Introduction: A Firsthand Account of Time Travel

In the realm of forex trading, time is a dual-edged sword. It can be both a formidable foe and an invaluable ally. Yet, the concept of navigating time took on a whole new meaning for me when I stumbled upon the art of multi-timeframe forex trading. Like a seasoned time traveler, I discovered that peering into multiple time dimensions could unveil previously hidden patterns and trading opportunities.

Image: forexpops.com

Picture this: You stumble upon a chart that tantalizingly hints at a potential trend reversal. But alas, a nagging doubt lingers—is this merely a fleeting fluctuation or the genesis of a bigger move? This is where multi-timeframe analysis comes into its own. By examining the same currency pair across different timeframes, you can eliminate the noise and discern the true market narrative.

The Alchemy of Timeframes: Discerning Patterns Across Dimensions

The beauty of multi-timeframe trading lies in its ability to provide context and confirmation. Imagine you’re scrutinizing a 15-minute chart and notice a bullish engulfing pattern. This pattern alone may not inspire confidence, but when you shift to the daily timeframe and observe a similar bullish pattern forming, a sense of conviction takes hold.

The convergence of patterns across different timeframes acts as a powerful corroboration, increasing the probability of a profitable trade. Moreover, by observing the broader trend on higher timeframes, you can gauge the strength and sustainability of the potential reversal, providing a crucial insight into risk management and profit potential.

Navigating the Time Maze: A Step-by-Step Guide

Embarking on a multi-timeframe trading journey can be likened to charting a course through a labyrinth. To guide you through this time-bending adventure, here’s a step-by-step roadmap:

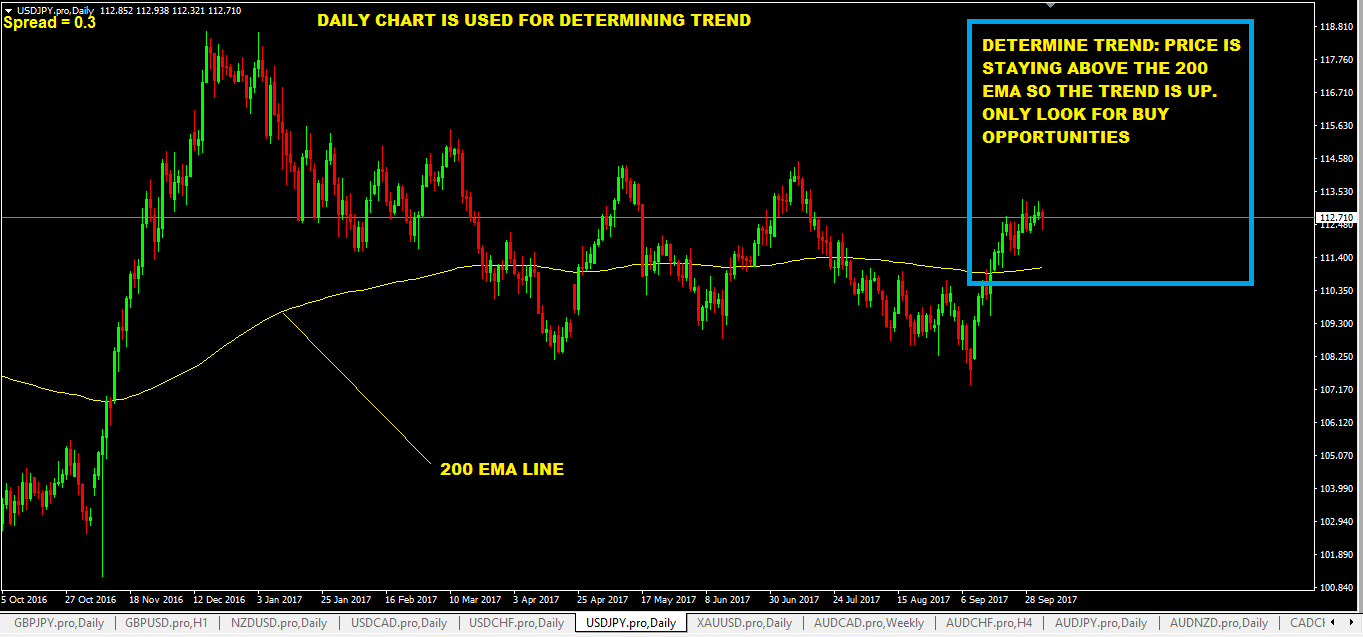

- Identify the primary trend: Begin by analyzing the daily or weekly timeframe to establish the overarching trend direction.

- Drill down to lower timeframes: Once you’ve grasped the broader context, shift to shorter timeframes (15-minute or 1-hour charts) to identify potential entry and exit points.

- Seek convergence: Compare the patterns, indicators, and price action on multiple timeframes to find areas where they align, indicating increased trading opportunities.

- Manage risk: Understand that multi-timeframe trading can amplify risk. Always employ sound risk management techniques, such as setting stop-loss orders.

Expert Insights: Harvesting Wisdom from Seasoned Traders

“Multi-timeframe analysis is akin to having a team of scouts at your disposal,” says professional trader Mark Douglas. “Each timeframe provides a unique perspective, and by combining their insights, you can make more informed trading decisions.”

Echoing this sentiment, forex educator Anna Coulling emphasizes, “Timeframe hopping is not about predicting the future. It’s about increasing the probability of your trading success. By leveraging multiple perspectives, you gain a deeper understanding of market dynamics.”

Image: www.forextrading200.com

FAQ: Unraveling Time-Related Forex Enigmas

Q: How many timeframes should I use?

A: Start with 2-3 timeframes, focusing on those that align with your trading style and risk tolerance.

Q: Is it possible to trade against the trend using multi-timeframes?

A: While it’s not advisable to trade against the primary trend, you can use multi-timeframes to identify potential countertrend opportunities with limited risk.

Q: How do I handle conflicting signals from different timeframes?

A: Prioritize signals from higher timeframes, as they carry more weight in determining the overall market direction. Use lower timeframes for fine-tuning entry and exit points.

Multi Timeframe Forex Trading Strategy

Conclusion: A Time Traveler’s Odyssey into Market Profits

Multi-timeframe forex trading is not a mere strategy; it’s a transformative mindset that empowers you to perceive the market from multiple angles. By embracing this time-bending approach, you unlock a realm of trading possibilities, increasing your accuracy, managing risk, and maximizing your profit potential.

If you’re intrigued by the prospect of traversing timeframes and unlocking market insights, I invite you to embark on this fascinating journey. Explore the multi-timeframe trading landscape, and discover how this powerful tool can elevate your trading game to new dimensions of success.