Navigating the global financial landscape can be daunting, especially when it comes to managing your international finances. The Niyo forex card has emerged as a convenient solution for travelers and global citizens, offering a range of currency management services. However, understanding the associated fees and charges is crucial to optimize your financial strategy.

Image: www.youtube.com

This comprehensive guide will delve into the intricacies of Niyo forex card ATM withdrawal charges, empowering you with the knowledge to make informed decisions. We’ll cover the ins and outs of fees, exchange rates, transaction limits, and tips for minimizing costs. Let’s embark on a financial journey and unlock the potential of your Niyo forex card.

Types of ATM Withdrawal Charges

When using your Niyo forex card at an ATM overseas, you may encounter the following types of charges:

- ATM withdrawal fee: Charged by the ATM operator for accessing the machine, typically ranging from $2 to $5.

- Niyo service fee: A flat fee charged by Niyo for conducting the withdrawal, usually around 1% of the transaction amount.

- Non-Niyo ATM fee: Imposed by the ATM operator if the ATM is not part of Niyo’s partner network, generally higher than the Niyo service fee.

- Dynamic currency conversion (DCC) fee: Optional fee charged by the ATM operator to convert the transaction amount to your home currency at a potentially unfavorable exchange rate.

Transaction Limits and Exchange Rates

Niyo sets transaction limits on daily ATM withdrawals to ensure responsible financial management. These limits vary depending on your card type and account balance. Additionally, Niyo offers competitive foreign exchange rates for withdrawals. However, these rates may fluctuate based on market conditions.

To obtain the most up-to-date exchange rates and avoid unfavorable hidden charges, consider the following tips:

- Check the Niyo app or website for real-time exchange rates.

- Opt out of DCC to convert the transaction amount to your home currency through your home bank at potentially more favorable rates.

- Compare exchange rates offered by different currency exchange providers before loading your Niyo card.

Minimizing Withdrawal Costs

Following these prudent financial strategies can help you minimize ATM withdrawal costs when using your Niyo forex card:

- Plan withdrawals: Avoid frequent small withdrawals and opt for larger ones to limit the number of ATM transactions.

- Find Niyo-network ATMs: Using ATMs within Niyo’s network can significantly reduce or eliminate non-Niyo ATM fees.

- Avoid peak tourist seasons: ATM withdrawal charges can be higher during popular tourist seasons due to increased demand.

- Consider local exchange rates: If the local exchange rate is favorable, it may be more cost-effective to withdraw cash at the local currency and convert it later.

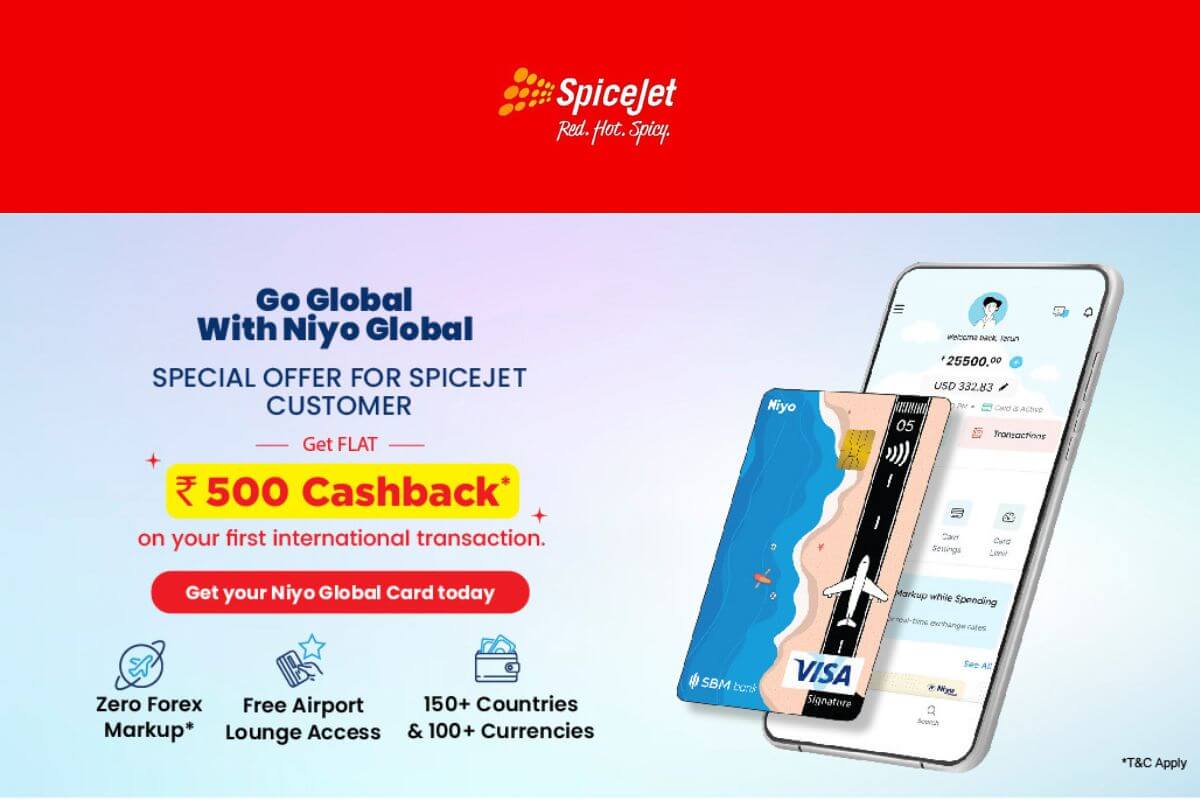

Image: aviationscoop.com

Niyo Forex Card Atm Withdrawal Charges

Additional Information and Resources

For further details on Niyo forex card ATM withdrawal charges, consider exploring the following resources:

- Niyo website: https://www.getniyo.com/

- Niyo support center: https://help.getniyo.com/

- Monetary Authority of Singapore (MAS) foreign exchange guidelines: