Navigating the ever-changing waters of the foreign exchange market requires not just an understanding of market fundamentals, but also the ability to interpret and analyze data effectively. Among the various charting techniques employed by Forex traders, line charts stand out as one of the most widely used and indispensable tools. This comprehensive guide will delve into the world of line charts, empowering you with the knowledge and insights needed to harness their full potential in your trading journey.

Image: howtotradeonforex.github.io

Unveiling the Power of Line Charts

In its essence, a line chart is a graphical representation of a financial instrument’s price movement over time. It consists of a single line that connects a series of data points, each representing the price of the currency pair at a specific time interval. Unlike bar and candlestick charts, line charts do not provide information on open, high, low, and closing prices. Their focus is solely on the price trajectory, offering a clear and concise visual representation of price movements.

Understanding Line Chart Basics

Interpreting line charts effectively requires a solid understanding of their foundational elements. Here’s a quick rundown:

- Data Points: Each point on the line chart represents the price of the currency pair at a specific time interval. These intervals can be customizable, ranging from minutes and hours to days, weeks, or even months.

- Trend Line: The line that connects the data points is known as the trend line. It provides a visual indication of the direction and momentum of the price movement.

- Timeframe: The timeframe refers to the time period represented by the chart. It determines the frequency of the data points and the level of detail provided.

Leveraging Line Charts in Forex Trading

Line charts offer a unique perspective for various trading applications. Here are a few key areas where they shine:

- Trend Identification: By analyzing the direction and slope of the trend line, traders can identify the current trend. An upward-sloping line indicates an uptrend, suggesting buying opportunities, while a downward-sloping line indicates a downtrend, signaling potential selling opportunities.

- Momentum Assessment: The steepness of the trend line can provide insights into the momentum behind a trend. A sharply rising line indicates strong momentum, while a gently sloping line suggests a weaker trend.

- Support and Resistance Levels: By identifying areas where the line chart bounces off its highs or lows, traders can establish potential support and resistance levels. These levels can serve as key pivot points in the market.

Breakout Trading: Breakouts occur when the price breaks through a significant support or resistance level. Line charts can help traders identify potential breakout opportunities, which often lead to strong price movements.

Image: www.protradingschool.com

Most Used Chart In Forex

Practical Tips for Maximizing Line Chart Analysis

To enhance your line chart analysis, consider these practical tips:

- Choose the Right Timeframe: The optimal timeframe for line chart analysis depends on your trading style and the type of currency pair you’re trading.

- Combine with Other Indicators: While line charts provide valuable insights, they should not be used in isolation. Combine them with other technical indicators, such as moving averages or oscillators, to confirm trading signals.

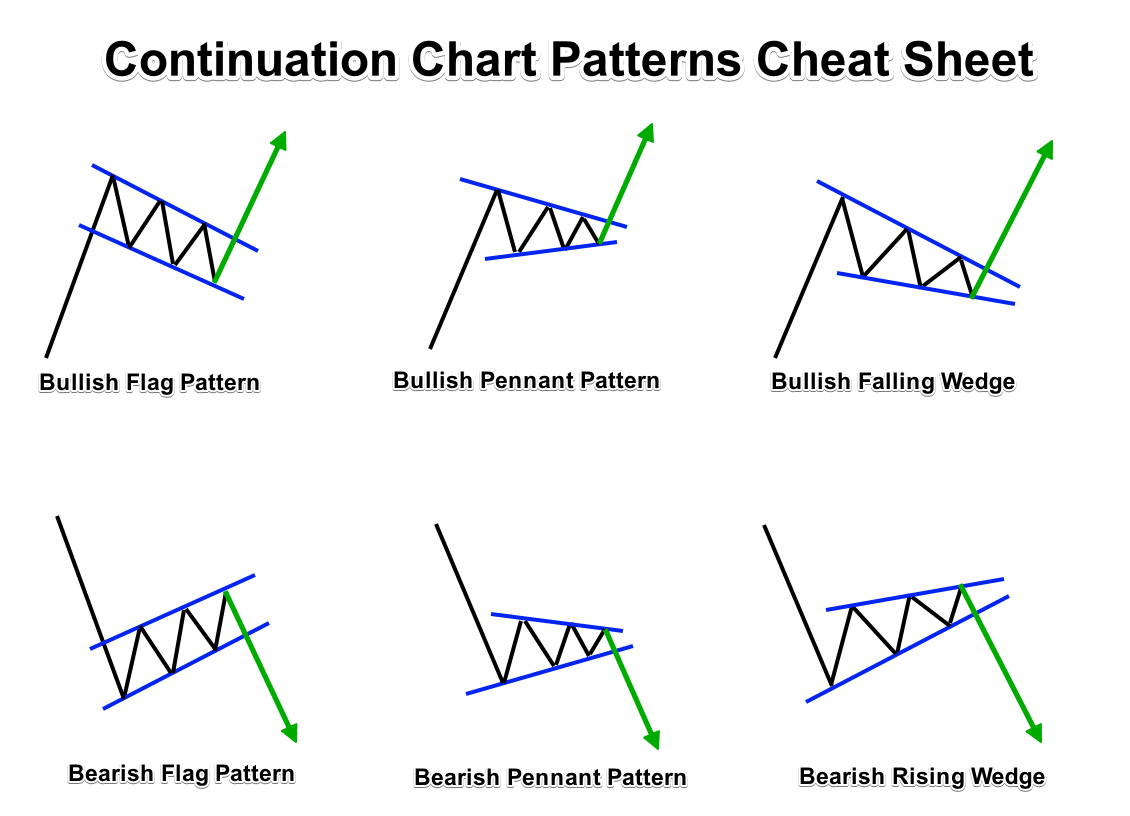

- Look for Patterns: Analyze line charts for recognizable patterns, such as triangles, flags, and wedges. These patterns can provide additional clues about future price movements.

- Practice Risk Management: Remember that line charts are a tool, not a holy grail. Always implement sound risk management strategies to protect your capital.

Conclusion: Unlocking the Potential of Line Charts

In the fast-paced world of Forex trading, line charts stand as a fundamental tool for traders of all experience levels. By understanding their basic concepts, leveraging their strengths, and implementing practical analysis techniques, you can unlock the potential of line charts to gain deeper insights into market dynamics. Embracing this valuable tool will empower you to make informed trading decisions and navigate the markets with greater confidence.