# Unlocking the Secrets of Multiple Timeframes: A Trader’s Advantage

Image: www.pinterest.cl

Welcome to the world of forex trading, where the ability to conquer uncertainty and leverage opportunity is paramount. In this realm of perpetual market movements, traders are constantly seeking the edge that will give them a decisive advantage. One such edge is mastering the art of analyzing multiple timeframes on a single chart.

Envision a chart pulsating with a symphony of synchronized timeframes, each providing a distinct perspective on market dynamics. As you shift gears from the vast panorama of monthly trends to the rapid-fire fluctuations of the minute chart, a new world of insights unfolds before your eyes. The harmony between these different timeframes transcends the individual perspectives, creating a comprehensive tapestry of market behavior.

The Symphony of Timeframes

Let’s embark on a musical exploration of the various timeframes and their unique characteristics:

1. Monthly Timeframe (The Grand Master)

The monthly timeframe reigns supreme, offering a panoramic view of long-term market trends. It reveals the overall direction and momentum of the market, providing a solid foundation for making strategic decisions.

2. Weekly Timeframe (The Conductor)

The weekly timeframe is the conductor of the timeframes. It adds a layer of detail to the monthly timeframe, revealing emerging patterns and the formation of higher highs and lower lows.

3. Daily Timeframe (The Lead Violin)

The daily timeframe is the workhorse of trading. It captures key market events and provides insights into short-term price movements. It’s where traders can fine-tune their entries and exits.

4. Hourly Timeframe (The Harmonizer)

The hourly timeframe harmonizes the daily and minute timeframes, offering a granular view of price movements. It’s ideal for identifying trading opportunities and managing risk.

5. Minute Timeframe (The Virtuoso)

The minute timeframe is the virtuoso of the timeframes. It reveals the intricate details of market action, providing insights into the psychology and volatility of the market.

The Harmonic Convergence

When these timeframes converge in harmony, like the notes of a grand symphony, a trader can navigate the choppy waters of the forex market with greater precision. This convergence allows traders to:

1. Identify Market Structure

The various timeframes offer different perspectives on market structure, allowing traders to discern trends, ranges, and breakouts.

2. Confirm Trade Direction

The alignment of signals across multiple timeframes provides a higher level of confidence in trade decisions, reducing the risk of false breakouts and whipsaws.

3. Optimize Entry and Exit Points

By analyzing the convergence of timeframes, traders can pinpoint optimal entry and exit points, increasing their potential for profit and minimizing losses.

4. Manage Risk Effectively

Understanding the interplay of timeframes helps traders manage risk more effectively by identifying potential support and resistance levels within the larger market context.

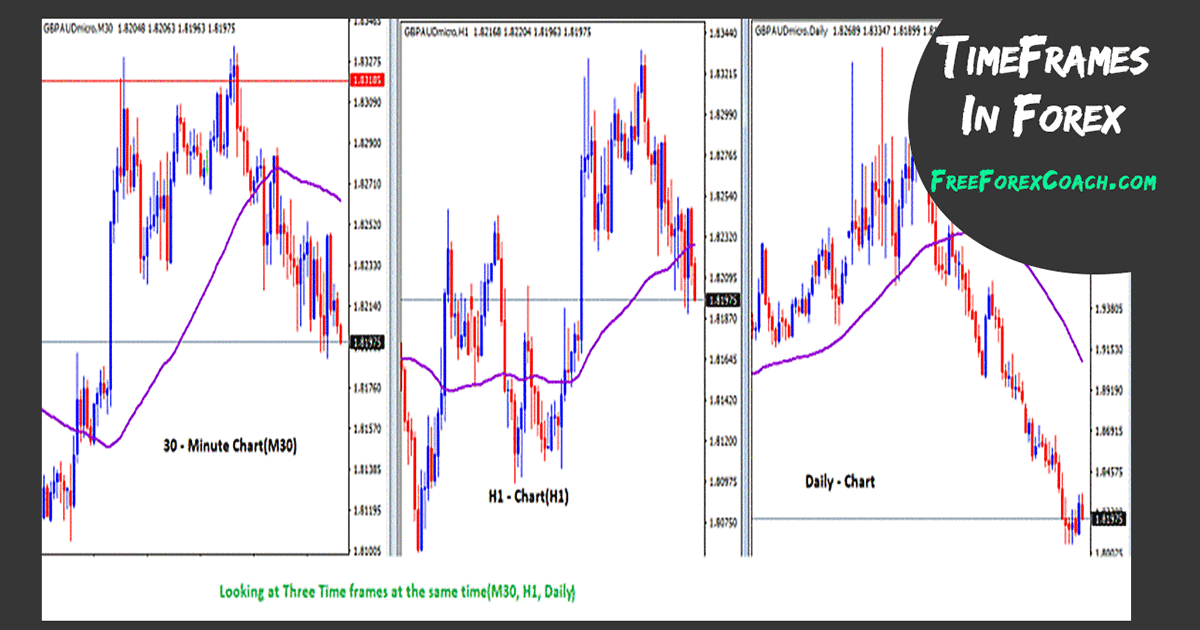

Image: freeforexcoach.com

The Anatomy of a Winning Strategy

Harnessing the power of multiple timeframes is not a mere technique; it’s a philosophy that transforms the approach to forex trading. Here’s the anatomy of a winning strategy:

1. Identify the Trend

Begin by identifying the long-term trend on the monthly and weekly timeframes. This will provide the overall direction for your trades.

2. Set Boundaries

Use the daily timeframe to define key support and resistance levels, providing your trading boundaries. These levels will help you identify potential entry and exit points.

3. Pinpoint Entry Opportunities

Analyze the hourly timeframe for potential entry points. Look for price action patterns or indicators that align with your trend analysis.

4. Manage Risk

Continuously monitor the minute timeframe to manage your risk. Protect your positions by placing stop-loss orders at appropriate levels.

Multiple Timeframes On One Chart Forex Winners

https://youtube.com/watch?v=3CqSnXgTjgU

Conclusion

Unlocking the secrets of multiple timeframes is like wielding the sword of knowledge in the forex arena. By mastering this technique, you gain an unrivaled advantage, enabling you to identify market opportunities, mitigate risk, and secure consistent profits. Remember, the true path to trading success lies not in isolated technical tools but in the harmonious convergence of insights across multiple timeframes. Embrace this symphony of timeframes and watch your trading soar to new heights.