Introduction

In the fast-paced world of forex trading, time is of the essence. Traders rely on technical indicators to identify trading opportunities and make split-second decisions. The moving average (MA) is one of the most versatile and powerful indicators for analyzing short-term price trends. In this article, we will delve into the nuances of using the moving average for 1-minute forex charts, unlocking its potential for precise and profitable trading strategies.

Understanding Moving Averages

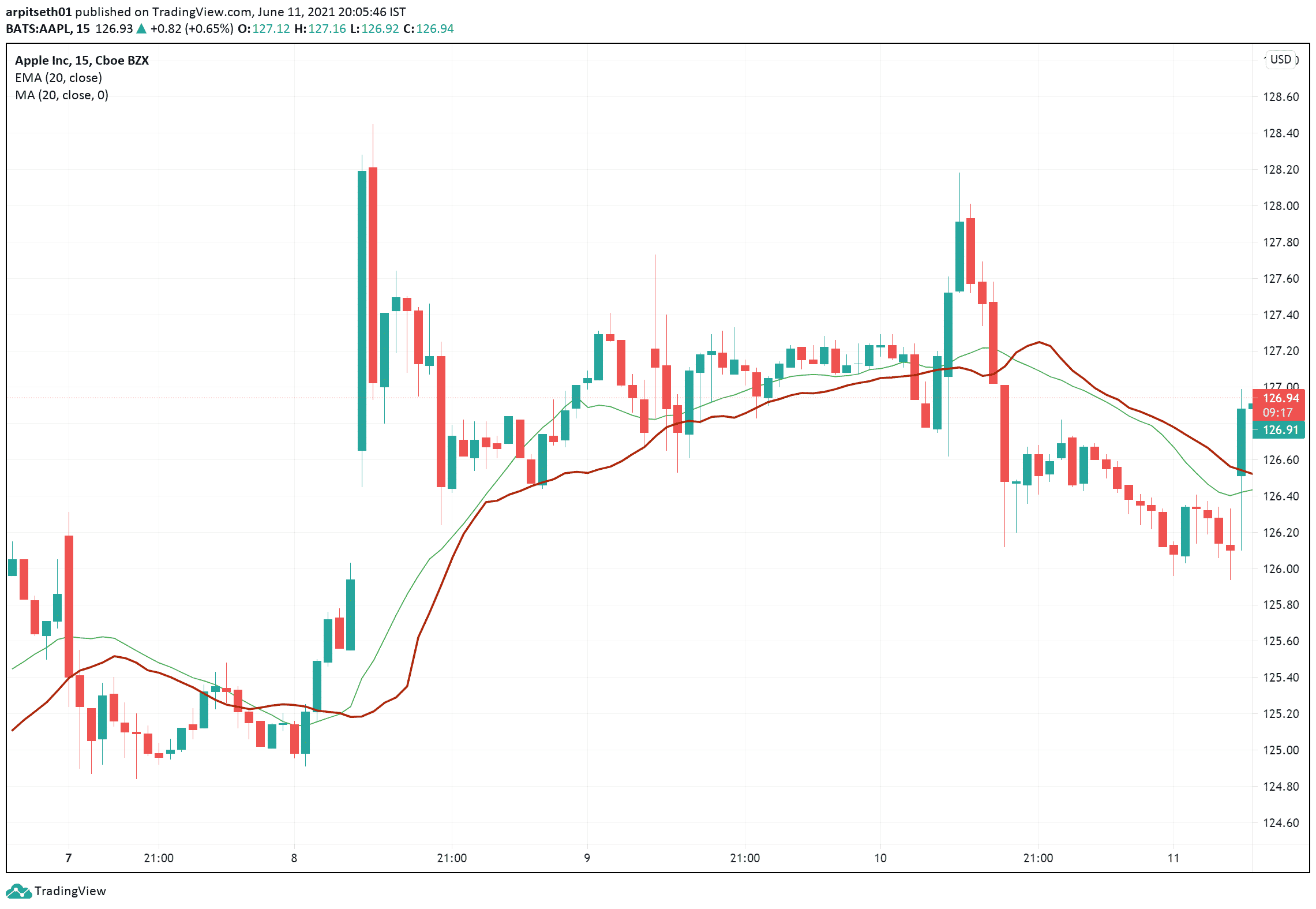

A moving average calculates the average price of a financial instrument over a specified period. The 1-minute MA, for example, calculates the average price of the last 1 minute of trading data. By smoothing out price fluctuations, moving averages help traders identify the overall trend and filter out market noise.

Types of Moving Averages

There are three main types of moving averages: Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA). Each type assigns different weights to past prices, resulting in different degrees of sensitivity to recent price changes. For 1-minute forex charts, the EMA is commonly preferred due to its responsiveness to recent price action.

Applying Moving Averages to 1-Minute Forex Charts

Using moving averages on 1-minute charts requires careful attention to trading signals and risk management strategies. Here’s how you can apply MAs effectively:

-

Identify Trend Direction: The 1-minute MA can indicate the overall trend of the market. If the MA is sloping upwards, the trend is bullish, while a downward-sloping MA suggests a bearish trend.

Image: forexnewsupdate.com -

Spot Potential Reversals: When the price breaks above or below the MA, it can signal a potential trend reversal. Traders can use these breakouts as entry or exit points.

-

Manage Risk: Moving averages alone do not guarantee profitable trades. Combining them with other indicators and setting stop-loss orders helps mitigate risk and protect profits.

-

Determine Overbought and Oversold Conditions: By analyzing the relationship between the price and the MA, traders can identify overbought or oversold conditions. When the price is significantly above the MA, it may be overbought and due for a correction. Conversely, when the price is below the MA, it may be oversold and due for a rally.

Strategies Using Moving Averages

Traders can develop various strategies by incorporating moving averages into their trading systems:

-

Trend-Following Strategy: This strategy involves identifying the direction of the trend using the 1-minute MA and trading in the same direction. Traders exit positions when the price breaks below the MA for a bullish trend or above the MA for a bearish trend.

-

Mean Reversion Strategy: This strategy assumes that prices oscillate around a moving average. Traders buy when the price falls below the MA and sell when it rises above the MA.

-

Breakout Strategy: This strategy relies on price breakouts above or below the 1-minute MA. Traders buy when the price breaks above the MA and sell when it breaks below.

Image: greatdaytrading.com

Moving Average For 1 Minute Chart In Forex

https://youtube.com/watch?v=olC1qSTmzu0

Conclusion

Using moving averages for 1-minute forex charts provides traders with a powerful tool to analyze short-term price trends. By understanding the different types of MAs and applying them strategically, traders can identify potential trading opportunities, manage risk, and develop profitable trading systems. Whether you’re a seasoned professional or a novice trader, incorporating MAs into your forex trading arsenal can enhance your precision and improve your trading performance. Remember to conduct thorough research, backtest your strategies, and trade responsibly to maximize your chances of success in the fast-paced world of forex trading.