In the fast-paced realm of forex trading, equipping oneself with the proper tools is paramount. Amidst the plethora of available indicators, discerning the most effective ones can be daunting. This comprehensive guide will delve into the world of forex indicators for the MetaTrader 4 (MT4) platform, empowering you with the knowledge to navigate the markets with confidence.

Image: tradeforexnation.weebly.com

A Voyage into Forex Indicators

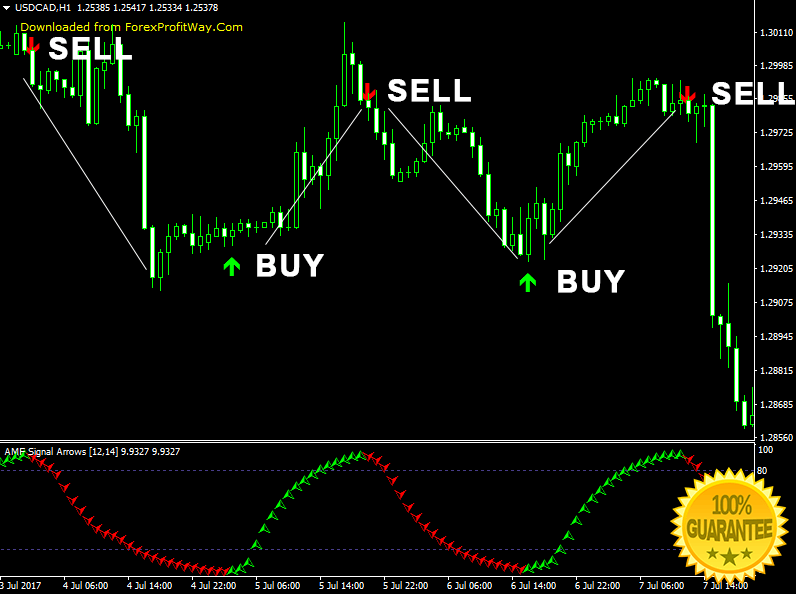

Forex indicators are invaluable tools that analyze historical price data to identify potential trading opportunities. They provide objective insights into market trends, helping traders make informed decisions. Among the numerous trading platforms, MT4 stands out as the most popular, offering a vast array of indicators catering to various trading styles. Understanding the most commonly employed indicators is crucial for traders seeking success.

Meet the Top Contenders: Unraveling the Most Popular Forex Indicators for MT4

1. Moving Averages:

Moving averages smooth out price fluctuations to reveal the overall market trend. Traders can select different time periods to assess short-term or long-term trends. Some popular moving averages include the Simple Moving Average (SMA), Exponential Moving Average (EMA), and Moving Average Convergence Divergence (MACD).

2. Bollinger Bands:

Bollinger Bands create an envelope around price action, marking standard deviations above and below the moving average. They help identify potential overbought or oversold conditions, as well as possible breakouts.

3. Relative Strength Index (RSI):

The RSI measures the momentum of price changes, oscillating between 0 and 100. Overbought conditions are indicated when the RSI is above 70, while oversold conditions are associated with readings below 30.

4. Stochastic Oscillator:

Similar to the RSI, the Stochastic Oscillator compares current closing prices to recent price ranges and fluctuates between 0 and 100. It identifies overbought and oversold conditions and can indicate potential trend reversals.

5. Ichimoku Cloud:

The Ichimoku Cloud is a comprehensive indicator that combines multiple technical analysis tools. It offers insights into trend direction, momentum, support, and resistance levels.

6. Fibonacci Retracement:

Fibonacci Retracement levels are derived from the Fibonacci sequence and indicate potential areas of support and resistance. Traders use these levels to identify potential entry and exit points.

7. Support and Resistance:

Support and resistance levels mark areas where price action has consistently bounced. Traders can use these levels to predict future price movements and identify potential trading opportunities.

Harnessing the Power: Tips from the Experts

Master traders emphasize the importance of selecting indicators that align with your trading style and risk tolerance. Begin by experimenting with a few indicators and gradually incorporate more as you gain experience. Never rely solely on indicators; combine them with fundamental analysis and technical analysis techniques for a comprehensive understanding.

Image: indicatorchart.com

Most Popular Forex Indicator For Mt4

Conclusion: Embark on Your Forex Journey with Confidence

The world of forex indicators is vast, but with the right knowledge, you can unlock their potential. This comprehensive guide has introduced you to the most popular forex indicators for MT4, empowering you with the tools you need to navigate the markets with confidence. Remember, knowledge is power, and by continuously learning and adapting, you can elevate your trading to new heights.