In the fast-paced world of financial markets, contracts for difference (CFDs) have emerged as a powerful tool for traders seeking to capitalize on price fluctuations. CFDs offer a unique blend of flexibility, leverage, and accessibility that has made them increasingly popular among investors in the United States.

Image: programminginsider.com

Understanding CFDs: A Path to Diversification

CFDs are financial instruments that allow traders to speculate on the price movements of underlying assets without taking direct ownership of those assets. This innovative approach provides traders with the ability to diversify their portfolios and participate in markets that may otherwise be inaccessible or require substantial investment.

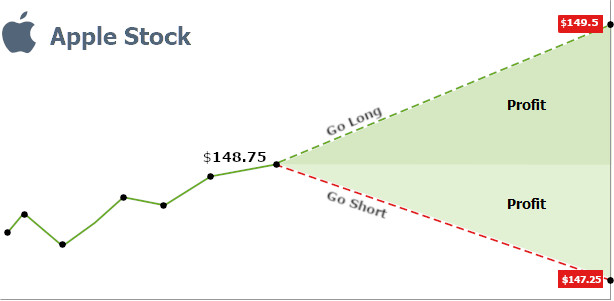

The Mechanics of CFD Trading

CFD trading involves entering into a contract with a broker, agreeing to exchange the difference between the opening and closing prices of the underlying asset. The profit or loss is determined based on the accuracy of the trader’s prediction regarding price movements.

Benefits of CFD Trading in the US

- Flexible Leverage: CFDs offer flexible leverage ratios, allowing traders to amplify their returns. This can potentially increase profits but also carries higher risks.

- Access to Global Markets: CFDs provide access to a wide array of global markets, including stocks, indices, commodities, and currencies.

- Reduced Capital Requirements: Compared to traditional stock ownership, CFDs require a lower initial investment, making them more accessible to retail traders.

Image: www.ifcm.co.uk

Risks and Considerations

Despite its potential rewards, CFD trading also involves inherent risks that must be carefully considered.

- Leverage Risk: The use of leverage can magnify both profits and losses, making it essential for traders to manage their risk exposure prudently.

- Margin Calls: Traders may potentially receive margin calls if the market moves against their position and their account balance falls below a certain level.

- Volatility: CFDs are sensitive to market volatility, and sudden price movements can result in significant losses.

Strategies for Successful Trading

To enhance their success in CFD trading, traders should employ a range of strategies, including:

- Strong Technical Analysis: Traders should conduct thorough technical analysis to identify market trends and price patterns.

- Effective Risk Management: Implementing stop-loss orders and position-sizing techniques enables traders to limit their exposure to losses.

- Diversify Portfolio: Diversifying investments across multiple markets and assets helps spread risk and enhance overall returns.

Cfd Trading In The Us

Conclusion

CFD trading in the US presents a compelling opportunity for investors seeking to harness the potential of diverse markets with enhanced flexibility. By understanding the benefits and risks involved, and adopting sound trading strategies, traders can unlock the potential of CFDs to generate profitable returns. As the financial landscape continues to evolve, CFDs will undoubtedly remain a vital tool for investors eager to navigate global markets and maximize their investment outcomes.