Introduction

In the realm of currency trading, where fortunes are made and lost in the blink of an eye, savvy traders rely on a myriad of technical indicators to navigate the intricate markets. Among them, none stands out quite like the Money Flow Index (MFI), an indispensable tool that has been embraced by traders for its uncanny ability to decipher market sentiment and identify potential trading opportunities. In this comprehensive guide, we will delve into the world of the MFI, unraveling its intricacies and empowering you with the knowledge to harness its hidden power for forex trading success.

Image: www.thaiforexreview.com

Understanding the Money Flow Index

The Money Flow Index (MFI) is a technical analysis tool that measures the flow of money into and out of a particular asset. Developed by J. Welles Wilder in the 1970s, the MFI is derived from price and volume data, providing traders with a comprehensive understanding of the market’s underlying dynamics.

The MFI is calculated using the following steps:

-

Identify the Typical Price (TP) for a given period. The TP is calculated as (High + Low + Close) / 3.

-

Determine the Positive Money Flow (PMF) for a given period. The PMF is calculated by multiplying the TP by the volume of trades that closed higher than the previous period’s close.

-

Determine the Negative Money Flow (NMF) for a given period. The NMF is calculated by multiplying the TP by the volume of trades that closed lower than the previous period’s close.

-

Calculate the Money Flow Index (MFI) for a given period. The MFI is calculated as (100 * PMF) / (PMF + NMF).

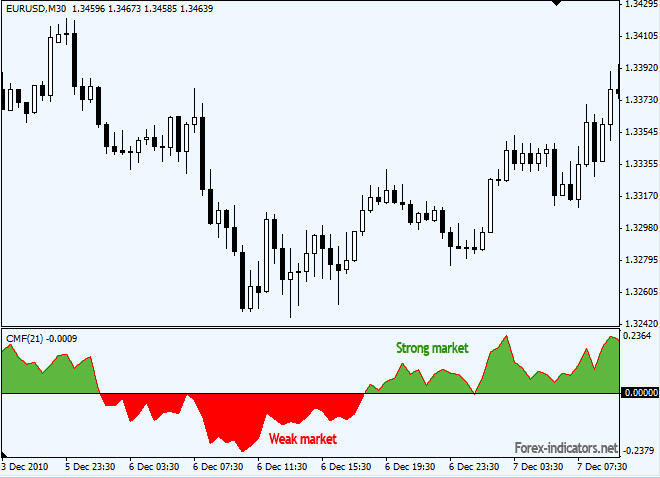

Interpreting the Money Flow Index

The MFI is represented as a single numerical value that ranges from 0 to 100. Typically, values below 20 indicate that there is a larger volume of selling pressure in the market, while values above 80 suggest a larger volume of buying pressure. By observing the fluctuations of the MFI over time, traders can gain insights into the market’s underlying sentiment and potential trend reversals.

Trading Strategies with the Money Flow Index

The versatility of the Money Flow Index makes it an effective tool for both trend-following and contrarian trading strategies.

Image: forexrobotsignals1.blogspot.com

Trend-Following Strategies:

-

When the MFI is above 80 and rising, it indicates a strong buying momentum, suggesting that the uptrend is likely to continue. Traders can enter buy positions to capitalize on this trend.

-

When the MFI is below 20 and falling, it indicates a strong selling momentum, suggesting that the downtrend is likely to continue. Traders can enter sell positions to capitalize on this trend.

Contrarian Strategies:

- Contrarian traders may choose to enter long positions when the MFI is oversold (below 20) and enter short positions when the MFI is overbought (above 80). The premise behind this strategy is to buy when others are selling and vice versa.

Practical Application of the MFI in Forex Trading

Let’s illustrate the practical application of the Money Flow Index in forex trading with an example. Suppose you are analyzing the EUR/USD currency pair. The MFI for the EUR/USD pair is below 20 and has been declining over the past few days. This suggests that there is significant selling pressure in the market, potentially signaling a downtrend. As a result, you decide to enter a short position, anticipating that the EUR/USD pair will continue to decline in value.

Combining the Money Flow Index with Other Indicators

While the Money Flow Index can deliver valuable insights on its own, combining it with other technical indicators can provide a more robust and accurate trading framework. Some of the most commonly used combinations include:

-

The Relative Strength Index (RSI): The MFI and the RSI both measure market momentum, but the MFI incorporates volume data. Using both indicators together provides a more comprehensive assessment of market sentiment.

-

The Moving Average Convergence Divergence (MACD): The MACD measures trend strength and momentum. Combining the MFI with the MACD allows traders to identify potential trading opportunities at the convergence or divergence of the two indicators.

-

Bollinger Bands: Bollinger Bands are volatility bands plotted around a moving average. Adding the MFI to Bollinger Bands can help traders identify potential breakout or pullback opportunities.

Money Flow Index In Forex

Conclusion

In the ever-evolving landscape of forex trading, the Money Flow Index stands as an indispensable tool that empowers traders with an in-depth understanding of market sentiment and trend dynamics. Its versatility extends to both trend-following and contrarian trading strategies, providing traders with the flexibility to adapt their approach to the ever-changing market conditions.

By immersing yourself in the intricacies of the Money Flow Index and mastering its practical application, you can unlock the secrets of forex success and take your trading journey to new heights. Remember, the key to becoming a successful trader lies in a disciplined approach, diligent analysis, and the relentless pursuit of knowledge.