The foreign exchange (forex) market is a vast and dynamic global marketplace where currencies are traded round-the-clock. India, as a burgeoning economic powerhouse, plays a significant role in this global arena, and understanding the country’s most actively traded forex pairs is crucial for market participants.

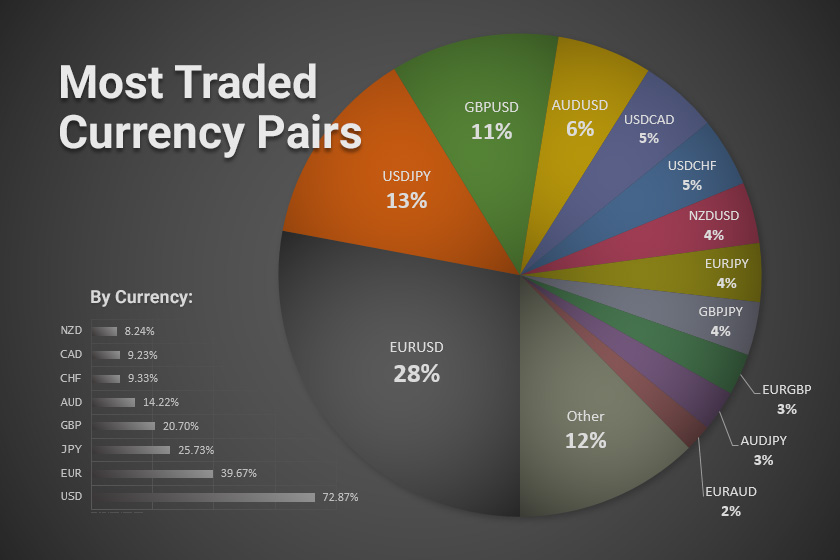

Image: howtotradeonforex.github.io

This comprehensive guide delves into the dynamic world of forex trading in India, exploring the most actively traded currency pairs and their significance for Indian traders. We uncover their unique characteristics, market trends, and strategies to navigate the ever-evolving forex landscape.

USD/INR: The Dominant Pair

The US dollar (USD) and Indian rupee (INR) pair is the most heavily traded forex pair in India, accounting for over 70% of all forex transactions. The stability and liquidity of the USD make it the preferred choice for international trade and investment, while the INR’s strong domestic fundamentals provide a stable counterparty.

EUR/INR: The European Connection

The euro (EUR) and INR pair ranks second in terms of trading volume. Eurozone countries are among India’s largest trading partners, and the EUR/INR exchange rate significantly impacts cross-border transactions. This pair often shows higher volatility than USD/INR due to political and economic developments in the eurozone.

GBP/INR: The British Legacy

Historically, the Indian rupee was pegged to the British pound (GBP), and the GBP/INR pair remains popular even today. The United Kingdom remains a major trading partner for India, and this pair is closely watched by businesses engaged in cross-border transactions between the two countries.

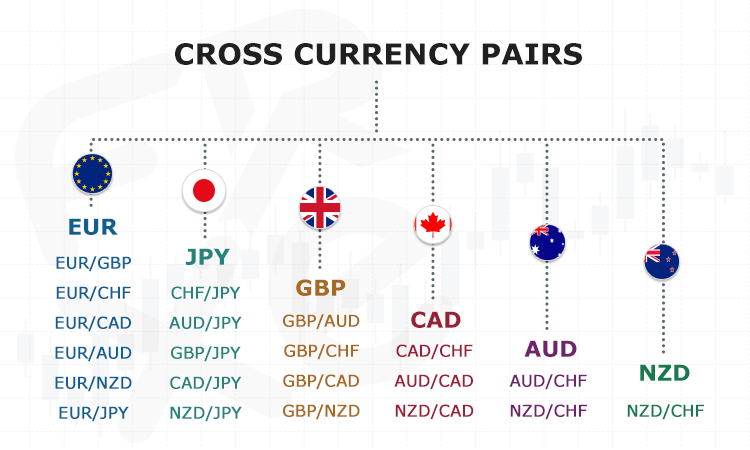

Image: www.litefinance.org

JPY/INR: The Asian Influence

The Japanese yen (JPY) and INR pair has grown in significance in recent years, reflecting the increasing economic ties between India and Japan. Japan is a major investor in India’s infrastructure and technology sectors, and the JPY/INR exchange rate is critical for businesses involved in these industries.

Trading Strategies for Active Forex Pairs

Navigating the forex market requires a combination of market analysis and strategic trading techniques. For Indian traders, understanding the market dynamics and fluctuations of the most actively traded forex pairs is essential.

One effective strategy involves trading during high-liquidity market sessions when volatility tends to be lower. Monitoring economic indicators and news events can also provide valuable insights, as sudden shifts in exchange rates can create short-term trading opportunities.

Most Actively Traded Forex Pairs India

Conclusion

The most actively traded forex pairs in India provide a window into the country’s dynamic economic relations and global market position. Understanding these pairs not only equips Indian traders with insights into the forex market but also empowers them to leverage these instruments for cross-border transactions and strategic investments.

As the forex landscape continues to evolve, staying informed about these currency pairs and employing appropriate trading strategies will remain crucial for Indian market participants seeking success in the global forex arena.