The globalized world of finance demands precision, especially when navigating the intricate waters of currency exchange. In the realm of forex trading, the normal transit period emerges as a pivotal concept that can significantly influence your trading strategy. Step into the depths of this critical topic, and discover how it can empower you to maximize your trading prowess.

Image: forexnew0database.blogspot.com

Defining the Normal Transit Period

In the realm of forex, the normal transit period represents the timeframe within which a currency trade is settled. It refers to the duration between when the trade is executed and when the respective currencies are exchanged. Understanding this time frame is paramount, as it directly impacts the timing of your trading decisions. In most cases, this period typically falls within two business days, although it can vary depending on the currencies involved and specific market conditions.

Why It Matters: The Relevance of the Normal Transit Period

The normal transit period holds significant implications for traders, shaping their strategic approaches:

- Impact on Trade Execution: Knowing the transit period allows you to plan your trade executions accordingly. By factoring in the settlement timeframe, you can avoid any potential delays or misalignments in your trading schedule.

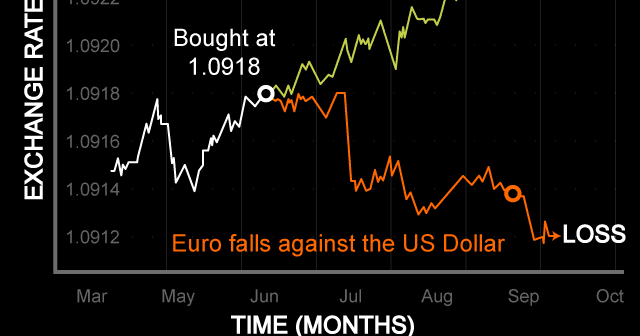

- Influence on Risk Management: The transit period plays a crucial role in risk management. If the timeframe is extended due to market volatility or other factors, it increases the risk of exchange rate fluctuations. Anticipating this potential allows you to adjust your risk parameters effectively.

- Optimization of Trading Strategies: Understanding the transit period empowers you to optimize your trading strategies. By knowing the exact settlement time, you can devise strategies that align with your trading goals and time frame.

Navigating the Normal Transit Period: Strategies and Considerations

Mastering the normal transit period requires careful consideration and strategic maneuvering:

- Prioritize Liquidity: Seek out currency pairs with high liquidity, as they generally have shorter transit periods. This reduces the risk of delays and ensures a smoother settlement process.

- Monitor Market Conditions: Market volatility can prolong the transit period. Stay abreast of economic news, political events, and other factors that could impact the exchange rates and potentially extend the settlement time.

- Choose Reputable Brokers: Partner with reputable forex brokers who adhere to industry-standard transit periods. This ensures timely execution and settlement of your trades, minimizing any potential disruptions.

Image: www.houseofjhumkas.com

Normal Transit Period In Forex

Conclusion: Harnessing the Normal Transit Period for Strategic Advantage

Embracing the nuances of the normal transit period in forex is crucial for traders seeking success in the dynamic currency markets. By delving deep into this topic, you gain the knowledge and foresight necessary to execute informed trades, manage risk effectively, and optimize your trading strategies. Remember, mastering the normal transit period empowers you to navigate the forex landscape with precision, yielding greater control and unlocking enhanced trading outcomes.