Introduction

In today’s interconnected global economy, national debts and foreign exchange (forex) markets bear a profound and often multifaceted relationship. Sovereign debts, when managed prudently, can facilitate economic growth. However, excessive debt levels can have far-reaching consequences, shaping macroeconomic policies and exerting significant influence on currency values. Delving into the intertwined dynamics of these two arenas holds crucial implications for policymakers, businesses, and investors alike.

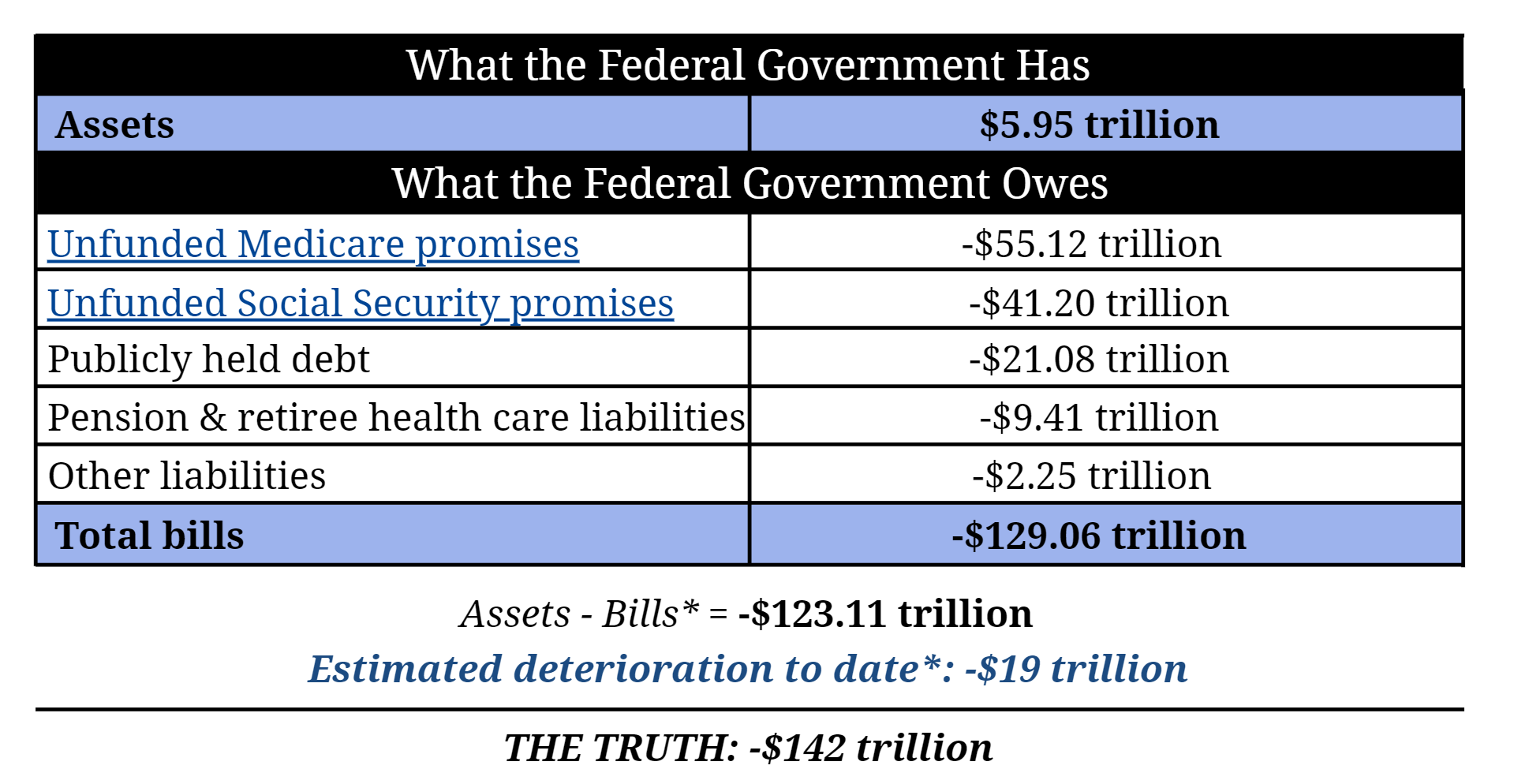

Image: money.cnn.com

Understanding National Debt

National debt, the total amount owed by a government to creditors, can arise from various sources. These include budget deficits, when government spending exceeds revenue, as well as borrowing to finance public infrastructure or stimulate economic activity. While debt is often necessary for governments to meet their obligations, its accumulation must be managed responsibly to avoid financial instability and the erosion of economic sovereignty.

Forex Influences on National Debt

The forex market, where currencies are exchanged for other currencies, plays a crucial role in determining the value of a nation’s debt. When a country’s currency depreciates relative to other currencies, it becomes more expensive to repay foreign debts. This can lead to increased fiscal risk and debt servicing costs. On the other hand, currency appreciation can alleviate the debt burden by making repayments cheaper.

Moreover, forex fluctuations can impact the real value of debt. For instance, if a country’s currency depreciates against a currency in which it has borrowed, the debt’s real value rises as more local currency is required to repay the same nominal amount. This can exacerbate existing financial pressures and limit the government’s fiscal options.

Debt-induced Forex Volatility

High levels of national debt can also induce forex volatility. Investors may become concerned about a country’s ability to repay its obligations and begin selling its currency. This can lead to a depreciation of the currency, further increasing the cost of servicing external debts. In severe cases, a debt crisis may ensue, causing turmoil in the forex market and economic upheaval.

Image: www.fxempire.com

Case Studies: National Debts, Forex, and Economic Consequences

Historical case studies provide valuable lessons on the intertwined effects of national debts and forex influences. The Asian financial crisis of 1997-1998, for example, highlighted the risks of excessive private and public indebtedness. Currency pegs, initially implemented to maintain stability, became unsustainable as exchange rate pressures mounted. The ensuing currency devaluations and debt defaults had profound economic and financial consequences across the region.

In a contrasting example, the Swiss franc peg to the euro, which was dissolved in 2015, led to a rapid appreciation of the currency. Swiss policymakers intervened heavily in the forex market to prevent further appreciation and safeguard economic competitiveness. The decision reflected the substantial costs that currency fluctuations can impose on countries with high levels of foreign debt.

Mitigating Debt-Forex Risks: Policy Considerations

Recognizing the potential risks associated with the nexus of national debts and forex influences, policymakers should adopt prudent macroeconomic strategies. These include maintaining sound fiscal policies, avoiding excessive borrowing, and prudently managing foreign exchange reserves. Central banks often intervene in forex markets through monetary policy tools to influence currency values, a measure that can be complemented by capital controls or other exchange rate management mechanisms.

National Debts And Forex Influences

Conclusion

National debts and forex influences are intricately linked, creating complex and often unpredictable dynamics in the global financial landscape. Managing these interrelationships is essential for policymakers and economic actors to promote financial stability, foster sustainable economic growth, and mitigate potential risks to the global economy. By understanding the factors that shape this relationship and adopting responsible debt and forex management policies, nations can navigate the challenges and capitalize on the opportunities this interplay presents.