Introduction

In the dynamic and ever-evolving world of Forex trading, traders seek every possible edge to enhance their decision-making and optimize their outcomes. Among the innovative tools that have emerged, NSTP (No Stop Trading Profit) stands out as a highly versatile and effective strategy. Embraced by both novice traders and seasoned professionals, NSTP offers a unique blend of simplicity and power, empowering traders to navigate market volatility and achieve consistent profitability.

Image: cryptoshitcompra.com

Delving into NSTP: A Deeper Understanding

NSTP is a non-directional trading strategy that focuses on capturing small, consistent profits from price fluctuations rather than aiming for significant gains on a single trade. It involves entering the market with a predetermined profit target and no predefined stop-loss level. This approach allows traders to ride out temporary price swings without being prematurely exited from the trade due to market volatility. The key principle behind NSTP lies in the idea that markets tend to move in a series of oscillations, presenting numerous opportunities for profitable trades if one has the agility to adapt to these movements.

The Power of No Stop-Loss

Traditionally, traders have relied on stop-loss orders to limit their potential losses. However, these orders can often be triggered prematurely, prematurely exiting profitable trades during periods of market fluctuations. NSTP eliminates the use of stop-loss orders, freeing traders to hold onto their positions longer and capitalize on favorable market conditions. By adopting a flexible and adaptive approach, NSTP traders can stay in the market long enough to capture consistent profits, even in volatile market conditions.

Expert Insights and Practical Applications

Seasoned NSTP traders recommend entering the market with a clear profit target and a predefined risk-to-reward ratio. They suggest aiming for a profit-to-loss ratio of at least 2:1, ensuring that potential profits outweigh potential losses. Additionally, they advocate for using a trailing stop-loss strategy, which adjusts the stop-loss level as the trade moves in a profitable direction, providing an additional layer of protection while allowing profits to grow.

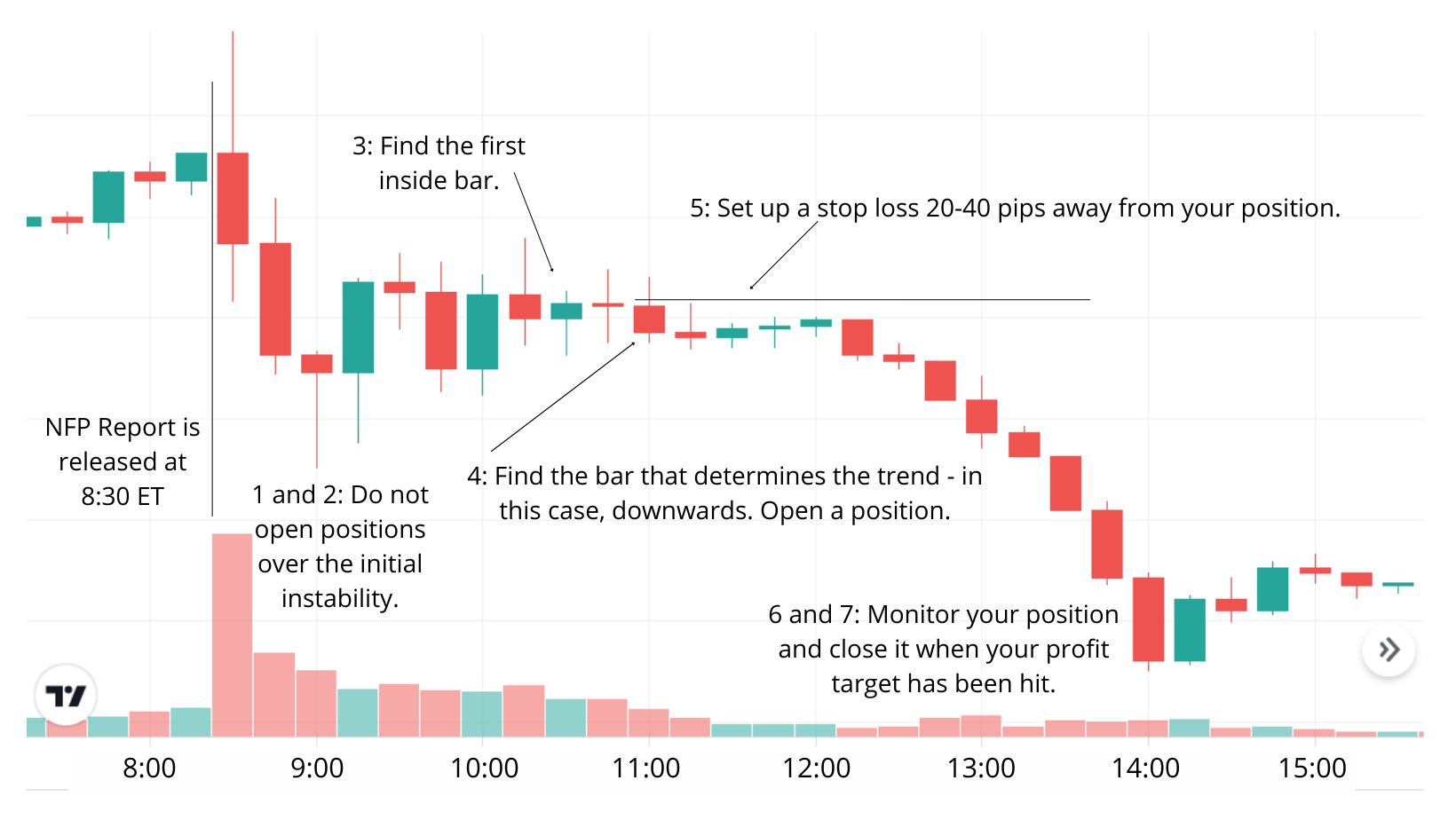

Image: www.daytrading.com

Nstp Full Form In Forex

Compelling Conclusion

NSTP has revolutionized the way traders approach Forex trading, offering a versatile and effective strategy for capturing small, consistent profits. By eliminating the premature exits associated with traditional stop-loss orders and embracing an adaptive trading style, NSTP empowers traders to navigate market volatility and achieve consistent profitability. Whether you are a novice trader or an experienced professional, incorporating NSTP into your trading arsenal can significantly enhance your chances of success in the dynamic and ever-changing world of Forex trading.