Introducing HDFC Bank: A Pioneer in Forex Trading

HDFC Bank is India’s leading private sector bank, renowned for its comprehensive portfolio of financial services, including forex trading. With a vast network of branches and cutting-edge online platforms, HDFC Bank offers a seamless and secure forex trading experience for individuals and businesses.

Image: mybankinghub.com

Step-by-Step Guide to Opening an HDFC Bank Forex Account

Step 1: Visit an HDFC Bank Branch

- Locate the nearest HDFC bank branch and schedule an appointment for a comprehensive account opening consultation.

- Carry necessary documents such as identity proof (PAN card, Aadhaar card), address proof (utility bills, rental agreement), and income proof (salary slips, bank statements).

Step 2: Complete Account Opening Formalities

- Fill out the account opening form provided by the bank executive and provide all the required details accurately.

- Submit the necessary documents and have them verified by the bank officials.

Step 3: Verify Your Identity and Address

- The bank may request additional documents for identity and address verification.

- These may include photographs, self-attested copies of your identity proof, or a visit to your registered address by a bank representative.

Step 4: Link Trading Platform to Account

- Once your account is approved, you can link it to a forex trading platform.

- Popular platforms such as MetaTrader 4 or MetaTrader 5 can be integrated with your HDFC Bank account seamlessly.

Step 5: Fund Your Account

- Transfer funds into your HDFC Bank forex account using NEFT, RTGS, or IMPS.

- The minimum deposit amount may vary depending on the type of account you choose.

Understanding Forex Trading with HDFC Bank

Forex trading involves buying and selling currencies in the global foreign exchange market. HDFC Bank offers a range of forex services, including:

- Spot Trading: Buy or sell currencies at the current market price for immediate delivery.

- Forward Contracts: Lock in exchange rates for future delivery at a predetermined price.

- Currency Options: Gain the right to buy or sell currencies at a specific price within a specified timeframe.

- Forex Advisory Services: Access expert advice and market analysis to make informed trading decisions.

Tips for Forex Trading Success with HDFC Bank

- Set Realistic Goals: Establish clear and achievable trading objectives to manage expectations.

- Understand Market Dynamics: Study currency trends, economic indicators, and global events that influence forex prices.

- Manage Risk: Implement stop-loss orders and use leverage cautiously to mitigate potential losses.

- Practice Discipline: Stick to your trading plan and avoid emotional decision-making.

- Seek Professional Guidance: Consult with a financial advisor or forex analyst for personalized insights and strategies.

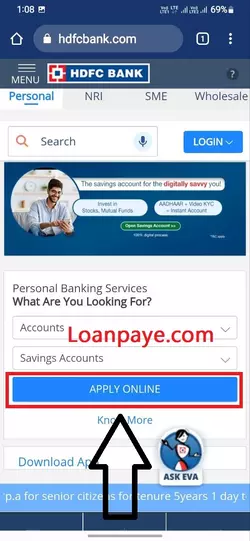

Image: loanpaye.com

Frequently Asked Questions about Opening an HDFC Forex Account

Q: What are the eligibility criteria for opening an HDFC Bank forex account?

A: Indian residents with a valid PAN card and Aadhaar card can open an HDFC forex account.

Q: What documents are required for account opening?

A: Identity proof (PAN card, Aadhaar card), address proof (utility bills, rental agreement), and income proof (salary slips, bank statements).

Q: How long does it take to open an HDFC forex account?

A: Typically, it takes 2-3 business days for account opening after document submission and verification.

Q: What are the trading hours for forex trading with HDFC Bank?

A: Forex trading hours are from 9 am to 5 pm IST on weekdays, except for national holidays.

Q: How do I get a forex advisory service from HDFC Bank?

A: Contact your HDFC Bank relationship manager or visit the bank’s website to request forex advisory services.

Open Hdfc Bank Account Forex

Conclusion

Opening an HDFC Bank forex account is an excellent choice for individuals and businesses seeking a trusted and reliable platform for forex trading. With its comprehensive suite of forex services, cutting-edge trading tools, and expert advice, HDFC Bank empowers you to navigate the dynamic currency markets with confidence.

If you are interested in exploring the potential of forex trading, we encourage you to reach out to HDFC Bank today and embark on this exciting financial journey.