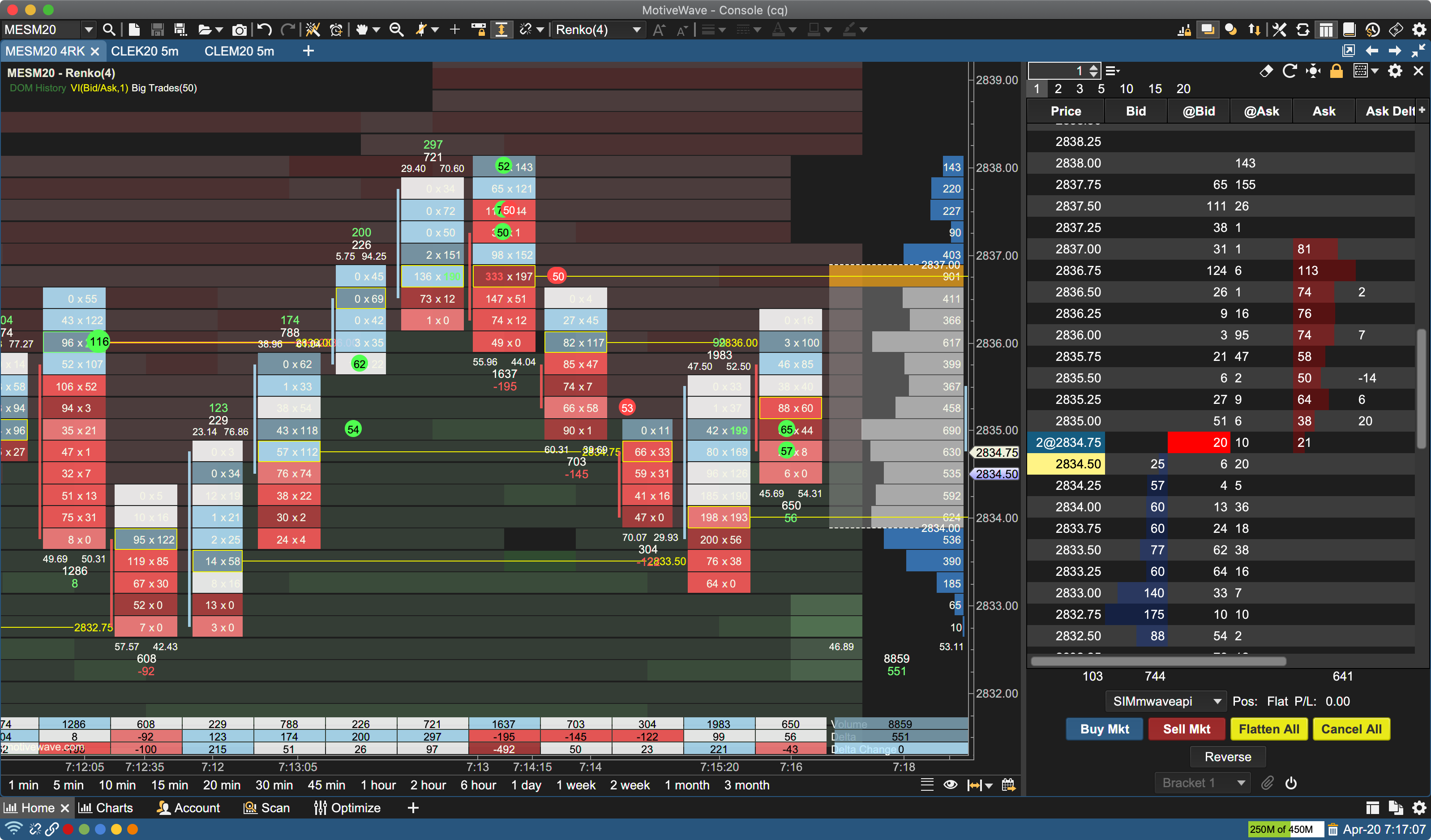

One of the key indicators in order flow analysis is the footprint chart, a visual representation of the orders entering and exiting the market. By analyzing the size, timing, and sequence of these orders, traders can identify potential trading opportunities and assess the strength of the trend. Imagine being able to see the footsteps of market giants and anticipate their next move – order flow analysis makes this possible.

Another critical element in order flow analysis is market depth, which measures the volume of buy and sell orders at different price levels. This data provides traders with a snapshot of the supply and demand dynamics, highlighting potential areas of support and resistance where the market is likely to find temporary equilibrium.

Unveiling the Secrets of Smart Money

Large financial institutions often employ sophisticated trading algorithms to execute their orders. By analyzing the behavior of these algorithms, order flow analysts can uncover recurring patterns and anticipate their future actions. It’s akin to cracking a secret code, granting traders the ability to align their trades with the strategies of market giants and capitalize on their market prowess.

One of the fascinating aspects of order flow analysis is its ability to reveal imbalances between supply and demand. When a significant imbalance occurs, it creates an opportunity for traders to enter or exit positions at advantageous prices.

Harnessing Order Flow for Profitable Trading

Embracing order flow analysis is not merely an academic pursuit; it’s a practical skill that can empower traders to make profitable trading decisions. By integrating order flow techniques into their trading strategies, traders can significantly improve their risk management, trade timing, and overall trading performance.

Order flow analysis provides a window into the thought process of market giants, enabling traders to align their trades with the market’s underlying forces. It’s a truly transformative tool that empowers traders to unlock the secrets of forex trading and gain a competitive edge in the ever-evolving financial markets.

Image: uyanilalabiwi.web.fc2.com

Order Flow Trading Strategy Forex

https://youtube.com/watch?v=A4KMO3dg88Y

Call to Action

Don’t let this opportunity pass you by. Delve into the captivating world of order flow trading strategy forex. Educate yourself, embrace new techniques, and witness your trading journey transform into a path of consistent profitability. Join the ranks of elite traders who leverage order flow analysis to outsmart the markets and attain financial success.