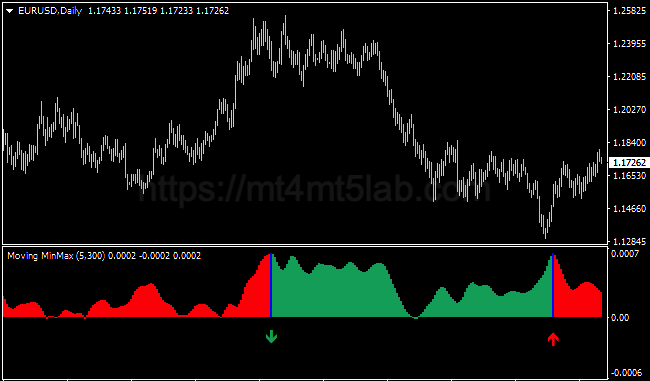

In the dynamic world of Forex trading, traders rely on technical indicators to analyze market movements and make informed decisions. Among the most versatile and effective indicators is the Moving Min Max Indicator (MMMI), a tool that helps traders identify market extremes and optimize their trading strategies.

Image: mt4mt5lab.com

The MMMI measures the highest and lowest prices over a specified period, providing valuable insights into market volatility and price ranges. By visualizing these extremes, traders can better predict potential reversal points and pinpoint potential trading opportunities. This article delves into the Moving Min Max Indicator, exploring its functions, benefits, and applications in Forex trading.

Functions and Calculations of the MMMI

The MMMI is calculated by recording the maximum and minimum prices over a predetermined period. This period can be adjusted to suit different trading strategies, ranging from short-term scalping to long-term investing. Common periods include 10, 20, 50, and 100 candlesticks.

Once the period is set, the MMMI plots two lines on the price chart:

- Maximum Line: Represents the highest price reached during the specified period.

- Minimum Line: Represents the lowest price reached during the specified period.

The vertical space between these two lines indicates the price range or volatility of the market. The wider the range, the more volatile the market. Conversely, a narrower range suggests lower volatility and consolidation.

Benefits and Features of the MMMI

The Moving Min Max Indicator offers several advantages to Forex traders:

- Identifies Market Extremes: The MMMI clearly shows extreme price levels, helping traders identify overbought or oversold conditions.

- Determines Price Ranges: The distance between the maximum and minimum lines indicates the expected price range, assisting traders in setting their order targets and stop-loss levels.

- Supports Breakout Trading: When prices break beyond the MMMI lines, it can signal potential trading opportunities. For example, a breakout above the maximum line suggests a bullish trend, while a break below the minimum line indicates bearishness.

- Highlights Support and Resistance Levels: The MMMI lines often act as dynamic support and resistance levels, helping traders identify potential reversal points and anticipate market turns.

- Customizable Period: Traders can adjust the MMMI period to suit their specific trading style and market conditions.

Applications of the MMMI in Forex Trading

The MMMI can be implemented in various Forex trading strategies, including:

Image: www.forexcracked.com

1. Breakout Trading

When prices break beyond the MMMI lines, it signifies a potential trend reversal. Traders can place orders above or below the breakout level to capitalize on the movement.

2. Range Trading

The MMMI helps identify price ranges, allowing traders to devise trading strategies within these ranges. Scalpers and day traders often use this approach.

3. Support and Resistance Identification

The MMMI lines can act as dynamic support or resistance levels. By placing orders near these levels, traders can anticipate price reversals and protect their profits.

4. Trend Confirmation

The MMMI can help confirm a trend by indicating the direction of price movements. For example, when the maximum line is rising and the minimum line is flat, it suggests an uptrend.

Moving Min Max Indicator Mt4 Forex

Conclusion

The Moving Min Max Indicator is a powerful and versatile tool that helps Forex traders navigate market volatility and identify trading opportunities. By visualizing price extremes and ranges, the MMMI equips traders with a deeper understanding of market dynamics and enables them to make informed trading decisions. Whether you are a seasoned trader or just starting out, incorporating the MMMI into your analysis can significantly enhance your trading strategies and improve your trading outcomes.