Introduction

The foreign exchange (forex) market, a global decentralized market, facilitates the exchange of currencies between nations for international trade, investments, and tourism. Understanding the nature of forex inflows and outflows is crucial for businesses, investors, and anyone engaged in cross-border transactions to navigate this complex market. This article delves into the computation methods for forex inflows and outflows, explaining their significance and implications.

Image: enterslice.com

Defining Forex Inflows and Outflows

Forex inflows refer to the flow of foreign currencies into a country, while outflows represent the flow of currencies out of a country. Inflows can stem from exports, foreign direct investments, and remittances, while outflows may occur due to imports, foreign currency purchases, and loan repayments.

Computation Methods for Forex Inflows

The computation method for forex inflows involves determining the total amount of foreign currencies received by a country during a specific period. Key data sources include:

- Balance of Payments (BOP) Data: The BOP is a standardized framework for recording all economic transactions between a country and the rest of the world. It categorizes forex inflows under current and capital accounts.

- Trade Statistics: Customs data provide information on the value of exports, which represent a major source of forex inflows.

- Foreign Direct Investment (FDI) Data: FDI refers to investments made by foreign entities in a country’s economy, contributing to forex inflows.

- Remittance Data: Money sent back home by expatriates working abroad constitutes a significant source of forex inflows for some countries.

Computation Methods for Forex Outflows

Forex outflows are calculated similarly to inflows, with the focus on identifying the total amount of foreign currencies spent by a country in a given period. Key data sources include:

- Balance of Payments (BOP) Data: Similar to inflows, the BOP categorizes forex outflows under current and capital accounts.

- Trade Statistics: Customs data provide information on the value of imports, a primary component of forex outflows.

- Foreign Exchange Market Turnover: Data on foreign currency purchases and sales in the forex market can indicate the flow of foreign currencies out of a country.

- Debt Repayment Data: Loan repayments to foreign creditors represent a major source of forex outflows.

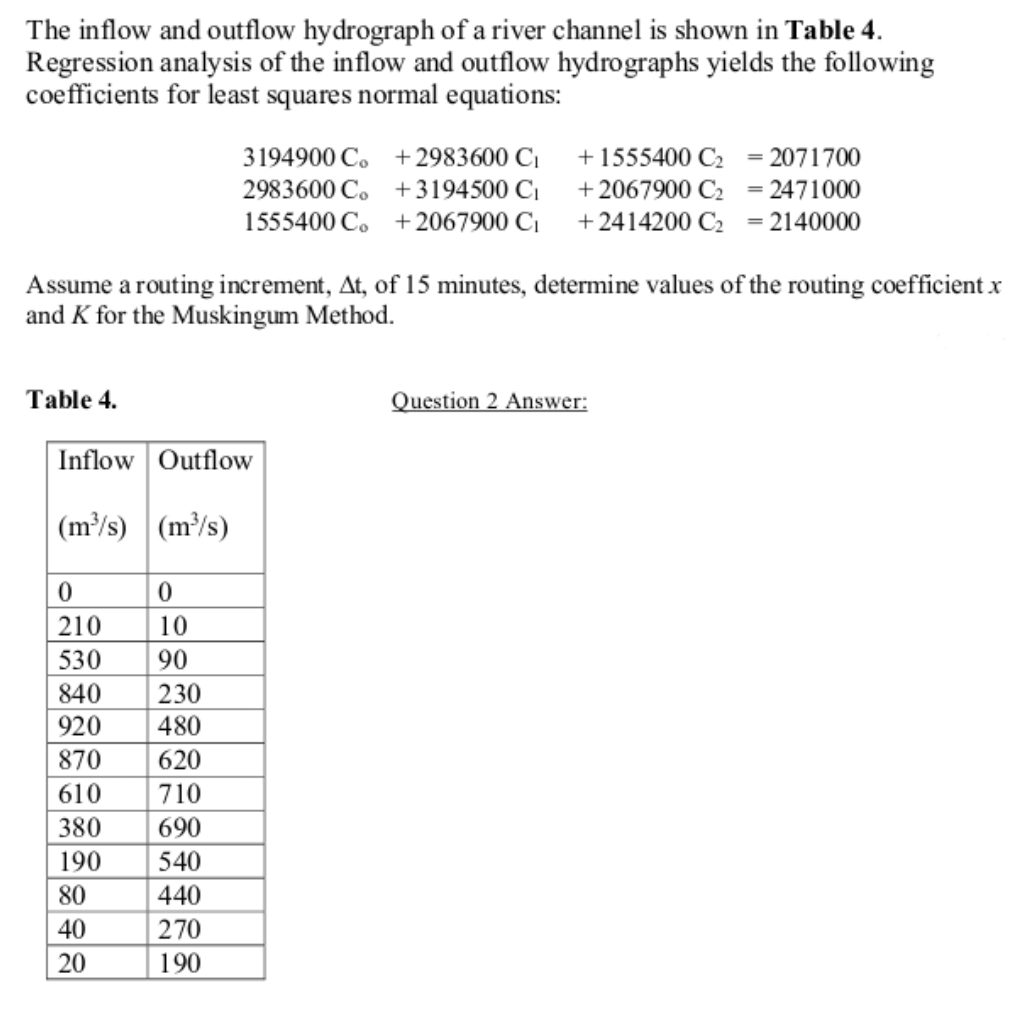

Image: www.bartleby.com

Economic Impacts of Forex Inflows and Outflows

Forex inflows and outflows have a profound impact on a country’s economy:

- Balance of Payments Equilibrium: When inflows exceed outflows, a country’s balance of payments is in surplus, strengthening its currency value. Conversely, a deficit occurs when outflows surpass inflows, potentially weakening the currency.

- Economic Growth: Foreign capital inflows can spur economic growth by financing investments, creating jobs, and enhancing productivity. Outflows can constrain economic growth if they exceed inflows and result in a lack of foreign exchange reserves.

- Exchange Rate Stability: Forex inflows and outflows influence the demand and supply of foreign currencies, thereby affecting exchange rates. A surge in inflows can strengthen a currency, while outflows can lead to depreciation.

- Government Policy: Governments may implement policies to manage forex inflows and outflows, such as exchange rate controls, foreign debt regulation, and incentives for exports.

Nature Of Forex Inflow And Outflow Computation Method

Conclusion

Understanding the nature of forex inflow and outflow computation methods is essential for deciphering the complexities of the forex market and making informed economic decisions. By monitoring these flows and their impact on the balance of payments, exchange rates, and economic growth, businesses, investors, and policymakers can effectively navigate this dynamic and interconnected global marketplace.