Navigating Market Turbulence with Distinction

Welcome to the electrifying realm of foreign exchange (forex) trading on the National Stock Exchange of India (NSE). As adventure-seekers delve into this dynamic financial arena, it’s crucial to identify and navigate the inherent volatility that comes with this exhilarating pursuit. Understanding the currency pairs that fluctuate the most can empower traders with strategic knowledge and help them mitigate risks.

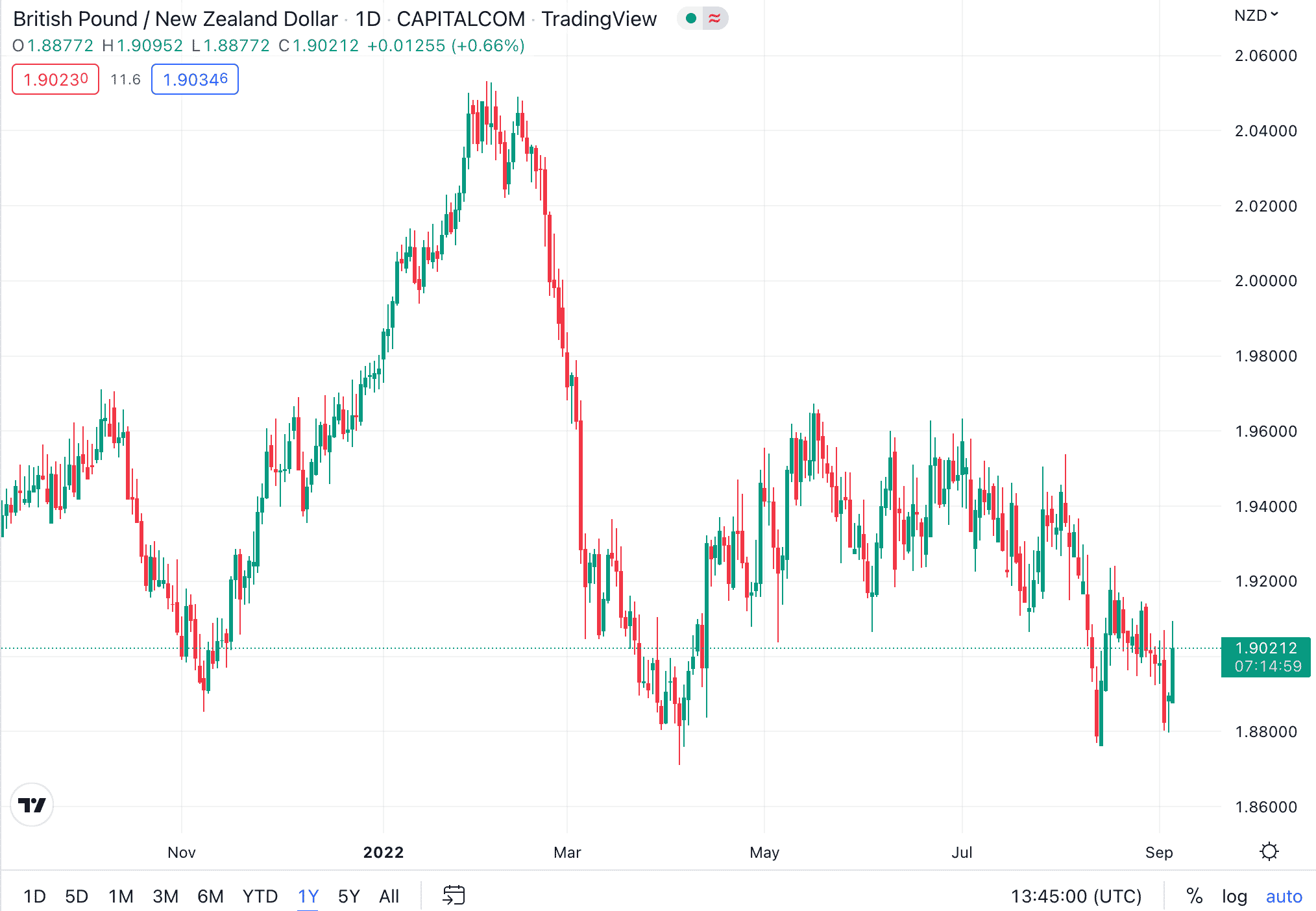

Image: www.business2community.com

In this comprehensive guide, we’ll explore the most volatile currency pairs in forex trading on NSE, providing valuable insights into their dynamic nature. We’ll uncover the factors that contribute to their heightened fluctuations, and delve into expert strategies for navigating these volatile waters. Get ready to enhance your forex trading prowess and harness the power of these ever-moving currency markets.

The Anatomy of Volatility

Volatility, in the context of financial markets, quantifies the magnitude and frequency of price movements for a given asset. In forex trading, volatility measures the relative movement of currency pairs. Currency pairs that experience significant changes in their relative values are considered volatile, presenting both opportunities and challenges for traders.

Several factors influence currency pair volatility, including economic data releases, political events, interest rate decisions, and global market sentiment. These factors can trigger sharp price swings, creating uncertainty and potential risks for traders.

Unleashing the Volatility Titans on NSE

- USD/INR: The US dollar (USD) and Indian rupee (INR) pair is a highly traded currency pair in India. It exhibits significant volatility due to the close economic ties between the two countries and the fluctuating demand for Indian goods and services in the global market.

- GBP/INR: The British pound (GBP) and Indian rupee (INR) pair is another volatile currency pair. The UK and India share a long-standing historical connection, and the pair’s volatility is often influenced by political and economic events in both countries.

- EUR/USD: The euro (EUR) and US dollar (USD) pair is a globally significant currency pair. Their movements impact other currency pairs and markets. Volatility in this pair can be driven by economic releases and monetary policy decisions from the European Central Bank (ECB) and the US Federal Reserve.

- AUD/USD: The Australian dollar (AUD) and US dollar (USD) pair is heavily influenced by commodity prices, particularly gold and iron ore. As a commodity-linked currency, AUD/USD can experience high volatility due to fluctuations in global demand for these commodities.

- JPY/USD: The Japanese yen (JPY) and US dollar (USD) pair is known for its sensitivity to risk sentiment and safe-haven flows. During periods of market uncertainty, traders often flock to buy JPY, making it a frequently volatile currency pair.

Taming the Volatile Beast

Embracing the dynamic nature of volatile currency pairs requires strategic navigation. Traders can adopt several tactics to mitigate risks and capitalize on market movements:

1. Risk Management: Implementing robust risk management strategies, such as setting stop-loss and take-profit orders, can help limit potential losses and lock in profits.

2. Technical Analysis: Utilizing technical analysis tools, like charting and trendlines, can provide insights into historical price patterns and potential future movements.

3. News and Event Monitoring: Keeping abreast of economic data releases and political events that could impact currency pairs can equip traders to anticipate and respond to market fluctuations.

4. Leverage Management: Using leverage judiciously can enhance profitability, but traders must be mindful of the amplified risks associated with it.

Image: dailypriceaction.com

FAQ: Your Forex Queries Answered

- Q: What are the benefits of trading volatile currency pairs?

A: Volatility can offer opportunities for high returns, but it also comes with increased risks. Traders must carefully evaluate their risk tolerance before trading volatile pairs. - Q: How can I stay informed about currency pair movements?

A: Subscribing to financial news outlets, following market analysts on social media, and using trading platforms with real-time updates can keep traders in the know. - Q: What is a good strategy for trading volatile currency pairs?

A: A scalping strategy, which involves making numerous small trades over a short period, can be effective for capitalizing on rapid price fluctuations in volatile pairs. - Q: How do I minimize losses when trading volatile currency pairs?

A: Implementing strict risk management measures and maintaining a disciplined trading approach can help reduce potential losses. - Q: Is it possible to profit from both rising and falling markets when trading volatile currency pairs?

A: Yes, traders can utilize short-selling or CFDs (contracts for difference) to profit from price declines in volatile currency pairs.

Most Volatile Currency Pairs In Forex In Nse

Conclusion

Navigating the most volatile currency pairs in forex trading on NSE requires a blend of courage, knowledge, and strategic planning. Understanding the factors that drive volatility and adopting appropriate risk management techniques can empower traders to harness the opportunities these currency pairs present. Remember, the pursuit of high returns in forex trading always comes with inherent risks. By thoroughly researching, continuously monitoring the markets, and implementing sound trading strategies, traders can capitalize on the dynamic nature of volatile currency pairs while mitigating potential losses.

Would you like to dive deeper into the world of forex trading and explore other potential opportunities? Leave a comment below, and let’s engage in a discussion!