Introduction

The financial landscape is constantly evolving, and with it comes the need for efficient and transparent reporting systems. In the realm of foreign exchange (forex) transactions, purpose codes play a pivotal role in ensuring accuracy and clarity in reporting. To enhance the effectiveness of these codes, new purpose codes have been introduced to streamline the reporting of forex transactions and repayment processes. These codes facilitate better categorization and communication of financial activities, enabling regulators and financial institutions to accurately monitor and analyze forex markets.

(1).jpg)

Image: www.vance.tech

Importance of Purpose Codes in Forex Reporting

Purpose codes serve as a common language for reporting financial transactions, providing a systematic way to classify the underlying reasons behind forex exchanges. They are crucial for understanding the nature and intent of transactions, which helps in detecting suspicious activities, managing risk, and ensuring compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations.

Benefits of New Purpose Codes

The introduction of new purpose codes offers several advantages:

- Enhanced Clarity: The new codes provide more granular categorization, allowing for precise reporting of transaction purposes. This improves the accuracy and reliability of data, facilitating better decision-making.

- Improved Monitoring: Regulators can use the specific purpose codes to closely monitor certain types of transactions, such as those related to trade, investment, or hedging. It enables them to identify potential irregularities and respond accordingly.

- Streamlined Repayment Processes: For transactions involving repayment, the new purpose codes help in better tracking and reconciling payments. This smoothens the repayment process, reducing potential delays or discrepancies.

Types of New Purpose Codes

The new purpose codes cover a wide range of forex transactions and repayment scenarios, including:

- Trade-Related Transactions: Codes for transactions related to imports, exports, and other trade activities.

- Investment-Related Transactions: Codes for transactions involving foreign direct investment, portfolio investments, and other investment activities.

- Hedging-Related Transactions: Codes for transactions aimed at managing currency risk through hedging strategies.

- Loan-Related Transactions: Codes for transactions involving loan repayments, interest payments, and other loan-related activities.

- Repayment-Related Transactions: Codes for transactions specifically used for repaying financial obligations, such as principal repayments and interest payments.

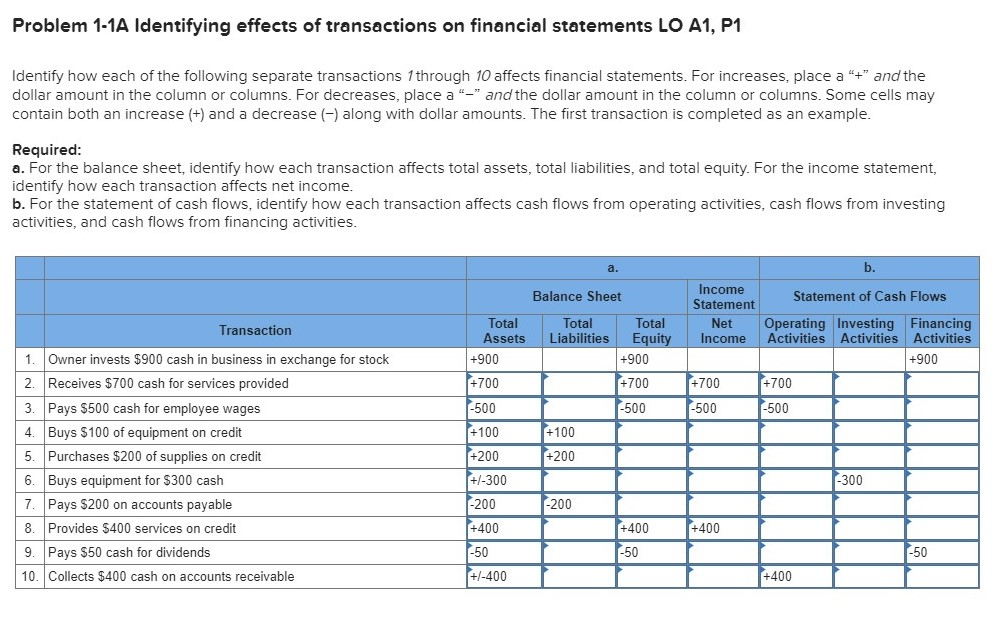

Image: www.chegg.com

Implementation Considerations

Financial institutions need to be aware of the new purpose codes and incorporate them into their reporting systems. This involves:

- Updating Reporting Systems: Upgrading or modifying reporting systems to support the new codes and ensure accurate classification of transactions.

- Staff Training: Educating staff on the new codes to ensure proper application and interpretation.

- Data Validation: Implementing data validation mechanisms to check the accuracy and consistency of reported data using the new codes.

New Purpose Codes For Reporting Forex Transactions Rpayment Purposes

Conclusion

The introduction of new purpose codes marks a significant step towards enhancing the reporting of forex transactions and repayment processes. These codes provide greater clarity, improve monitoring capabilities, and facilitate efficient repayment processes. Financial institutions must embrace these codes and ensure their proper implementation to contribute to a more transparent and robust financial ecosystem. By incorporating these new purpose codes, we can collectively enhance the accuracy and effectiveness of forex reporting, fostering a more informed and well-regulated financial environment.